Now that the second quarter has concluded we will start getting the full picture (before revisions, of course) of the warm weather. So far initially “economists” have been cutting back their forecasts, though at least this time it is ahead of “unexpected” declines in economic fortunes.

Below is a summary of where expectations sit now, though since these are nothing more than regression models there is as much validity to them as anything else retrofitting a probabilist interpretation on a complex system.

Consumer spending in May rose just 0.2 percent, half of what was expected, after being flat in April. Spending by consumers accounts for more than two-thirds of U.S. economic activity, and the lowered growth forecasts now raise concerns that the economy will not be able to rebound to the more than a 3 percent growth rate widely expected for the balance of the year.

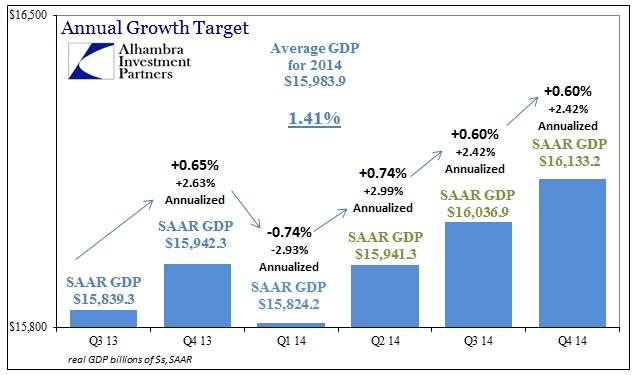

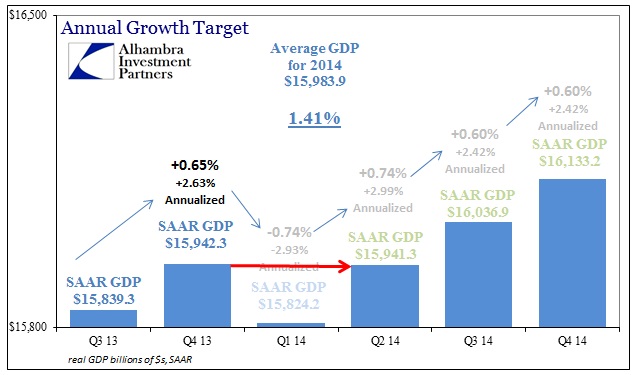

Goldman Sachs economists trimmed second quarter tracking GDP to 3.5 percent from 4.1 percent, and Barclays economists said tracking GDP for the second quarter fell to 2.9 percent from 4 percent. At a pace below 3 percent, the economy could show contraction for the first half due to the steep first quarter decline of 2.9 percent. [emphasis added]

Economists at JP Morgan cut their 2014 growth expectation to just 1.4%, including half of a percent off the last six months of the year.

That means that current expectations are for a slight contraction in H1 from the pace of the last quarter of 2013. Again, this assumes that the economy actually grew at the pace expected by even these downgraded assessments.

Of the data that has come in so far of April and May, none of it really looks like even that much of a rebound.

Consumer spending increased 0.2 percent in May after being flat in April, and was down for a second straight month when adjusted for inflation, the Commerce Department said.

That suggests consumer spending, which accounts for more than two-thirds of U.S. economic activity, could struggle to regain momentum this quarter after growing at its slowest pace in nearly five years in the first three months of the year.

That understates the case by quite a bit, likely because it contradicts the mainstream, orthodox expectation. For some reason there is no accounting for anything aside the ridiculous and persistently wrong forecasts from economists.

Analysts see the economy growing at an annual rate of 2.0 percent in the current quarter, down from a previous estimate of 2.5 percent, according to the Philadelphia Federal Reserve’s quarterly survey of 45 forecasters, released on Friday. Second-quarter growth was forecast to accelerate to 3.0 percent, up from a prior forecast of 2.9 percent.

The economy is expected to grow at a rate of 2.8 percent for all of 2014, versus a previous estimate of 2.6 percent in the previous survey in November. Growth in 2015 is expected to accelerate to 3.1 percent.

The quoted article above was from the middle of February, speaking about the disaster of the first three months while it was in progress. While there was only the “realtime” data from January to analyze at that point, it was obvious even then that there was trouble brewing (as opposed to Polar vortices brewing). Yet that only rated a downgrade to +2%, still missing by nearly 5% from the final, revised tally!

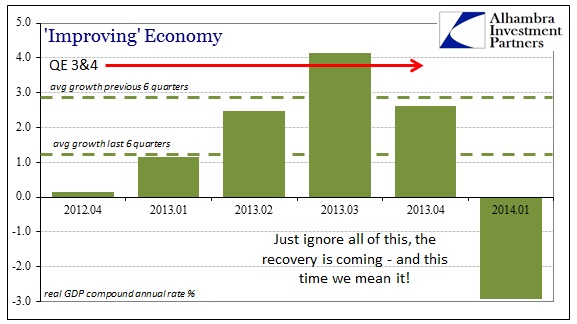

That applies to the rest of the year, as well. In February, economists were still thinking about almost 3% for 2014 – and even upgraded their expectations for the year then. We will be lucky if even these newly revised downgraded estimates actually happen. In the previous six quarters (prior to the just-concluded second of 2014), only one came close to 3% growth and that was the record-inventory surge of July-September 2013.

To get an average of 3% growth over the final nine months of this year would mean a return to economic conditions from the middle of 2011 until early 2012 – in other words the rate of growth before the massive 2012 slowdown (which wasn’t all that great then). There is absolutely nothing to suggest that is likely, or even possible, particularly given that so many accounts and factors are steadfastly depressed and “refuse” to return to such growth rates.

But what is perhaps most interesting is that JP Morgan’s economists actually noticed the vast and growing inconsistency in the figures.

Real GDP appears to have contracted in the first half. At the same time, payroll employment averaged 231,000 in 1H14, the strongest six-month run of job growth in the expansion to date.

That’s one hell of a contradiction, suggesting that something somewhere may need to be revised. Since employment is typically a lagging indication, the revisions may not necessarily be coming from the current estimates of the Establishment Survey’s statistics (though I have to think that will be the case at the benchmarks), but rather these persistent growth expectations that don’t seem to generate any kind of accountability. Everything (economists, the Establishment Survey, monetary policy, etc.) is still being taken at face value despite all these obvious contradictory assessments and estimates.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com