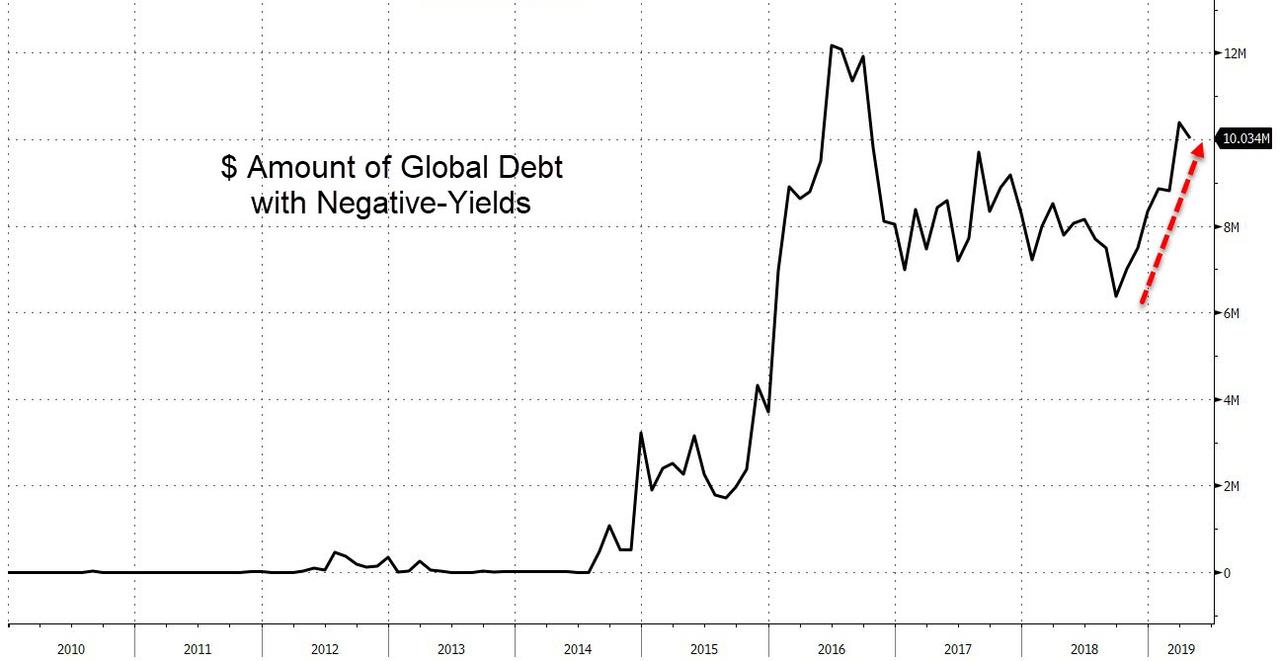

In a healthy economy with lots of profitable opportunities, few investors have an interest in, say, a government bond yielding -0.3%. Europe is clearly not that kind of place anymore, as the outstanding amount of negative-yielding government bonds is up by 20% this year to about $10 trillion. That’s the highest since 2016, when the ECB was depressing rates by snapping pretty much every available eurozone sovereign bond.

https://www.zerohedge.com/news/2019-05-01/negative-yielding-bond-are-back-and-why-thats-bad-thing