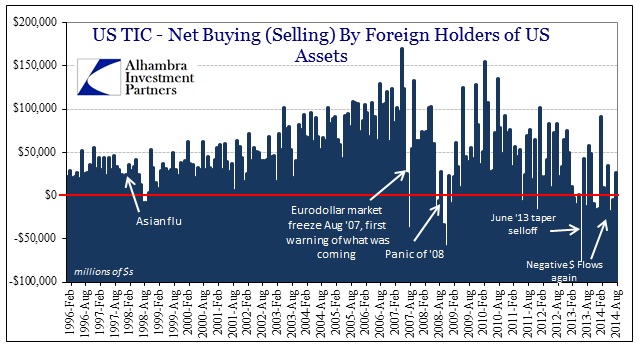

There would be a lot more use for the Treasury Dept’s TIC flows and holdings data if it was released closer to real time, but even with that evident staleness about it I think there is a lot of use in how it frames what we see in the dollar and currencies (thus spilling over into “markets” everywhere). The dominant feature of the past few months, beginning around July 3, has been the sharp “rise” in the “dollar.” That really meant tightening eurodollar offers globally, a fact all too obvious now.

What the TIC flows show us is some depth to understanding why this rise has been so precipitous compared to even 2013. In some ways that is a two-part pattern, starting first with global central banks essentially relaxing their posture throughout 2014.

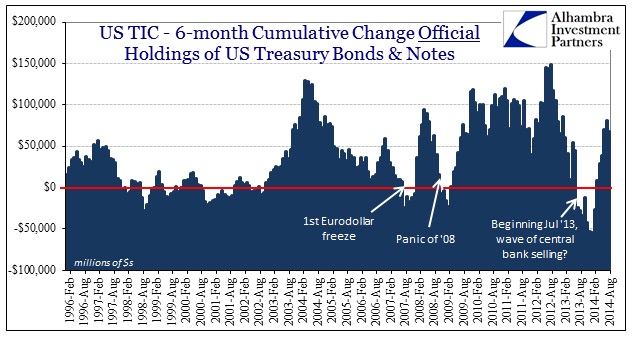

Total net holdings shown above combine both the “public” (central banks and foreign governments) and private, so breaking them apart provides clarity.

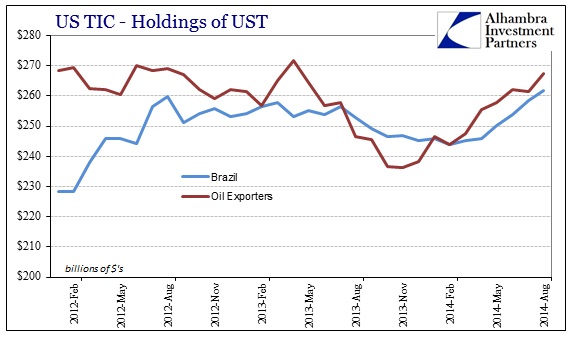

Since about February this year, right around when the dollar attained “stability” (along with gold and so many other credit market indications and even currencies) “official” holdings of UST resumed their upward course. That meant that foreign entities, largely central banks, began to scale back their dollar bypasses, being more confident about funding stability in the global dollar short.

We see that in the behavior of some of the most impacted nationalities, like Brazil. That also extends globally where the rise in foreign UST holdings shows that change toward a more tranquil tendency in monetary policy related to the “dollar” and “dollar reserves.”

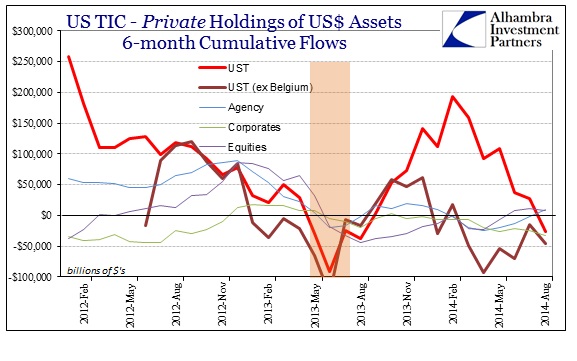

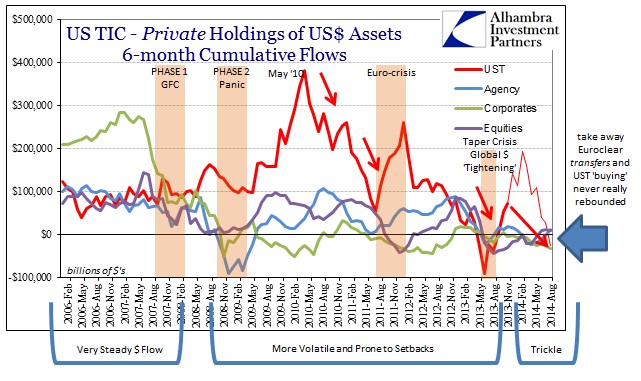

So on that side of the ledger, policy grew more benign and less alert. On the other side, the private “dollar” market, turmoil and disruption remained the dominant theme.

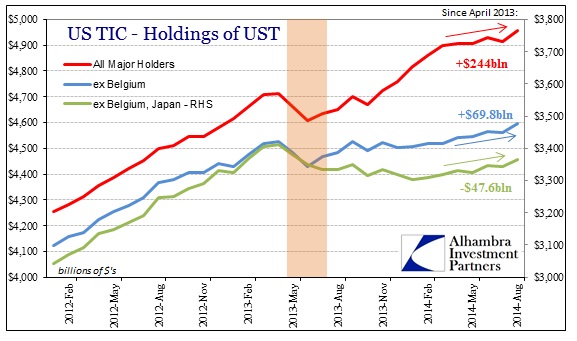

In fact, as noted previously, private holdings of assets here are skewed by what is certainly now a one-time transfer of UST holdings to Euroclear in Belgium. Accounting for that flow, private holdings of dollar-denominated assets (at least as a proxy through TIC) have been steadily battered without much change since 2013 – in direct contrast to what central banks were perceiving and how they acted on those perceptions.

The combined tendency of still-roiling private “dollar” funding conditions set against largely absent central bank measures (see Banco do Brasil’s recent winding down of their swaps) I think explains well why the dollar’s “rise” has been so sharp in this latest episode. There are, I believe, two important implications of that. First, as always, central banks remain far behind the curve as a result of their bureaucratic nature as well as the inability and reluctance (institutional inertia: recency bias combined with orthodox predispositions toward generic and monolithic interpretations) to peer beyond the surface.

The second implication is more serious, and I think it relates to what is taking place with the “dollar” post-August 9, 2007. Funding conditions under the eurodollar standard have become more challenging, in my analysis in no small part tracing to central liquidity capacity and elasticity. That is a complicated story in its own right, but in some sense the more central banks have acted since August 2007 the less “room” there has been for private markets. I’ll have more to say about this in the future, but needless to say that in very important aspects the liability side of the global dollar short seems to have become very comfortable with “official” dollar supply to the point that private “dollar” providers have simply gone elsewhere (again, this is not the only factor, but I think it highlights a lot about systemic erosion, particularly what we see here).

If you are a dollar provider and you are essentially “competing” with a central bank to provide funding, and central banks’ entire focus is to “cheapen” funding, then you are simply going to respond less and less as they respond more and more. It is a form, so to speak, of crowding out, but the net result is what we see below:

In short, the entire global eurodollar standard, I believe, is far more unstable now than at any point since 2009; thus the asymmetry of currencies now vs. even 2013 (which was itself full of imbalance and asymmetry, only with a deeper penetration domestically). The margin of “safety” for orderly operation has withered now to the point that minor changes to perceptions are producing outsized and volatile behavior that, more importantly, lingers for prolonged periods.