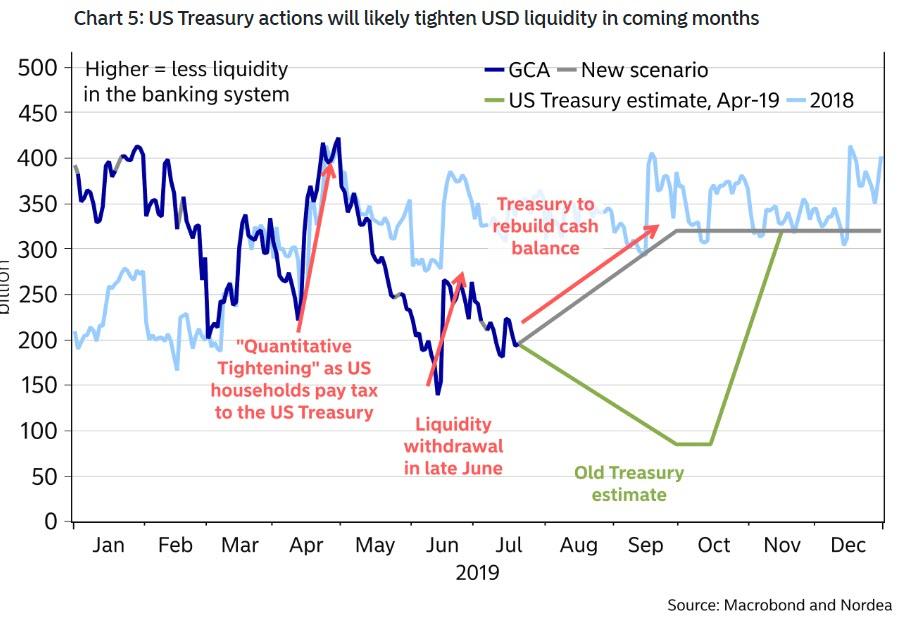

We first hinted at this last week when we noted that as part of the recently completed debt ceiling deal, instead of taking its time in replenishing the cash balance (green line in the chart below), the US Treasury will scramble to rebuild its cash balance up to $350 billion, from today’s level of $133 billion (gray line), a process which as we said last Wednesday will “significantly tighten up liquidity in the banking system and potentially result in turmoil in funding and money markets as the world is flooded with an issuance of T-Bills” as the Treasury seeks to fill the $217 billion cash hole, which will lead to a substantial liquidity withdrawal from the broader financial system as shown in the following Nordea chart.

https://www.zerohedge.com/s3/files/inline-images/2019-07-29.jpg?itok=A2EvotJa