The housing market has failed to perform as expected on either side. Instead, as far as a broader set of measures, real estate is in a bit of stasis, neither really growing nor falling apart. Given the set of mainstream economic expectations, that is confounding and could ultimately be a problem. If the economy is really growing, it should be generating significant construction and activity (apart from resales, apparently) to service rising general fortunes. If wages are to come, then housing would be one of the first expressions of that, even in anticipation of it.

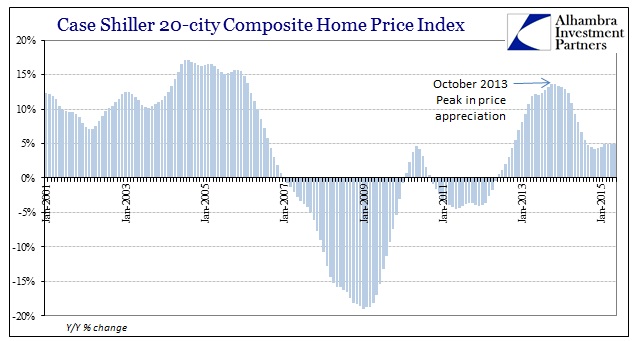

Nationally, single-family home prices have settled into an annual 4 to 5 percent pace of increase, moderating after the “double-digit bubbly pattern of 2013,” according to S&P/Case-Shiller.

“Over the next two years or so, the rate of home price increases is more likely to slow than to accelerate. Prices are increasing about twice as fast as inflation or wages,” David M. Blitzer, managing director and chairman of the index committee at S&P Dow Jones Indices, said in a statement.

The weak link in the market remains first-time home buyers, S&P/Case-Shiller reported.

“First time buyers provide the demand and liquidity that supports trading up by current home owners. Without a boost in first timers, there is less housing market activity, fewer existing homes being put on the market, and more worry about inventory,” Blitzer said.

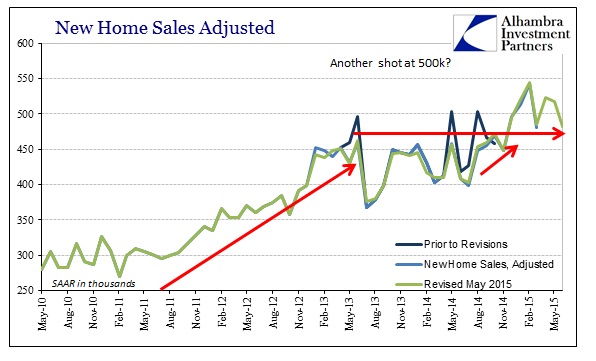

The most recent data on housing seems to indicate the same as what Case/Shiller prices are suggesting. There was a slight elevation in sales activity later last year, but that hasn’t followed through and now inventory, especially of specs and new property development, might be fairly misaligned for what is actually occurring.

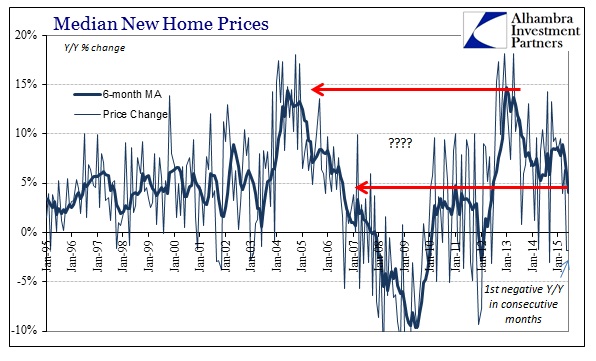

If builders took that small increase, along with incessant reference to the “greatest payroll expansion in decades”, to mean far more robust conditions in 2015 then the activity so far this year makes some sense. In terms of new home sales, prices have actually declined year-over-year in consecutive months for the first time since 2011. That would suggest builders having to both discount prices on existing inventory, giving up at least somewhat on last year’s hope-filled extrapolations, while also growing somewhat cautious about adding to it (lackluster and really deficient permits and starts in single-family construction).

The 6-month average yearly gain in median new home prices has fallen below 5%, which is less than even 2014’s “disastrous” Polar Vortex; largely indorsing what the price figures from Case/Shiller are displaying.

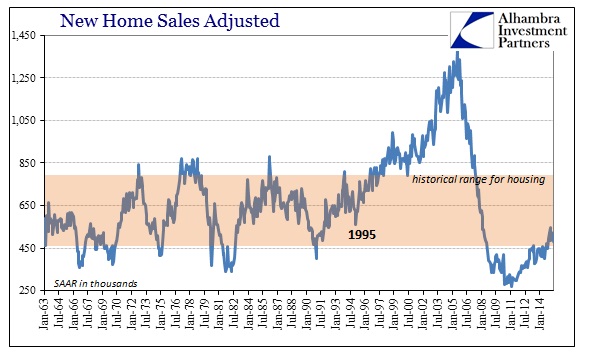

As usual, I think this is a fairly negative derivative commentary on the economy as a whole. Robust and rising payrolls, in actuality rather than just the pure statistical sense, would produce far greater and sustained demand especially after years and years now of economic suppression of that primal, successive instinct. The fact that this market in 2015 failed to live up to those standards set in 2014 suggests how much this economy is really deficient still to the point of fiction. In the latter 1990’s, when last estimated payrolls were so remarkable, new home sales were above 850k SAAR rather than 450-500k now.

Despite all the supposed economic growth the past few years, new homes are still only selling at the pace of the 1990-91 recession – not counting any population growth. At best, that suggests the economy remains under great and continued strain even if the immediate direction is less discernable if still highly questionable. It may also show how much the economy has been permanently shrunk by all that prior inflation.