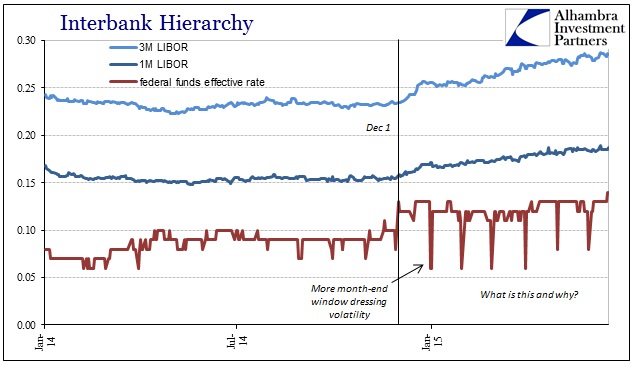

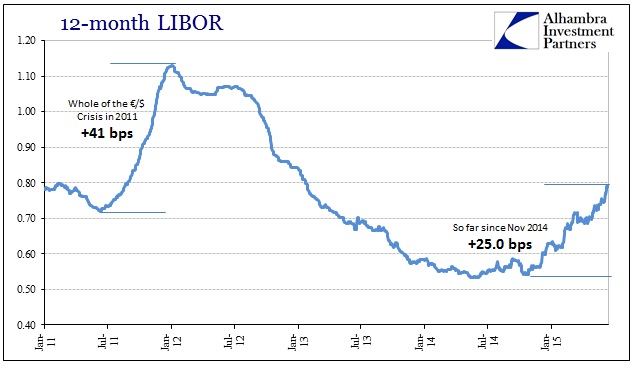

Yesterday, I briefly surveyed the outward credit risk portion of the “dollar” financing process, so it makes sense to update interbank risk. As you might expect, given hints of redrawing liquidity and a “dollar” disruption, interbank rates jumped in the early part of June. Even the federal funds rate (effective) moved up to 14 bps, the highest fix since early May 2013. Twelve-month LIBOR is at its highest rate since January 2013.

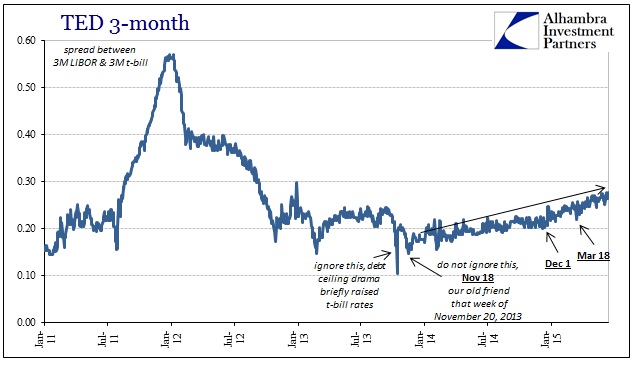

As I have maintained throughout, if this was just interbank rates adjusting to expectations of the Fed ending ZIRP then we should expect an almost smooth realignment, perhaps only clustered around FOMC statements to one effect or another. Instead, interbank rates have mostly ignored FOMC pronouncements in favor of acting in concert with other credit and “dollar” events. The most prominent, that which highly suggests a negative factor at work here, is December 1, 2014, when the “dollar” and broad credit went into a tailspin (immediately destabilizing the ruble and the Swiss franc).

Risk or liquidity perceptions are clearly being redrawn in a manner that seems to be quite removed from the Federal Reserve. Using the TED spread, for example, the inflections there, in sympathy with the rest of the interbank hierarchy, demonstrates a much longer and deeper appreciation for the entire “dollar” stress period going back to November 18-20, 2013. The elevation in LIBOR is thus highly suspect (about liquidity overall) as a latter-term addition to that trend.

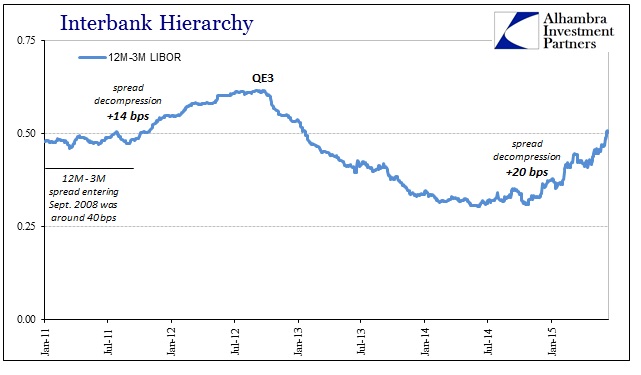

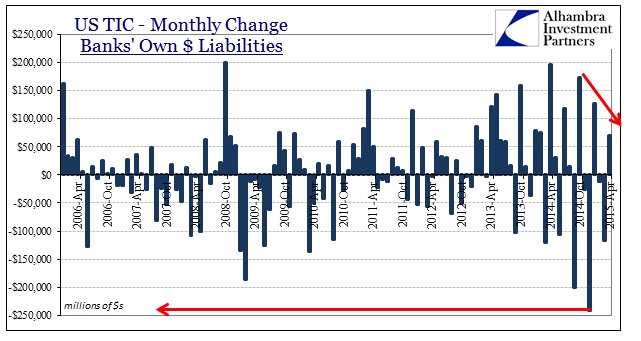

In early June alone, just as I was describing yesterday about copper and perhaps another negative “dollar” turn, 12-month LIBOR jumped by about 6 bps. Again, rather than being a part of monetary policy expectations, I think this is continued eurodollar resource extraction as global banks retreat from “money dealing” still further beyond what they had withdrawn during the height of the QE period. In other words, money dealing had become far less profitable as expectations surrounding QE in dealer activities (IR swaps, inventory profits in FICC) suddenly departed in the major taper selloff of 2013.

If risks are also rising as well, it makes sense that banks might accelerate that departure – if it is less profitable to provide global eurodollar liquidity on an ongoing basis, it is far worse continuing to do so where uncertainty is rising or even paramount once again (in a manner, it seems, not enough unlike 2011).

If the eurodollar system were to be replaced it might stand a better chance of transformation with something already standing ready to be that replacement. Money funds might well be fine in a limited role of strictly money dealing, but wholesale banking is far more than that including an entire suite of risk transformations and conduits for traded liabilities. Increasingly, banks themselves are telling the world that those vital activities are no longer profitable and they just don’t want to undertake the risks and efforts to carry them out anymore. If not them, who?

That is the problem of any Fed “exit”, as it is far more than just raising or normalizing short-term interest rates (as is commonly believed). The Fed has taken over money dealing in almost totality through QE’s. An exit from ZIRP is also an exit from the balance sheet support that has been maintaining at least the gates of disorder from springing open yet again. From that view, the uncertainty which banks are clearly unwilling to convert into money dealing activities, even at higher spreads so far, is about that transformation. I think that is why the 12-month tenor of LIBOR is moving much faster than the inner maturities because the (perceived) probability of a Fed-driven handoff is much greater in 1-year than certainly 3 or even 6 months.

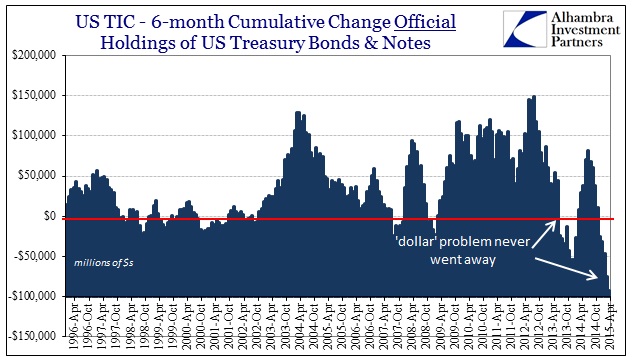

In short, interbank liquidity appears to be growing quite concerned about exactly how all this “dollar” and eurodollar business is supposed to work in its next conception. So far, it appears, banks aren’t sticking around to find out, which is why central banks globally are so drastically acting to fill the “dollar” void in this same timeframe. LIBOR, and even fed funds, tells us that void still grows deeper as no one really knows what comes next. History suggests that such turns are not so easy and carefree, and increasingly money markets agree.