Almost two weeks after the event, there is still more than a little nervousness about what took place on October 15 in UST trading – and for very good reason. Up to that point, proclamations about systemic liquidity degradations were just theoretical to most people. The reason was, and continues to be, that nobody seems to care about disruptions in UST collateral for repo. As we continue to evolve under changing “dollar” circumstances, authorities continue to wish it as “resilient” when in fact there are persistent tremors that demand serious attention.

The localized trading in UST that Wednesday was nothing short of extraordinary (and not just in UST, as corporate trading ground to near-bidless in the more opaque segments where leverage lies thickest), as the latest anecdote from Bloomberg reveals:

“It was a very high stress, very fearful trade,” Comiskey, whose firm is one of 22 primary dealers that trade directly with the Federal Reserve, said from his office in downtown Manhattan. “Once we recognized things started getting out of control, we shut it off immediately. It was like turning the clocks back to pre-electronic trading” in the 1990s.

Bank of Nova Scotia was hardly alone in taking steps to protect itself in one of the most volatile trading days since the collapse of Lehman Brothers Holdings Inc. in 2008, showing how regulators’ efforts to rein in risk-taking among the world’s biggest banks is causing disruptions in what is supposed to be the deepest, most liquid market in the world — that of U.S. Treasury securities. Because dealers have cut back so much in recent years, concern is deepening that parts of the market have become less efficient in times of turmoil.

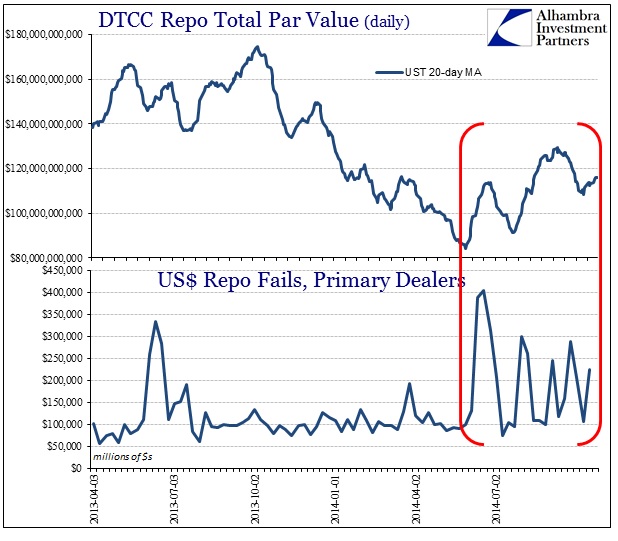

This was not a surprise to anyone observing bedrock liquidity via repo, where fails continue to offer a very compelling and disappointingly comprehensive rebuttal to everything the Fed’s reverse repo program was designed to accomplish. Going all the way back to June, the repo market cannot seem to gain any sort of “normal” operation. That is all the more surprising given how repo volume in UST has been curtailed in 2014 compared to years prior. Whatever is leading to slightly higher volumes since June is more pressure than the system can seemingly withstand.

The majority of commentary, such that any actually is expended, continues to focus on dealer inventories as a culprit, but that is confusing cause and effect. Dealer inventory declines are symptomatic of several changes, not just any Dodd-Frank/Basel “capital” rules that make dealer activities relatively more “expensive.” As I have argued for almost two years (and really going back to the t-bill/FDIC episode in April 2011), QE has the effect of crowding out private liquidity.

It is also a mistake, I believe, to ignore the narrowing of the domestic “dollar” liquidity conduits owing to changes in the European disfavor toward the global dollar short. That would suggest the timing of this disruption; why in 2014 and not back in 2013.

“Disruption” is indeed the correct word for the occasion, as shown without ambiguity by trading activity on October 15 regardless of how most other “markets” have lacked awareness and appreciation. Insufficiency in liquidity can take many forms, including the inability to deliver on bids (an offerless market is not the typical demonstration of illiquidity). We dodged a bullet here because the systemic signaling could have gained even more disorder, edging toward broad chaos (imagine if UST bids remained unfilled for longer, and UST rates dropped considerably across the board and remained there – what would that signal to other leveraged positions and, more importantly, leverage providers?).

“The market could not handle large flows without prices moving massively,” Michael Cloherty, the head of U.S. rates strategy at Royal Bank of Canada’s RBC Capital Markets unit, said in an e-mail. “We took that test Oct. 15 and failed.”

The repo market has been singing this tune for months, and with QE now in the past tense the conditions for more such “tests” are going to increase. With the Fed’s reverse repo program beyond impudent toward its original design (including repeated violation of the intended O/N rate “floor” – fails signify a great deal of repo rates executed at or around -3%) there is nothing out there to act as a “risk” absorber (which would include dealer positions in eurodollars and derivatives). The preferred action in policy circles around the FOMC is to simply hope that the economic “narrative” is sufficient in psychology (if lacking in substance) to be enough of a “fix” upon these kinds of events.

In other words, the Fed has its fingers crossed that “markets” will simply buy into the recovery idea finally and all this will just go away on its own. I’ve said it before over and over: they have no idea what they are doing, but they intend on doing it anyway. The history of every crisis is written in just this manner, as when they unfold they originally “come out of nowhere” (analysis of 2008 still shows far too much emphasis on “nobody saw it coming”) but only because “they” ignore and rationalize away the warning signs.