The wider impact of plummeting oil prices is just now starting to be considered. Just about all ‘experts’ are way behind the curve. There’s still people insisting it’s all be a big boon to all of our economies. Not here, as you know if you follow TheAutomaticEarth.com, or as you can find out by retracing us over the past 1-2 months. I said from the get go that this cannot end well. Oil is too large a part of the economy to let a 40% price drop be reason to party.

And now both the Federal Reserve and the Bank for International Settlements have clued in, with urgency, to leveraged loans, their role in CDOs, AND their link to the energy industry. And whatever we may think of either institution, when both hoot the red alarm horn at the same time, we should pay attention.

Two articles from very different sources paint the – essentially same – picture. One is from Wolf Richter, easily one of my favorite writers at the moment in this narrow financial niche of ours, and his article today does a lot to confirm that. The other is from my ‘friend’ against all odds (we never met nor communicated), Ambrose Evans-Pritchard, who proves once more what makes him, despite all else, an interesting journalist to read.

What connects the two articles is leveraged loans, which in turn are strongly linked to collateralized debt obligations (CDOs). Ambrose quotes the BIS as saying 55% of CDOs are issued based on leveraged loans, an “unprecedented level”. Which is another way of saying we’re not in Kansas anymore. While Wolf confirms that leveraged loans play a major role in the oil (re:shale) industry.

Obviously, so do junk bonds, but those don’t bother the Fed and BIS as much; they get sold to investors, mutual funds, pension funds and the like. Leveraged loans on the other hand directly impact major banks. And that gives grandma Yellen the ‘Janet Jitters’ (let’s remember that term). For good reason: the Fed can’t buy oil, but its owner banks are hugely exposed to it.

This is what makes the falling oil prices so dangerous. As I must have said a million times in just the past few weeks, it’s not about the energy, it’s about the money. And this time around, I don’t have to do much writing, I laid plenty groundwork recently, and now the story tells itself. Apologies for the long quotes, I deleted what I thought was suitable. So first, here’s Wolf:

Oil, Gas Bloodbath Spreads to Junk Bonds, Leveraged Loans. Defaults Next

The price of oil has plunged nearly 40% since June to $65.63, and junk bonds in the US energy sector are getting hammered, after a phenomenal boom that peaked this year. Energy companies sold $50 billion in junk bonds through October, 14% of all junk bonds issued! But junk-rated energy companies trying to raise new money to service old debt or to fund costly fracking or off-shore drilling operations are suddenly hitting resistance.

And the erstwhile booming leveraged loans, the ugly sisters of junk bonds, are causing the Fed to have conniptions. Even Fed Chair Yellen singled them out because they involve banks and represent risks to the financial system. Regulators are investigating them and are trying to curtail them through “macroprudential” means, such as cracking down on banks, rather than through monetary means, such as raising rates. And what the Fed has been worrying about is already happening in the energy sector: leveraged loans are getting mauled. And it’s just the beginning.

This monthly chart by S&P Capital IQ’s LeveragedLoan.com shows the leveraged loan index for the oil and gas sector. Earlier this year, when optimism about the US shale revolution was still defying gravity, these loans were trading at over 100 cents on the dollar. In July, when oil began to swoon, these loans fell below 100 cents on the dollar. The trend accelerated during the fall. And in November, these loans dropped to around 92 cents on the dollar.

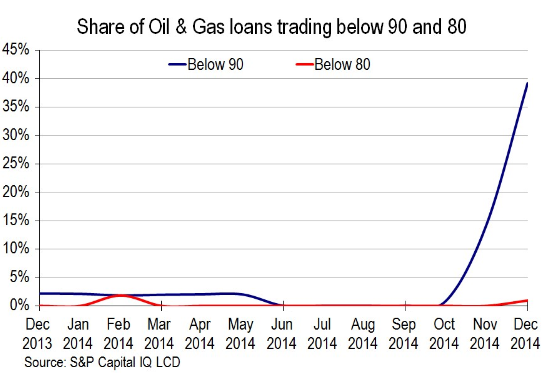

How bad is it? The number of leveraged loans in the oil and gas sector trading between 80 and 90 cents on the dollar (blue line in the chart below) has soared parabolically from 0% in September to 40% now. These loans are now between 10% and 20% in the hole! And some leveraged loans are now trading below 80 cents on the dollar:

“If oil can stabilize, the scope for contagion is limited,” Edward Marrinan, macro credit strategist at RBS Securities, told Bloomberg. “But if we see a further fall in prices, there will have to be a reaction in the broader market as problems will spill out and more segments of the high-yield space will feel the pain.”

Oil and gas stocks are bleeding: the Energy Select Sector ETF is down 21% from June; S&P International Energy Sector ETF down 29% and the Oil & Gas Equipment & Services ETF down 42% from early July. Smaller drillers are in trouble. All of them had horrific single-day plunges, some over 30%, on “Black Friday” after OPEC’s Thanksgiving decision [..] Traders who tried to catch these stocks have gotten their fingers sliced off since then:

Goodrich Petroleum -88% since June. Energy XXI -86% since June. Sanchez Energy -78% since June. Oasis Petroleum -75% since July. Etc.

These are the very companies that benefited during the crazy good times from yield-desperate investors who’d been driven to obvious insanity by the Fed’s interest rate repression. These investors – such as your bond mutual fund or your pension fund – loaded up on energy junk bonds and leveraged loans. And now the Fed-inspired financial house, where all risks have been eliminated by QE Infinity and ZIRP, is rediscovering risk. Turns out, the Fed, so ingeniously prolific in buying financial assets to inflate their prices, can’t buy oil.

Unless a miracle happens that will goose the price of oil pronto, there will be defaults, and they will reverberate beyond the oil patch. [..] even the 43 largest, most diversified players in the energy sector that are part of the S&P 500 are grappling with the new reality: analysts chopped earnings estimates by 20.5% since September 30, according to FactSet.

As of Friday, analysts expected the energy sector to report a 13.7% drop in revenues. At the beginning of the quarter, they’d expected a decline of only 1.7%, though oil prices had been plunging for three months. And they now expect a 14.6% swoon in earnings, as opposed to the 6.6% gain they still saw at the beginning of the quarter.

All of the energy companies in the S&P 500 got their EPS estimates decimated, even the biggest ones: Exxon Mobil by 20%, Chevron by 25%, Hess by 47%, Murphy Oil by 50%, and Marathon Oil by 63%.

And then Ambrose comes in from a completely different angle, to tell basically the exact same story. The overlords of finance are nervous and worried, and limited in the scope of their possible remedies. But I bet you, the Fed will still raise rates. With ‘official’ US jobless rates at 5.8%, they must, or they lose all credibility. And besides, don’t forget that Wall Street banks need higher rates now more than ever, never mind the real economy, exactly because of leveraged loans. Hey, amigo, everybody’s in oil!

Dollar Surge Endangers Global Debt Edifice, Warns BIS

Off-shore lending in US dollars has soared to $9 trillion and poses a growing risk to both emerging markets and the world’s financial stability, the Bank for International Settlements has warned. The Swiss-based global watchdog said dollar loans to Chinese banks and companies are rising at an annual rate of 47%. They have jumped to $1.1 trillion from almost nothing five years ago. Cross-border dollar credit has ballooned to $456bn in Brazil, and $381bn in Mexico. External debt has reached $715bn in Russia, mostly in dollars.

A chunk of China’s borrowing is disguised as intra-firm financing. This replicates practices by German industrial companies in the 1920s [..]“To the extent that these flows are driven by financial operations rather than real activities, they could give rise to financial stability concerns,” said the BIS in its quarterly report. “More than a quantum of fragility underlies the current elevated mood in financial markets,” it warned.

[..] Some of the violent moves lately go beyond stress seen in earlier crises, a sign that markets may be dangerously stretched and that many fund managers do not really believe their own Goldilocks narrative. “Mid-October’s extreme intraday price movements underscore how sensitive markets have become to even small surprises. On 15 October, the yield on 10-year US Treasury bonds fell almost 37 basis points, more than the drop on 15 September 2008 when Lehman Brothers filed for bankruptcy.”The BIS said 55% of collateralised debt obligations (CDOs) now being issued are based on leveraged loans, an “unprecedented level”. This raises eyebrows because CDOs were pivotal in the 2008 crash. “Activity in the leveraged loan markets even surpassed the levels recorded before the crisis: average quarterly announcements during the year to end-September 2014 were $250bn,” it said.

BIS officials are worried that tightening by the US Federal Reserve will transmit a credit shock through East Asia and the emerging world, both by raising the cost of borrowing and by pushing up the dollar.

The role of the US dollar is crucial in all this. If and when you see that “cross-border lending in dollars has tripled to $9 trillion in a decade“, you must recognize that you might as well forget about the demise of the greenback for the time being.

The dollar index (DXY) has surged 12% since late June to 89.36, smashing through its 30-year downtrend line. [..] Hyun Song Shin, the BIS’s head of research, said the world’s central banks still hold over 60% of their reserves in dollars. This ratio has changed remarkably little in 40 years, but the overall level has soared – from $1 trillion to $12 trillion just since 2000.

Cross-border lending in dollars has tripled to $9 trillion in a decade. Some $7 trillion of this is entirely outside the American regulatory sphere. “Neither a borrower nor a lender is a US resident. The role that the US dollar plays in debt contracts is very important. It is a global currency, and no other currency has this role,” he said.

The implication is that there is no lender-of-last resort standing behind trillions of off-shore dollar bank transactions. This increases the risks of a chain-reaction if it ever goes wrong. China’s central bank has ample dollar reserves to bail out its companies – should it wish to do so – but the jury is out on Brazil, Russia, and other countries. This flaw in the global system may be tested as the Fed prepares to raise interest rates for the first time in seven years. [..] The Fed’s new “optimal control” model suggests that rates may rise sooner and faster than markets expect. This has the makings of a global shock.

The great unknown is whether the current cycle of Fed tightening will lead to the same sort of stress seen in the Latin American debt crisis in the early 1980s or the East Asia/Russia crisis in the late 1990s. This time governments have far less dollar debt, but corporate dollar debt has replaced it, with mounting excesses in the non-bank bond markets. Emerging market bond issuance in dollars has jumped by $550bn since 2009. [..].. the weak links may not be where we think they are [..] the new threat may lie in non-leveraged investments by asset managers and pension funds funnelling vast sums of excess capital around the world, especially into emerging markets.

They engage in clustering and crowd behaviours, and are apt to pull-out en masse, risking a bad feedback-loop. This could prove to be today’s systemic danger. [..] [The BIS] now warns that the world is in many ways even more stretched today than it was in 2008 [..]

This is the story of today. Oil is everywhere. In all aspects of our lives. If oil prices suddenly move up a lot, people driving cars get hit, bad for the economy. If they move down much, the industry gets hit, jobs are lost, also bad for the economy. And everyone’s invested in that industry, whether they know it or not. We simply can’t afford $40 oil anymore than we can $200 oil; that is, in the short term. Our pensions funds, mutual funds and especially our banks are too heavily invested in it. Let alone our governments.

Falling oil prices are not just set to create future mayhem, they’re doing it now, you ain’t seen nothing yet. Much of the industry itself is scrambling to stay alive, many parties won’t make it if prices stay low or go lower, and the financial world, including your pension funds and mutual funds, will go south with it.