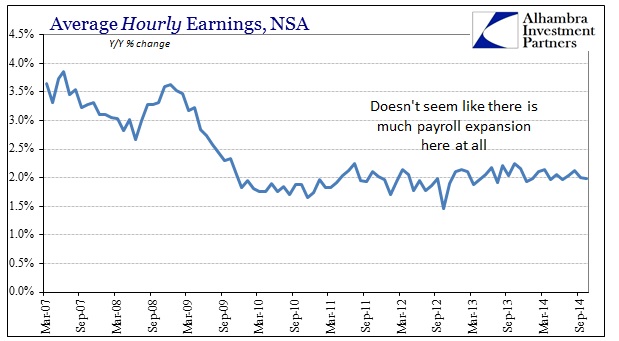

The other part of payrolls, the far more important piece actually, is of course wages and income. Here there is nothing to speak of an increase in the jobs market to anything like what the Establishment Survey suggests. To that end, disconnect is apparent when comparing wage rates with (adjusted) estimates for utilization:

The average hourly wage has been stuck at 2% for more than four years, itself a statistical curiosity that would probably have been modeled at the outset as a “triviality” or impossibility. Yet, here we are with that as the wage baseline.

As I said in my prior post about the payroll report itself, economists see that as fully consistent with “slack.” The idea of slack as a regression variable might look in that direction, but in the real world businesses don’t operate that way. You can’t have it both ways, you cannot claim “slack” on wages and then say that this is a robust jobs market. It is either one or the other because “slack” is not static and monolithic, it applies at the margins.

If that was the only deficient factor the economy might still have more room for expansion, but unfortunately central banks are never content to leave such alone. The pervasive idea of “inflation” as some kind of economic tool for advancement is still the dominant strain. And as is plain now in Japan (unfortunately too late), there is a clear effect here in the US.

With nominal wages doing nothing more than stagnating, marginal changes at the household level are being determined solely by price changes. Whether or not you think the Federal Reserve has actually “created” positive inflation or failed at doing so really doesn’t matter since the net result of all of this is perceptions (valid at that) of price instability. The Fed keeps saying they want “inflation” and keep doing QE’s ostensibly to convince people they are serious about it, so the net of having no actual increases in nominal wages is actually conforming to orthodox theory. That is the problem.

Official inflation measures seek to homogenize personal stations, but individual households react and are affected by prices in very different ways. That is especially true of households unfortunately captured by stagnant wages (or on some measure of fixed income, be it retired or unemployed), as they are more likely to be cautious about their own perceptions of prices. In that manner, orthodox theory is, unsurprisingly, exactly backwards as “inflation” jiggering does not foster economic growth but retards it.

That is why, I believe, the decline in prices in 2013 had so little “stimulative” effect on consumer spending – either it wasn’t real, as official inflation measures combine too many competing factors into a single nonsensical statistic, or households didn’t see that “reprieve” from prices as any different than another piece of instability that has reigned ever since the Fed has gone to its “emergency” toolkit.

That probably doesn’t matter much now with real wages again moving in the “wrong” direction to varying degrees. Again, those most susceptible to price changes, which seem like far more than “should” be given the supposed gains in the Establishment Survey, will react more harshly to price perceptions including reinforcing the ideas and negative factors of price instability. In that respect, the US is very much like Japan, if not to nearly the same magnitude.

The recent direction of weekly earnings is somewhat in doubt as well since the seasonally adjusted figure “somehow” is rising again after a year-long pause. Unadjusted, real weekly earnings are moving in the opposite direction, overall, and are not much changed from 2012. Even the small increase in the adjusted figure, amounting to about a rounding error, belies the notions contained in the Establishment Survey/unemployment rate narrative.

Wage growth gives no indication that the economy is moving toward a true recovery track, and that is the important variable in price and “inflation.” Instead, what is contained here matches pretty closely the disappointing track of consumer spending. As with spending patterns, there is nothing here to suggest that is about to change especially as prices have been, if not rising, unstable yet again. Without wages, “inflation” policy isn’t just folly it is depressive as well as oppressive. The whole point is not really whether prices change or even by how much, but the real effects on consumers under conditions of such instability.