It might be expected that monetary policy would fail to achieve its goal in attempting to manage the economy when it cannot even meet its own basic technical requirements. The main lever of Fed policy continues to be the federal funds rate even though it is entirely irrelevant, and has been for a long time. There is much more to money markets (plural) than the FOMC considers, a fact proven time and again since August 9, 2007.

In the midst of the panic, for example, the FOMC voted to speed up its interest payments for reserve balances held in custody (electronically). The Financial Services Regulatory Relief Act of 2006 had given the Fed statutory authority to begin the IOR and IOER regime in October 2011, but the conditions of October 2008 warranted, in the view of the Committee, additional “tools.” The immediate problem was one that is still misunderstood today by convention, namely that in the worst parts of the financial crisis the federal funds rate was “too” low; not high.

The Fed believed that the IOER would help create an interest rate “floor” for federal funds, without any comment on LIBOR and eurodollars (to this day). It didn’t work. When the Fed went to ZIRP on December 16, 2008, they reconfigured the interest calculation to IOER in order to more effectively gain that floor. It didn’t work, either, as the Kansas City Fed admitted by 2010:

Over the next couple of months [between October and December 2008], however, as it became apparent that these rates on reserve balances were not sufficient to establish a floor under the target funds rate, the FOMC gradually narrowed the difference between the target funds rate and the rate paid on reserves. By mid-December 2008, when the FOMC lowered the funds rate target to a range of 0 to 25 basis points, the Board of Governors set the interest rate on both required and excess reserves at 25 basis points. Since that time, the funds rate has traded within its target range but still persistently below the interest rate on excess and required reserves.

At the other end of this new corridor approach, the so-called ceiling, is first the upper boundary for federal funds and then the Primary Credit rate (formerly Discount Rate). Federal funds have not challenged either, but other money market rates have. Indeed, by the behavior of other rates we can only conclude, once again, the irrelevance of federal funds and monetary policy as anything other than symbolic superstition.

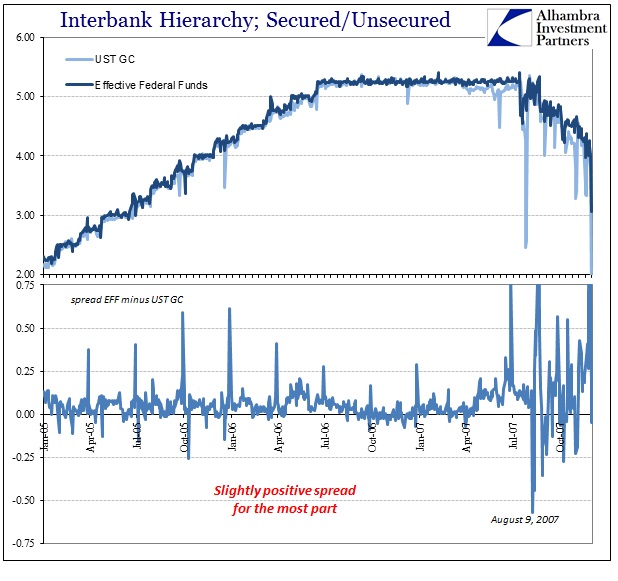

There is supposed to be a determined hierarchy of interbank money rates all governed by risk. Repo rates, for example, should, for the most part, trade less than federal funds or LIBOR (in comparison to term repo). The reason is simple and intuitive; secured vs. unsecured. A repo transaction contains collateral therefore the cash borrower obtains a lower cost for putting up financial security. Federal funds or eurodollars are unsecured and thus any bank borrowing in those markets will pay for the lack of security.

Prior to August 9, 2007, that is what we find in US$ GC rates as compared to the effective federal funds rate; a slightly positive spread. It was a small spread because these money markets operated efficiently, or so it was believed, where risk in even unsecured lending wasn’t judged to be too much more than repo and secured. That was one big mistake heading into the crisis, and one that the FOMC never seemed to understand (especially as it related to the geographical divide).

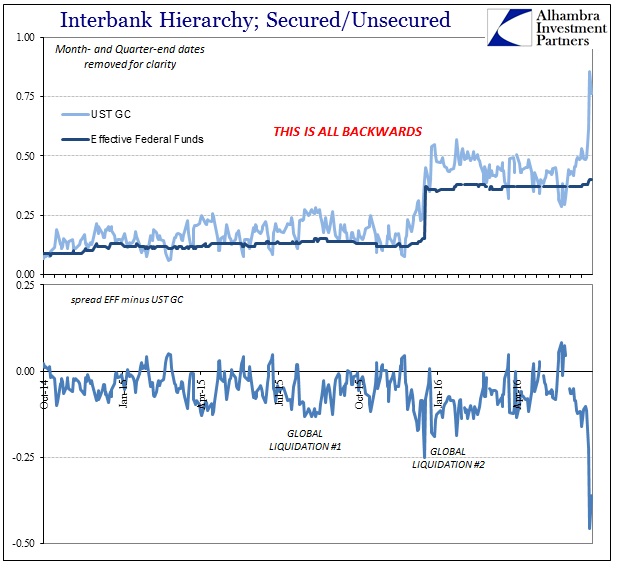

Since 2014, GC repo rates have been trading steadily above federal funds; meaning a negative spread. This is entirely backward, as there is no good reason why those borrowing at an elevated repo rate would not instead choose much lower and unsecured federal funds if they actually had that choice. In short, the federal funds “market” cannot be anything but irrelevant or repo rates would never spike so high (or even trade persistently at a positive spread to begin with). If federal funds don’t really matter in functional money terms, then what does the Federal Reserve actually do? The answer is to fool itself and as many other people as they can.

In the past two days of intense “dollar” illiquidity related to the Brexit “spark”, the GC repo rates have spiked even further above federal funds. For UST repo, the rate has been above 60 bps each of the past three trading sessions (starting the day before the vote) and was above 75 bps again today. That isn’t much improvement from Friday’s rate near 86 bps. Federal funds saw an increase, as well, with the effective rate “surging” 2 bps from 38 bps to 40 bps. There is, once again, no other conclusion that can be drawn about federal funds except that it just isn’t a legitimate consideration in functional liquidity.

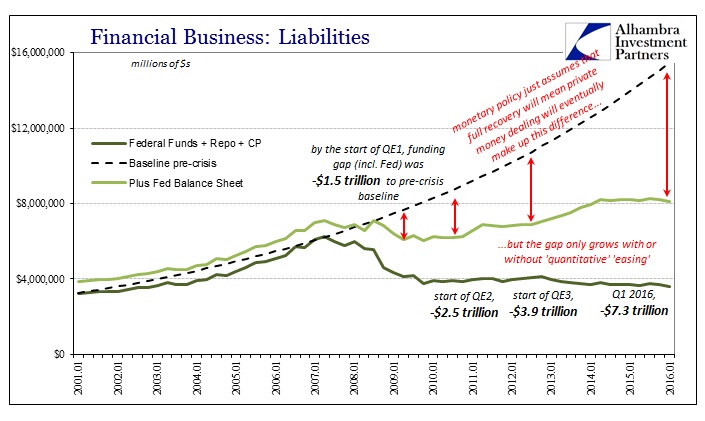

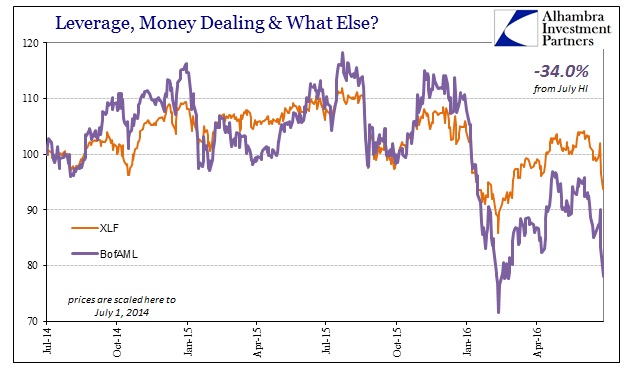

If monetary policy can’t manage its own corridor nor anything beyond a money “market” that clearly nobody goes to, then that should lead to serious questions and doubts even among those still, somehow, clinging to the fallacy of an all-powerful “don’t fight the Fed.” Without the Fed actually providing useful, functional “money”, then risk for and within the banking system would be far greater than perhaps otherwise believed. The Fed has declared QE successful on at least that one count, where the financial system has been fully restored (in its view). But that interpretation only applies where federal funds isn’t immaterial.

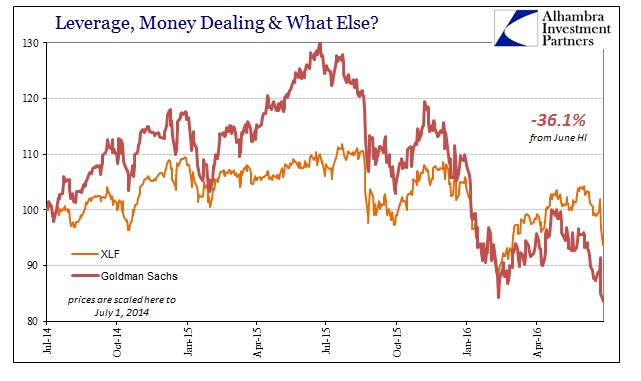

In my view, this is surely one reason why bank stocks have been treated far worse than the overall markets since the middle of last year – especially those in Europe where myths about money markets may be even greater than they are in domestic US$ terms. Banking stocks have been hammered again in the past two days not because of Brexit concerns (what does that have to do with US banks?) but because when repo rates bear no resemblance to monetary policy the whole QE-world that everyone assumed was real suddenly disappears. If the Fed (or any central bank) really cannot carry out its most basic task of “currency elasticity”, the banking system looks far, far different and much more dangerous. As money market hierarchies only further break down, perceptions of monetary risk must be altered by these unambiguous observations.

This is all the more extreme version of what has been the case all along; monetary contraction. The flipping around of the money hierarchy now at extremes shows that the contraction in supply extends quite far internally now as well as externally to the real economy; and it is only getting worse. The world was fooled by QE and bank reserves because nobody, it seems, was paying attention to what really happened in 2008. Ben Bernanke was never a hero since his FOMC fumbled about only from one failure to the next; monetary ineptitude that has only continued year after year under the cover of the logical fallacy of appeal to authority (in this case appeal to credentials alone). They really don’t know what they are doing; the difference now seems to be that the rest of the world is catching on, only a decade (or two) too late.