On Monday I examined the character change of post-interest rate targeting recoveries. By comparing recession/recovery cycles before and after 1990 it becomes obvious that the entire process of economic cycles has been altered. As such, the relative track of the Great Recession earned that name in sharp contrast to the much shorter and less dramatic recessions between the end of World War II and 1990.

I have been asked to add the Great Depression to that examination, particularly in contrast to the Great Recession. On its face, the Great Recession is dwarfed by the immense nature of the downturn of the 1930’s by any measure. That doesn’t mean there is nothing interesting about comparing the two periods. In fact, doing so leads to some striking similarities, if not in scale then at least in trajectory and shortcomings.

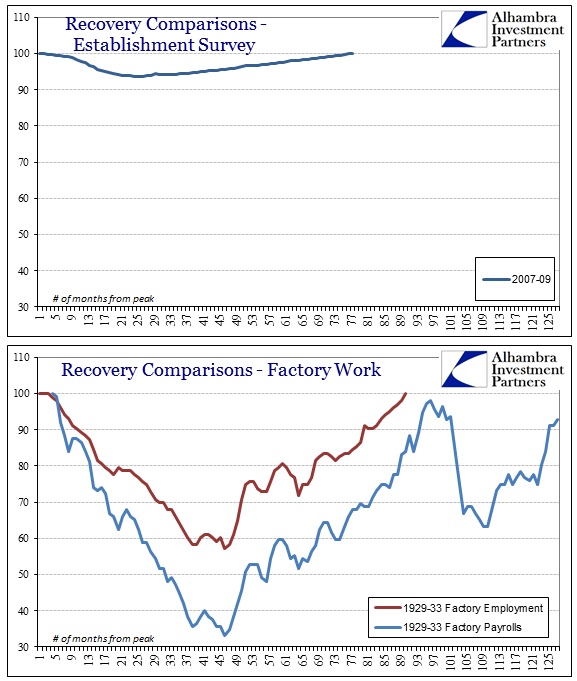

Using just the labor market, there are problems of data comparability since the Establishment Survey only goes back to 1939. What is available as a substitute is annual rather than monthly, and is modern rather than contemporary. Most statistical accounts from that age have been recreated using more “modern” techniques, which leads to both positive and negative attributes. In my analysis, there are more negatives in the highly adjusted, probabilistic series than the originals.

With that in mind, for our purposes here I am using the factory employment and payroll indices in the original Federal Reserve Bulletins. These are, of course, narrower in scope, measuring just one economic sector, than the Establishment Survey, which tallies all business-related employment (though omitting most self-employment). Even with that caveat in mind, it makes a worthwhile contrast in how dramatic the collapse after June 1929 actually was measured against recent experience.

Factory employment did not regain its 1929 peak until November 1936, ninety months later. Even here, the symmetry is astounding, as the downturn lasted (depending on your definition of the trough) 44 months; meaning the upswing back was an almost equal 46 months.

However, if we use the Fed’s old payroll index in addition to the employment index, we see a fuller measure of the disaster. Because of price changes (actual “deflation” rather than just fears of it), the total dollar amounts paid out to factory workers declined more steeply and recovered more slowly (sound familiar?).

That presented a couple of big problems – particularly when “policy” measures counted on a full and comprehensive “reflation” to create recovery mechanics. Reflation began, of course, with the confiscation of gold and devaluing the dollar with the aim of reversing the downward trend of prices. However, if prices rise faster than wages, reflation is far too narrowly construed to be effective. The shortfall of wages relative to prices thus ends up as a persistent drag that is large enough to derail the entire show. That was made plain by the severity of the re-depression that struck in the middle of 1937 (shown in the chart above), a retrenchment that was believed impossible because of the financial acts of reflation; the monetary system fully “gorged with gold.”

The peculiarity of the reflation’s divergence with wages, even imperfectly measured here, became expressed as a recovery that did not quite fit the downturn. While there is symmetry in the length of the collapse and recovery, as with the Great Recession now, that is because we are using the wrong standard.

In this part of the post I am going to use annual estimates from the 1970’s for much the same reasons as noted above – far less statistical intrusion but enough of an updated sample of data (at least for me). In terms of the labor market, this was a time before the labor force was chopped up into various stages of marginally attached, looking for work, not looking for work, etc. You were either employed, unemployed or in the military – there were no other options to complicate it all in trying to divine personal reasons for being placed in some labor force/out of labor force bucket.

Matching the factory employment series, the total, absolute number of employed Americans just about regained the 1929 peak by 1937. But over the course of those years the population still continued to expand. As a result, employment growth lagged the broader system.

From 1929 through 1937, the labor force grew by just over 6 million, while the net job growth for the cycle was -139k. As such, the number of unemployed grew by 6 million above 1929. A true recovery, at least as intuitively understood by most Americans, would not stop at a net zero level of employment but rather a net zero level of unemployment. It is not enough to regain lost jobs from the previous peak, a fully functioning economy would both replace all lost jobs and create new ones for new entrants to the labor force. This should sound very familiar.

This problem was made all the worse by the 1937 re-depression. By 1939, adding two more years of population growth, the whole situation had grown darker once again, giving the Great Depression its full measure of “Great.” Total employment was back to about 500k below 1929, while the population had grown another 1.5 million since 1937 – a total labor force gain of 7.5 million above 1929. So where there were 1.5 million unemployed in 1929, there were still 9.5 million a decade later. That is not recovery, that is persistent failure glossed over by modern conventions and historical recasting.

The second collapse in 1937 gives us insight into the lackluster nature of the recovery, particularly as it relates to the factory payroll data. There was a heavy element of finance involved which upset the reflation process. Reflation is nothing more than intentional redistribution like inflation. For all the price changes up and down, the payroll data reflects the reality that wages were destroyed on the way down and then hit again by price redistribution on the way back up. Again, this should sound very familiar.

By the onset of the second depression later in 1937, wholesale prices had recovered to where they were in 1930 and the rest of the latter 1920’s aside from the 1929 peak. However, as you can see above, department store sales were still well-below 1929 even in 1937 on the eve of the second cycle. Adjusting for population growth, sales lagged heavily for the entire decade and into the 1940’s. Orthodox economics assigns a psychological reason for that, namely the infamous and overused “bunker mentality” – where the collapse was so intense and dangerous that it altered consumption behavior.

Like so many other explanations, there is truth to that, particularly in comparison to the 1921 depression and recovery. But that does not offer, to me, a compellingly comprehensive story for recovery deficiency shown here. Some of the Great Depression recovery’s stinginess was no doubt due in part to lingering fear and caution, but you cannot overlook the process of redistribution during reflation. The disparity with wages, especially on a per capita basis, argues heavily for that being a primary culprit in the asymmetry of the upswing relative to the downturn. And that, once again, should sound very familiar.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com

In more than a few features, the Great Recession and “recovery” has been a scaled-down version of the Great Depression. That is not progress.