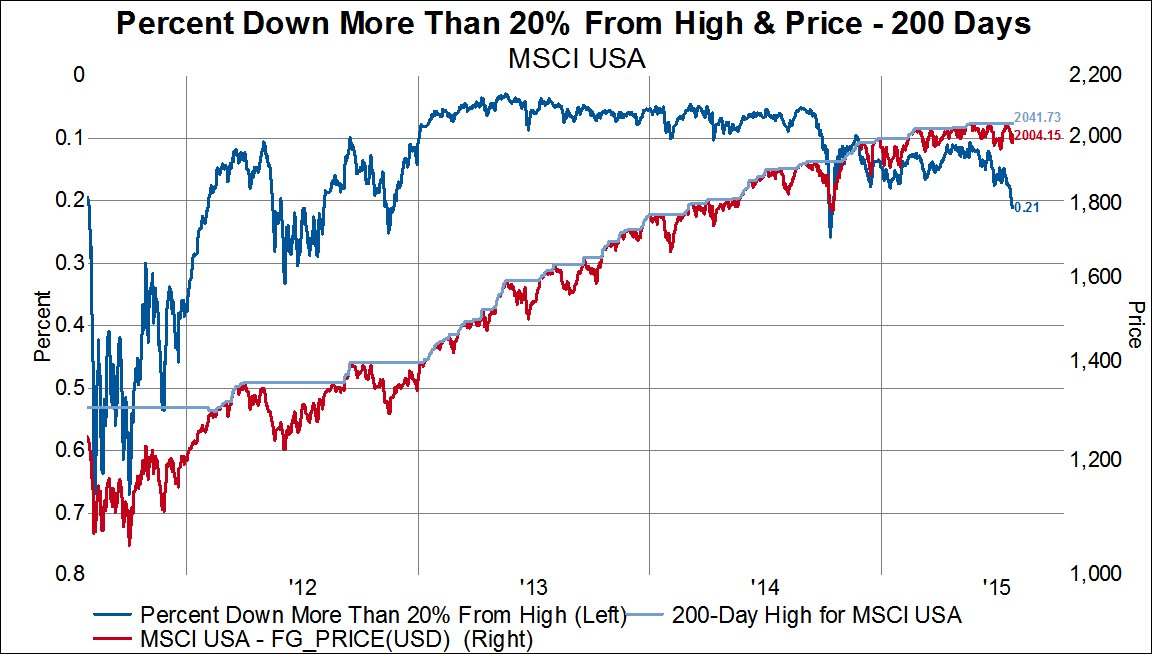

With the major US equity markets within 1-2% of their record highs, Gavekal Capital notes that underneath the headline indices, stock markets are extremely tumultuous. Rather stunningly 21% of MSCI USA stocks are at least 20% off their recent highs, and 68% of Canadian stocks are in bear markets, but the real carnage is taking place in Emerging Markets.

This is only the third time since the summer of 2012 that this many stocks are in a bear market. The most interesting aspect of this internal correction is the fact that the headline index is a mere 1.8% off the 200-day high. On October 10, 2014 when 21% of MSCI USA stocks were in a bear market, the headline MSCI USA index was 5.4% off the 200-day high. And on November 8, 2012 when 21% of the MSCI USA stocks were in a bear market, the headline index was 6% off the 200-day high.

The pain felt in US stocks is nothing compared to many markets around the world. Just a reminder that this all based on USD performance.

Canadian stocks have been getting pummeled. 68% of Canadian stocks are in a bear market. This is the greatest percentage of stocks in a bear market since 2011.

30% of MSCI Hong Kong stocks are in a bear market and 29% of MSCI Singapore stocks are in a bear market as well.

The true carnage is taking place in the emerging markets, however, where nearly 2/3 of all EM stocks are at least 20% off its 200-day high.

Some of the worst countries in EM are Brazil (82%), China (82%), Indonesia (77%), and Russia (81%).

http://www.zerohedge.com/news/2015-07-29/1-5-us-stocks-now-bear-market