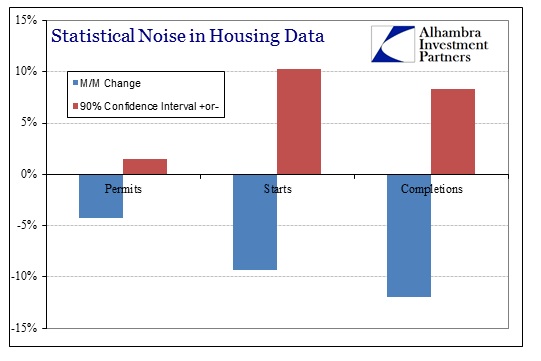

On a seasonally-adjusted basis residential home construction was beyond ugly. There were widespread declines in June from May’s levels that more than suggest a lack of weather bounce (not unlike a lot of other indications). However, there is more than a little caution with housing data as it remains one of the most “noisy” series of the major economic accounts. As with everything else, trends are what matter rather than month-to-month pseudo-precision.

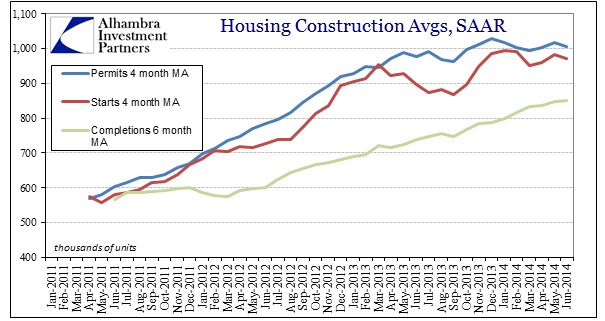

With that in mind, even if the actual levels of construction and permitting were better than first estimated here, that doesn’t change much with regard to what is taking place. There has been a clear variation in housing construction that dates back to early last year, with a further emphasis on instability last fall when mortgages became endangered.

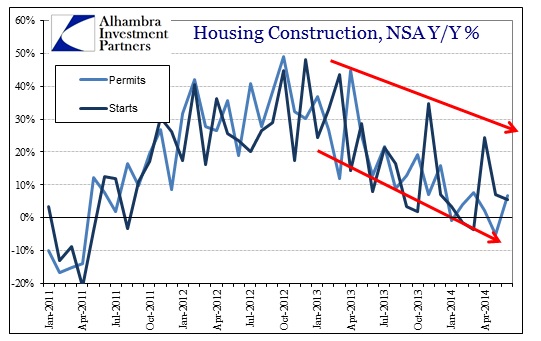

There still persists this idea of sunshine vs. winter, with the former supposedly explaining and dispelling any effects from the latter, but nothing here warrants any kind of major attribution toward snow and its melt. As you can see in the data immediately above, there is much by way of volatility even in the adjusted series that makes it more difficult to depend on monthly changes for analysis. But in terms of overall direction, what was once a definite upward bias has fully abated, volatility or not. The only remaining question is whether the trajectory since the inflection is sideways or down.

Again, the first estimates are pretty ugly in the month-to-month adjusted series, but the statistical noise there is too large to over-interpret the difference between May and June. What we can say with reasonable confidence is that there is nothing here that indicates construction rebounding, with implications not only for housing but GDP as well.

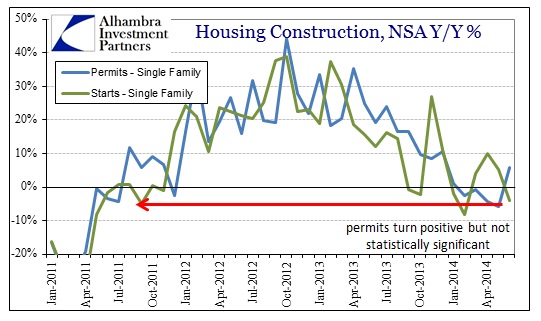

In the single family segment, permits were slightly positive on a non-adjusted Y/Y basis, but again that wasn’t significant enough to break out of the most recent trend

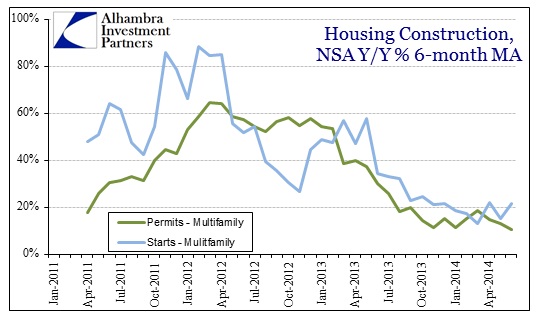

It is not really much different in apartment construction either. The tendencies here are pretty clear free from the statistical volatility, namely that the high rate of growth in 2012 and early 2013 has past and the inclination to build has diminished greatly.

In other words, nothing in June changes my analysis of home construction. If anything it only confirms that there isn’t much weather-related going on, and that construction is likely tied to economic factors more than anything else. None of that is surprising given how long this trend has been developing, but the results in June may force some of the more optimistic of mainstream commentators to relent on their sunshine, particularly with so much of their emphasis, really faith, in that month-to-month precision. In short, it may not have been as bad as the figures look, but that itself doesn’t rate as anything other than confirmation of lackluster construction, at best.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com