Earlier this week we looked at new home sales and saw a poor performance in April. Even if the calendar was partly to blame due to one less business day in April than usual, it was still weak. It suggests that panic buying earlier this year that was triggered by rising mortgage rates, has finally led to exhaustion of potential demand.

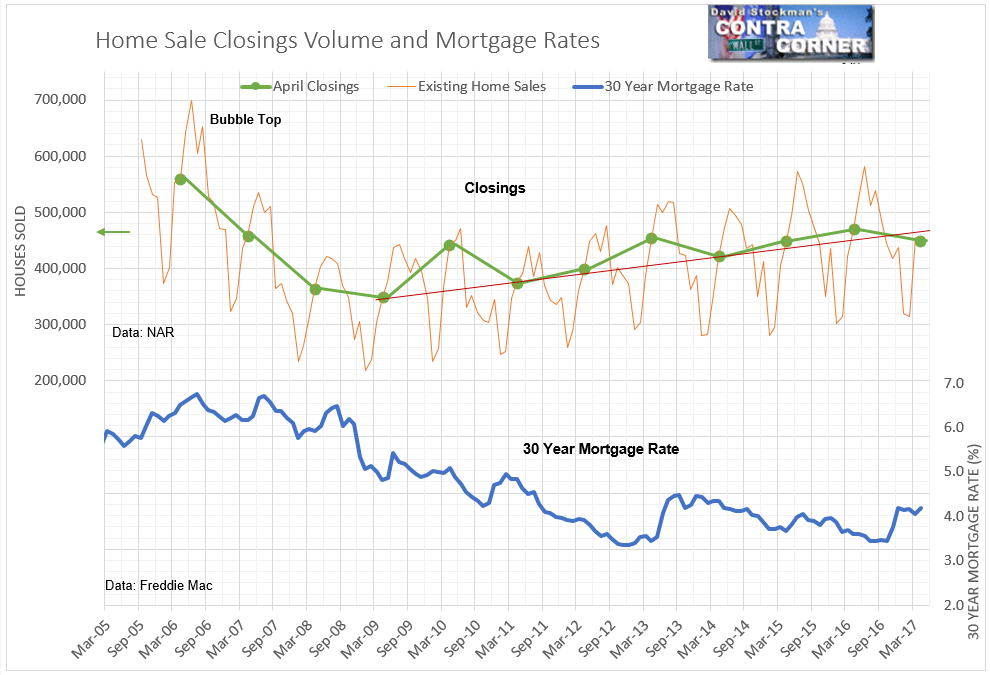

The same story played out in the misnamed Existing Home Sales report for April. “Existing Home Sales” is a count of sale closings during the month. It reflects sales that took place typically about 45-90 days prior, or February-March. It’s already old news. Conversely, the New Home Sales count is nearly real time. It’s a measure of contracts entered in April.

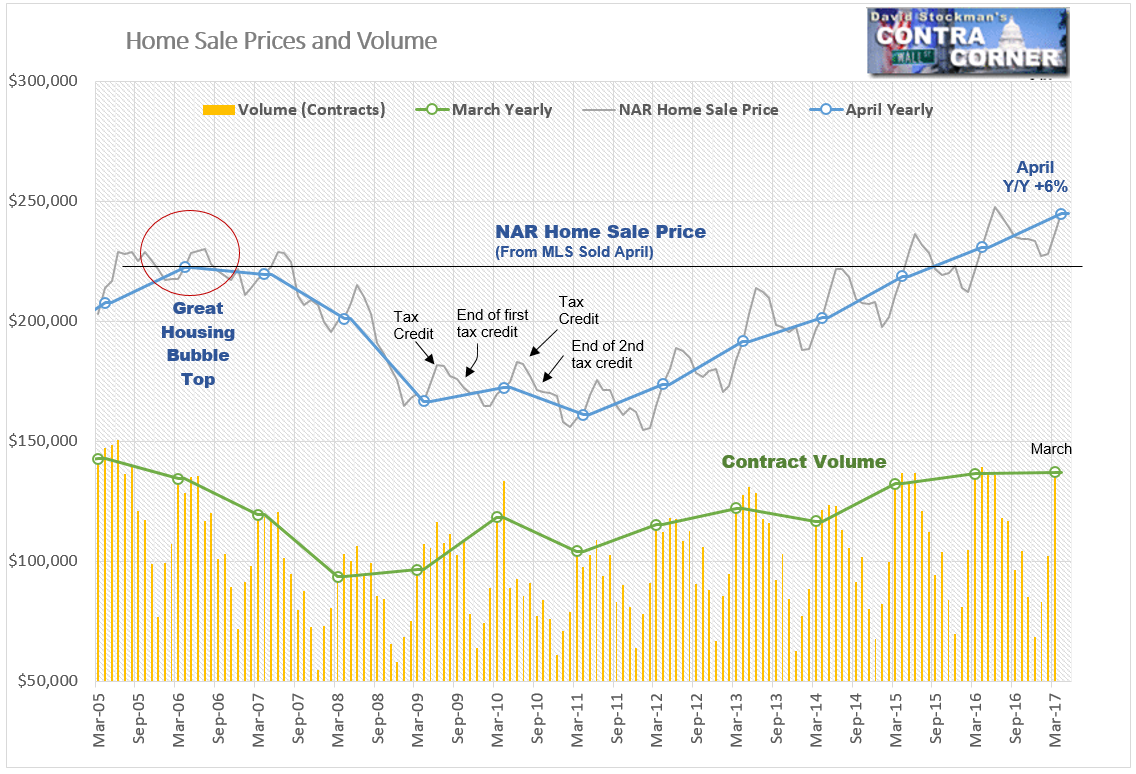

The count of sales contracts for existing homes in April will be reported next week. The NAR calls that Pending Home Sales. I would expect that to mimic April new home sales. It should show weakening. In the meantime, sales closed in April were also down. The drop has broken the 5 year uptrend in demand.

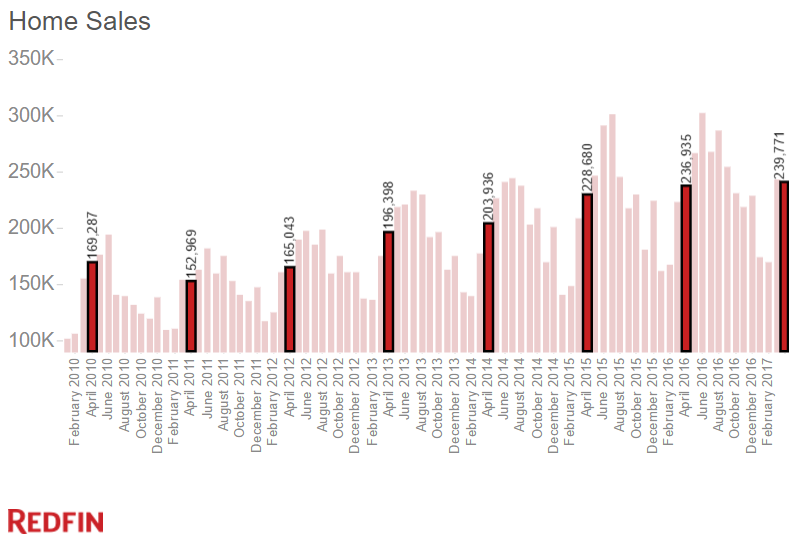

National online Realtor, Redfin, has already published the sales contract figures for April. Their numbers are based on the data it collects from the real time regional MLS data from the 42 markets it serves. These are the largest and most active housing markets in the country, so the skew, if any should be toward the strong side. Redfin reported 239,800 sales in those markets in April. That was down from 243,600 in March, and up 1.2% year over year. Only in one other year–2011–was April down from March. Last year sales rose 13,000 units between March and April.

The year to year gain of 1.2%, while weak, at least isn’t negative. But there’s a catch. Redfin reports this data on a 3 month average basis. The reported figure for April is actually the average of February, March, and April. The March 3 month average rose by 9%. The February average was up by 2%. For the April 3 month average to have been up by just 1.2% sales in April had to have been down significantly (pardon me for not doing the algebra). Look for the NAR’s “Pending” Home Sales data to confirm that the market is softening next week.

As demand weakens, we are finally beginning to see some cooling in housing inflation, which in February and March was approaching an annual rate of 8%. Prices of new homes actually dropped in April, both on a month to month and year to year basis. Affordability is the issue both in the volume of sales and in the sudden softening of prices. Buyers are completely tapped out. They could no longer afford the median sales prices in the previous couple of months, so builders and home sellers were forced to adjust.

New home sale prices fell by 3% in April. That’s the biggest decline in April since 2010, when the Federal Government had ended its second home buyer tax credit that had artificially inflated prices in the immediately preceding months. Prior to that, the last time prices fell that much in April was in 2007 as the collapse of the bubble was just starting.

Year to year, prices fell 3.8%. That was the worst year to year decline since 2012. And as you can see from the chart, it was a sharp break from the steadily rising price trend in March.

Prices of existing homes rose 3.5% from March and 6% year to year in April according to the NAR. The annual housing inflation rate of 6% is down from 6.8% in March and 7.6% in February. It sounds slight, but it’s a 20% decline in the inflation rate rate. Prices are currently 10% above the Great Housing Bubble peak.

That has been made possible by the Fed constantly reducing the interest portion of the monthly payment by forcing long term interest rates, and thus mortgage rates, lower. With each cut in rates, the principal portion of the payment had an offsetting increase, pushing prices up. If mortgage rates are allowed to rise from here, that will reduce demand and prices should follow.

Meanwhile, the US Government and mainstream economists do not believe in housing inflation. You will never see the word “inflation” related to housing in any comments by the Fed, or in any government communication, or in any economist’s comments. Housing prices, you see, don’t inflate. They “grow” or “appreciate.” There is no housing inflation, only growth or appreciation. It’s all good.

In fact, rather than use actual home prices in the CPI, the BLS goes so far as to include a phony substitute measure of housing inflation called Owner’s Equivalent Rent (OER) which boils down to a survey question to a tiny sample of homeowners that asks them what they think their house would rent for. It’s a little more complicated than that, but the end result is that OER constantly, grossly understates the inflation rate of housing. That OER number is roughly 41% of core CPI and 31% of total headline CPI. So a big difference there has a big difference on CPI.

Here’s what OER looks like compared to actual housing inflation as measured by FHFA.

When home prices began to recover in 2012, by the end of the year they had risen by 6%. OER showed 2%. The gap was 4.5% in 2013, 2.5% in 2014, and is now around 2.8% given the April home price data which is not yet reflected in the FHFA data. The OER inflation rate has persistently been half, or more than half, of the actual house price inflation rate.

Housing inflation is one of the purest manifestations of monetary inflation there is, yet we manage to completely ignore it. That’s because in mainstream thinking, housing doesn’t inflate. Would be homebuyers, may not know what to call it, but when they can no longer afford to buy a house they know what its effect is.

The economic world today is only seen through Alice’s looking glass. It’s crazy. It’s difficult to act intelligently as an investor if you can’t cut through the heap of utter garbage that’s piled upon you day in and day out. The bottom line is this, as home prices inflate, fewer people can buy, sales volume will continue to soften, and price inflation should reverse. If mortgage rates are allowed to rise, as I think they will, then the market will probably crash. Volume will dry up and prices will collapse, just line in 2007-2010.

Lee first reported in 2002 that Fed actions were driving US stock prices. He has tracked and reported on that relationship for his subscribers ever since. Try Lee’s groundbreaking reports on the Fed and the Monetary forces that drive market trends for 3 months risk free, with a full money back guarantee. Be in the know. Subscribe now, risk free!