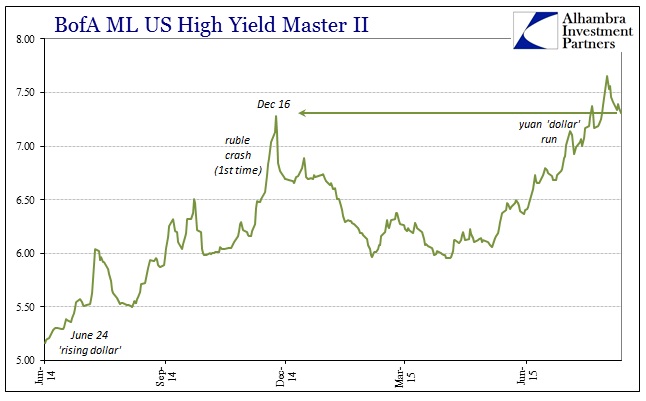

Gold is down again today but the yen up past 119 toward 118.5; and the real crashing under 3.8 now. In other words, as yesterday, the “dollar” market is somewhat mixed. That view, however, is somewhat deceptive as the absence of further “dollar” pressure does not equate to renewed optimism and a serious move back near funding normalcy. A stroll through the corporate debt bubble confirms that risk is not anywhere close to “on” and that raw concern remains even if there isn’t urgency right now.

Typically, after heavy liquidations there is an almost immediate resurgence; the point of bargain hunters seeking capitulation points. There can be no doubt that from early to late August the “dollar” was causing all manner of liquidations almost everywhere, but quite acute in the junk bubble. In the almost two weeks since August 24/25, there has been a notable lack of enthusiasm to repurchase or acquire bargains despite the liquidation easing. For all the diminishment in forced selling there is no massive wave of buying either; a relevant stalemate that suggests that something other than capitulation.

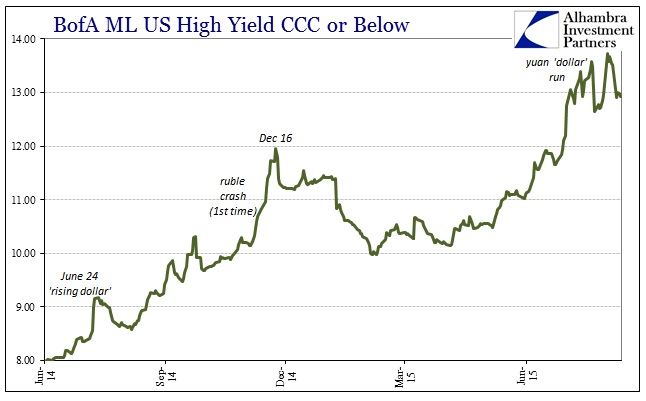

Instead, the price histories of corporate junk and leveraged loans are showing that the major disruptions of August might have only been the latest ratcheting as risk perceptions continue to align (or be forced to align) with the “dollar” view.

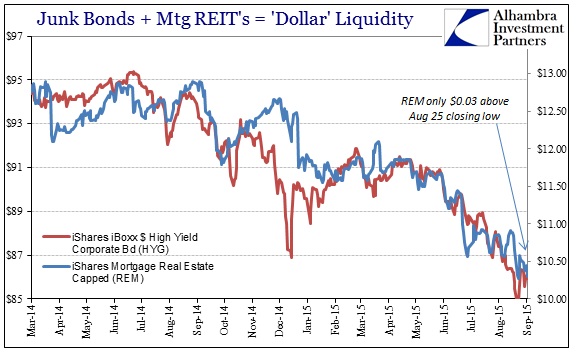

Retail junk bond prices continue to be desperately offered, while companion proxies for liquidity (particularly, with REM, in MBS liquidity which I believe has been an important pressure point as noted in MBS repo) aren’t much changed at all from the August 24 liquidation surge.

Institutional pricing is showing the same character, which further points to that last selling/”dollar” run not as the actual end reset in leverage and risk but rather more of perhaps a “catch up” in getting asset prices more closely aligned to funding reality. August 24-25, then, was not the “end” but rather just the next leg all within the same trend that has not yet been dissuaded to fundamental reality. I think that is the driving factor in all of this, “dollar” on up, as “transitory” becomes less and less plausible asset prices must follow. The “dollar” is, as always, the exchange mechanism for that process within its own wholesale purposes.

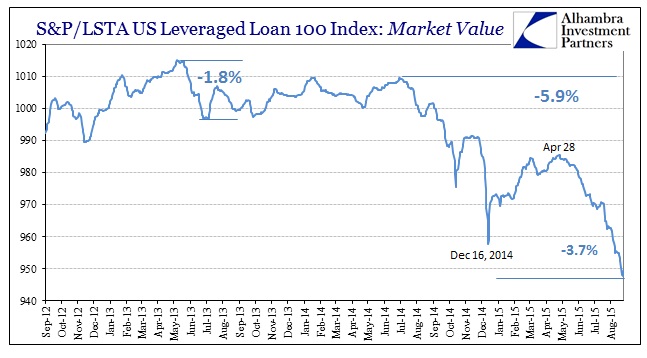

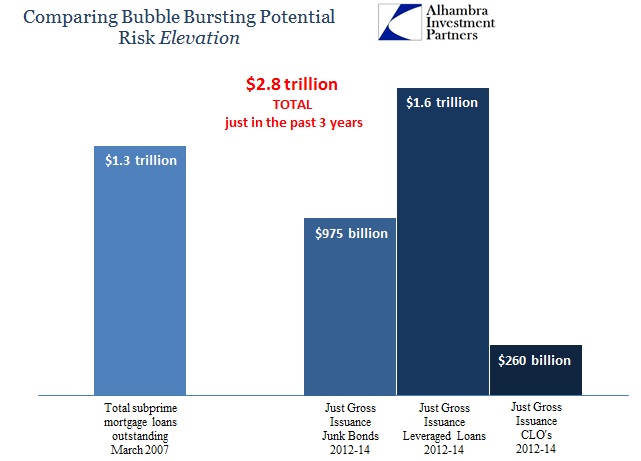

Just as with the week leading up to August 24, the S&P/LSTA Leveraged Loan index has languished without timely pricing updates. The last public quote for the index continues to be August 27, which cannot be a positive statement on the state of liquid conditions in this asset space. I think it will be clear at some point that leveraged loans will be the fracture point in all this bubble reversal, as the issuance the past few years has not just been immense but, as subprime, quite widely dispersed. In those facts, pricing problems are uniquely amplified beyond even liquidation potential, but rather leverage liquidation potential (it’s one thing to have margin calls because of concerns about accurate and meaningful prices, but quite another when that turns margin calls of specific securities or even industries into margin calls to get out of anything and everything).

That concern, in my view, is heightened here as the Leveraged Loan 100 Index bottomed not on August 24 or even August 25, but continued to get sold down to a low of 947.85 on August 26 while other corporate bubble pieces were at least out of the liquidation morass. And now continued pricing delays or whatever?

As noted on many occasions, the Leveraged Loan Index is also the best possible view on the overall leveraged loan class. Representing the 100 “most liquid” and traded names, difficulty in disseminating regular prices there cannot mean much good for the entire mass of junk not just sitting behind it but also deriving its own view of its own pricing from this now-troubled glimpse. While recognizing the dangers of being lazy in comparing subprime here, that was the first great panic impulse as it was ABX illiquidity that started “the run” on all “toxic waste.”

In other words, the process was exactly the same since generally illiquid even structured subprime securities were pricing themselves in far too many places based solely on the visibility of the ABX’s. For Wall Street, that was the beauty of having a relatively small tradable segment, offering efficient dealer operation as a selling point to mass production (without realizing, or much caring, that the opposite situation was not just a bottleneck but really amplification of deterioration). Having an entire mass of really awful debt pieces derive their immediate “valuations” from such a small window is just invitation for disaster once that window itself becomes irregular and even opaque; that was why it could never have been “contained” since investors and portfolio managers that may have been on-the-fence about growing reversals just decide to pull the plug rather than sit blind and risk being the Greater Fool. That, as usual, becomes simply self-reinforcing.

It is that context that should offer more concern about the lack of buying enthusiasm in the wake of some really stark liquidations. Has pricing momentum and growing concern over the solidness of those prices at least started to erode what might have been more steadfast and resolute optimism (the “transitory” case)? Obviously, there isn’t any direct interpretation but rather continued note of risk factors and possible shifting views. After all, the Leveraged Loan index, like HYG and the institutional junk rate indices, have a lot more behind them than what they offer in terms of direct discernibility.