It may be progress in some sense, but we have apparently shifted beyond the “unexpected” stages of the economy. Disappointing data, as with the crude oil collapse, is now being termed “temporary.” That was the case with almost all the data this week, including factory orders, all of which was disappointing and thus “temporary.”

But with domestic demand picking up, against the backdrop of lower gasoline prices and firming wage growth, any slowdown in economic growth is likely to be temporary.

As with everything else in this Bernanke/Yellen economy, this magical “picking up” is not taking place anywhere outside the narrowest of context. It is quoted as gospel yet never seems to materialize to any degree that resembles prior acts of it. Factory orders, for example, don’t show anything like an economy that is running at even an acceptable pace, let alone robust enough to garner such unqualified confidence.

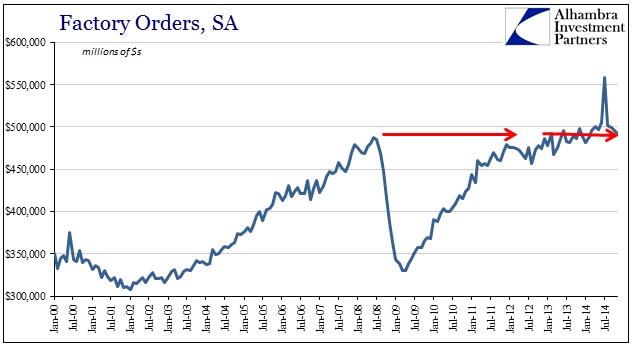

In fact, the seasonal rate for November 2014 at $492.7 billion was actually less than February 2013. In other words, for all this great and booming economy, the nation’s factories are running at the same “dollar” rate as they were more than a year and a half ago. That does not count for progress in any of the accepted definitions of the word, nor is it meaningful in any sense except accounting for why wages continue to stagnate. Ever since the 2012 slowdown, the economy has remained slowed down. To say otherwise is to completely ignore applicable context:

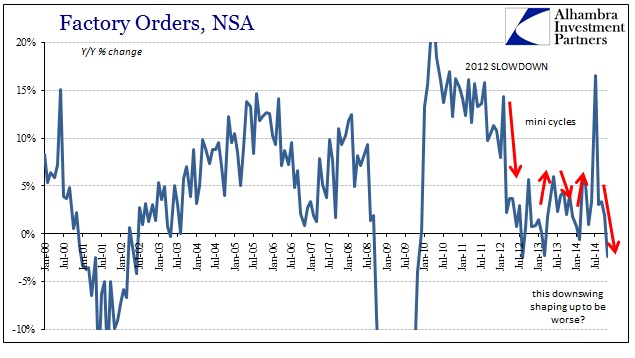

If there is any nuance to that observation it is in the minutiae of exact movement since the point of primary deceleration in early 2012. In other words, while the overall trend has been quite flat rather than growth, there are the easily observed mini-cycles ever-present in semi-annual gyrations. These minor ups and downs are causing, apparently, inordinate confusion in commentary simply because the mainstream seems to have forgotten what passes for real economic growth.

The real worry here is the downswing in the mini-cycle appears to have perhaps already obtained a significant degree. Undoubtedly that is related to the third consecutive Christmas disappointment, and like oil it also raises some serious possibilities of something worse than just the latest mini-cycle. There is at least some acknowledgement of that in certain places, such as Markit with its concurrent drop in the sentiments it measures (FWIW):

The US economy lost significant growth momentum at the close of the year. Excluding the drop in activity caused by the October 2013 government shutdown, the manufacturing and service sector PMIs collectively signalled [SIC] the weakest expansion since the end of 2012. This is also not just a one-month wobble: the pace of growth has now slowed for six consecutive months.

Of course, Markit’s credentialed economist assures the reader that this is nothing to worry about since, “growth is merely slowing from an unusually powerful rate rather than stalling.” But what if he is wrong about where the economy was in the middle of the year, instead mistaking “unusually powerful rate” for the mini-cycle peak? Again, that seems to be the bond market’s take, especially since factory orders above, among many others, doesn’t really show anywhere this “unusually powerful rate” might be present. Indeed, if the rate of factory orders is emblematic, “unusually powerful” is really highly concerning.

That is a world of difference with tremendous significance: slowing down dramatically from an “unusually powerful rate” is almost benign; slowing down dramatically from already deficient is highly worrisome.