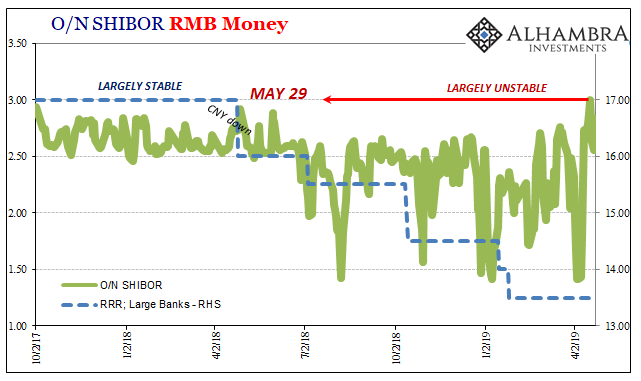

This kind of volatility especially at the shortest maturity suggests limited and temporary capacity for spare liquidity. It is the result of a titanic struggle to maintain control. The PBOC has had better success at term, but perceptions about the shortest maturity heavily color how participants act. If you think there’s a good chance you might need liquidity in a pinch, and this is what you see for overnight funding, it’s a little like volunteering for a game of Russian roulette.