Why won’t monetary policy just work as designed? It sounds so utterly simple:

To review: Interest rates are the price of lending and saving money. When interest rates throughout the economy are low, banks charge less for loans and individuals have less incentive to save; when they’re high, lenders charge more and individuals save more. This is why central banks tighten interest rates when they’re worried about inflation: Discouraging loans and encouraging individuals to sock their money away slows economic activity, which keeps inflation in check. Conversely, cutting interest rates in a recession encourages credit and consumption, which boosts job creation.

If interest rates could go negative — and banks started charging people for depositing their money — then this logic extends out: Not only would we be encouraging people to save less, we’d be actively penalizing them for saving rather than consuming.

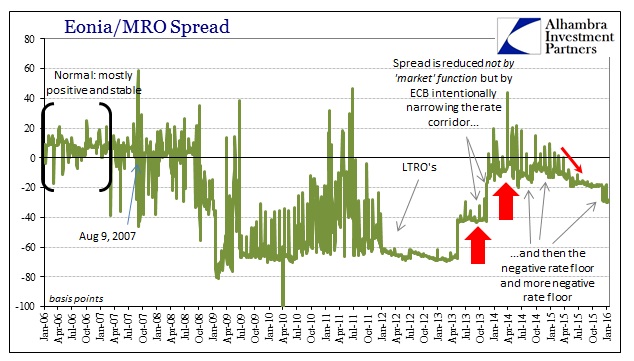

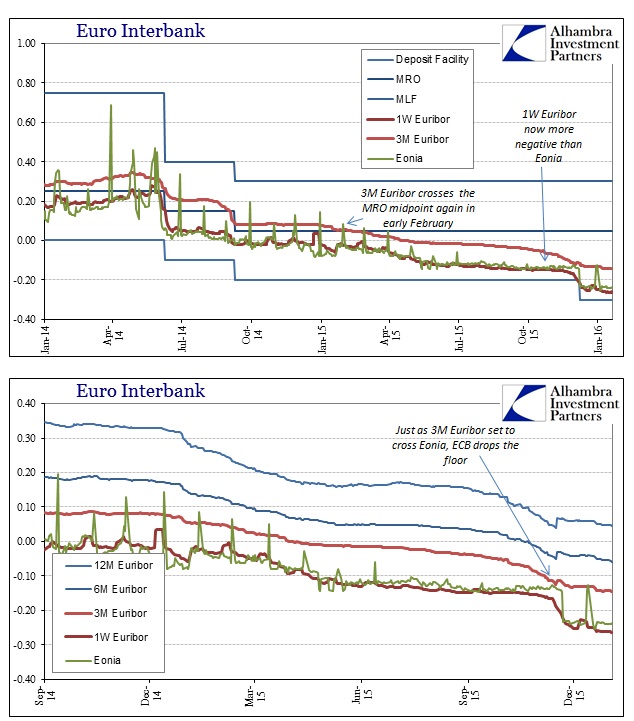

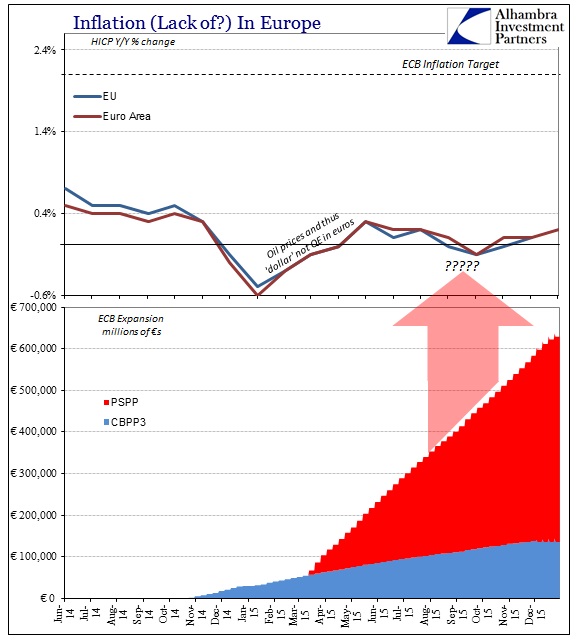

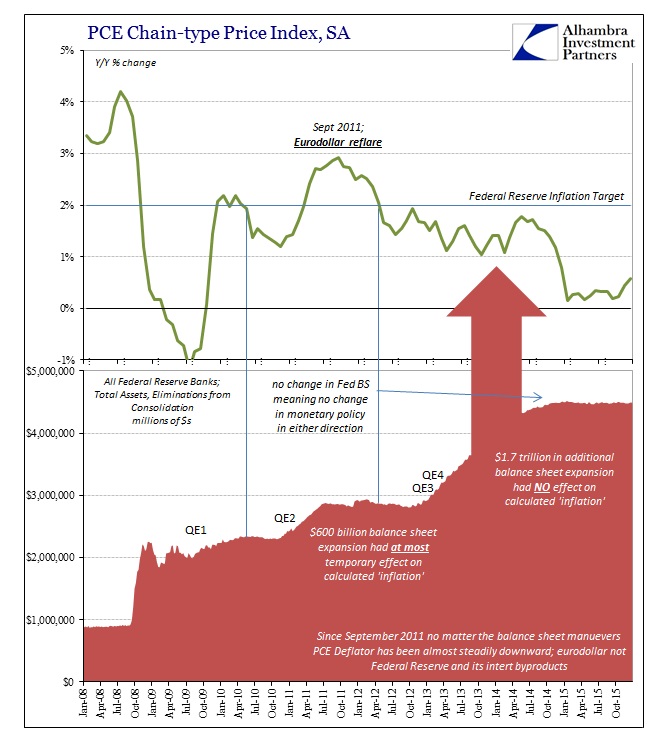

This is the cartoonish version of money and banking that is usually sketched out on the chalkboard of any Economics 101 class. The real world, however, looks something like this:

But even after that, the author makes this stunning claim about how BoJ’s NIRP & QE repackaging might actually work:

One reason to think the Bank of Japan’s gambit could help is that a lot of actors in the economy can’t really “stuff money in the mattress” in practice. Big financial firms and corporations and the like are dealing with huge sums of money parked in all sorts of wild financial instruments. In many cases, turning those holdings into cash and thus escaping the bite of negative interest rates will just be prohibitively difficult and expensive. So they may well eat the cost of the negative interest rates, and respond to the incentive the way the Bank of Japan hopes they will. This may explain why the negative interest rates from the ECB and others haven’t resulted in dysfunction.

My definition of “dysfunction” in this context is clearly different (as shown in the charts above). Instead, it may presume better understanding to answer where past extremes taking exactly this format as the author proposes failed to generate anything the author and the theory presupposes. It’s the politician who when losing a vote falls back on blaming his/her messaging or communications rather than the more fundamental proposition that there are no monoliths to easily exploit.

Maybe the cartoon was just a cartoon. In that respect, reaching for the slimmest of silver linings, the Panic in 2008, the attendant Great Recession and then the Great No Recovery have done us the favor of exposing the fairy tale. In very rough terms, the “Greenspan put” was this idea that the Fed (or any central bank) could if pushed far enough enforce an interest rate economy-wide and that would make for predictable economic control; just the sort presented above. But it was always that, just a threat.

The events starting in August 2007 dared the Fed to finally put up or shut up. It did the former and was thoroughly disproved. People, especially economists, have convinced themselves that there were exogenous or extenuating circumstances to explain being humiliated in such stunning fashion, but the truth is as explained at the outset – the entire theory of economics, especially monetarism, is simply cartoonish unreality. It may work on the chalkboard but it has been proven, via repeated and broad central bank experimentation across the globe, no less, to be complete bunk.

“When interest rates throughout the economy are low, banks charge less for loans and individuals have less incentive to save”, is only one possibility among many. The world is dynamic, changing and vibrant to every person living on it except the monetary economist. This will be the coming message of NIRP, that it is just so simple and easy as if they didn’t say the same thing about QE when it was fresh, exciting and purportedly candid. If QE had worked, there would be no need of NIRP; the unrealistic philosophy of NIRP is already captured in QE. QED.