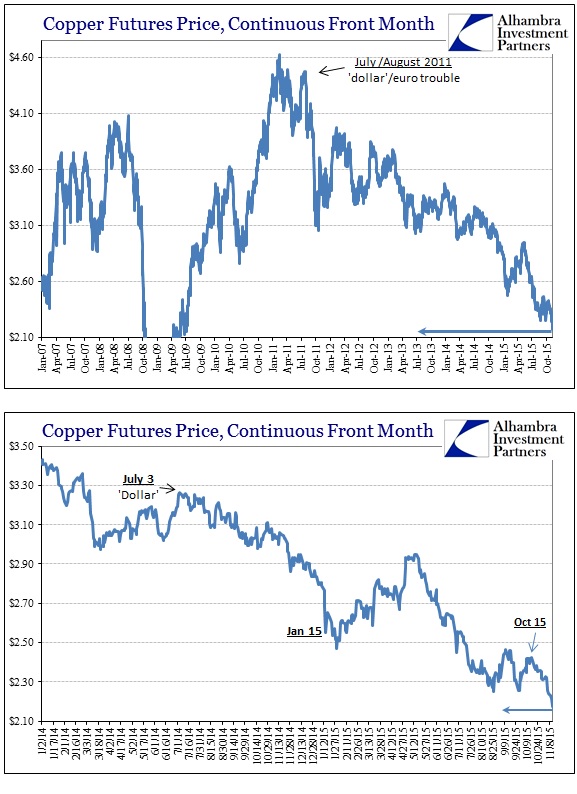

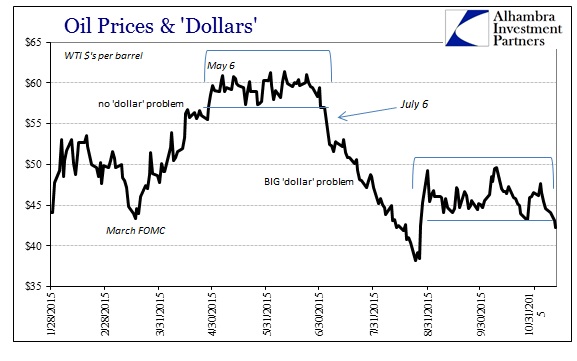

Copper prices closed yesterday at a new low just barely above the intraday low of August 24. In early trading today, the front maturity has blown past that point and traded as low as $2.164, and currently around $2.175 for another multi-year low. Crude prices are down sharply as well, though the trend in oil isn’t nearly as clear – yet. The range that has predominated in WTI since September has been threatened on several occasions, with today’s trading so far being the latest.

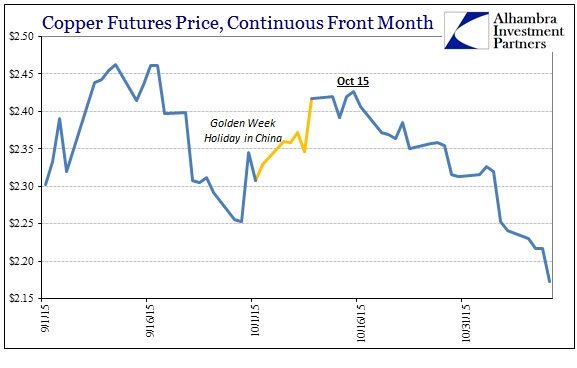

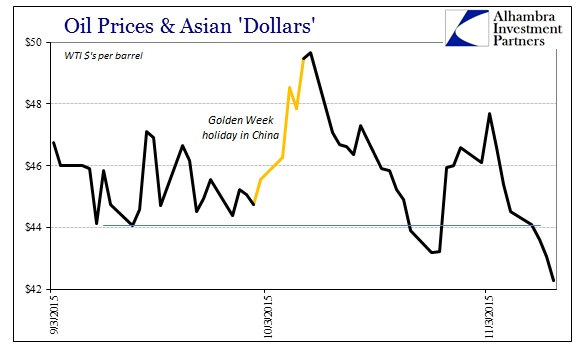

You can’t help but recognize China’s Golden Week holiday in the mix, as asset markets all over were provided an apparent reprieve. That counted in everything from global stocks to WTI to even copper which had been sold down as low as $2.25 again just as China’s holiday started. By the time China reopened on October 9, copper was trading at $2.417 – but where stocks kept going, copper and other commodities then got stuck at that level if only for a few days. After October 15, however, copper has been sliding almost uninterrupted to its new multi-year lows in every category.

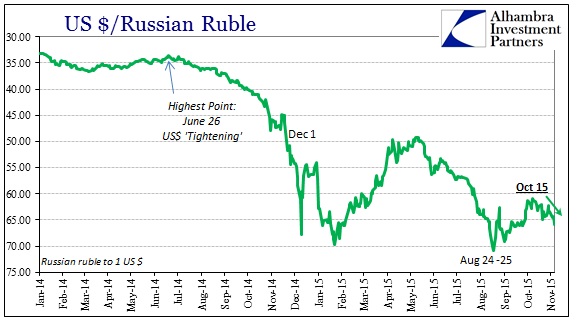

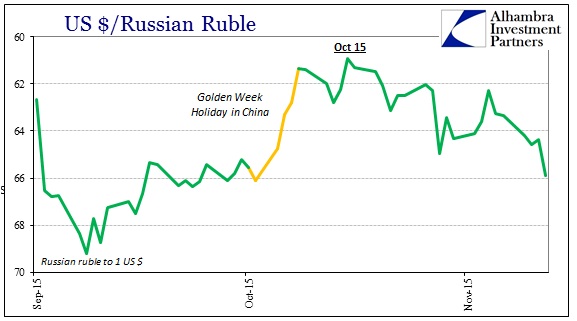

We see October 15 appear in other indications such as the Russian ruble which also took China’s Golden Week to significant (and very welcome) appreciation against the dollar. Threatening again to depreciation below 66 now in the second week of November, the ruble is instead not far off recent lows.

While the ruble had been moving higher since the global liquidations of August 24 and 25, the absence of China during the first week in October is obvious in its effect. Further, the ruble had been trading quite different than oil prices (global beyond WTI) suggesting much more than that direct correlation. But, like copper, there was little further appreciation for the ruble once China returned and then that conspicuous inflection at October 15.

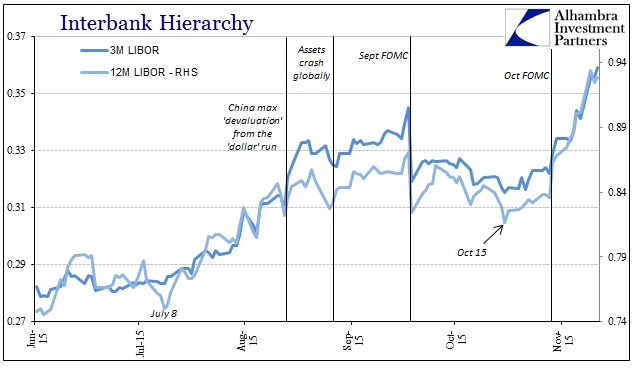

Two days ago I pointed out another turn at October 15, that of LIBOR. While LIBOR surged at the “hawkish” October FOMC, that was only after it had already moved against its prior trend. That brings, of course, the eurodollar and wholesale funding condition into view as the likely primary driver.

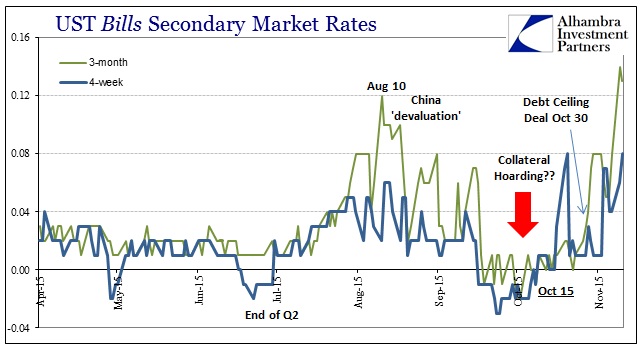

I think we can see China’s role in that not just in passing via the difference between the Golden Week on and off, but rather irregularly in US T-bill rates. The dramatic funkiness of US bills in the past three months or so is undoubtedly linked to the PBOC’s “dollar” attempts (which are still, contrary to the growing mainstream assessment, all over the place) at placating local wholesale funding markets straddling both “dollar” and renminbi. The 3-month bill traded off zero on October 15 pushed to 2 bps (effective yield) on the 26th , but there was a very sharp spike in the 4-week bill rate on October 15 and lasting through to the 20th; bills have been largely upward since.

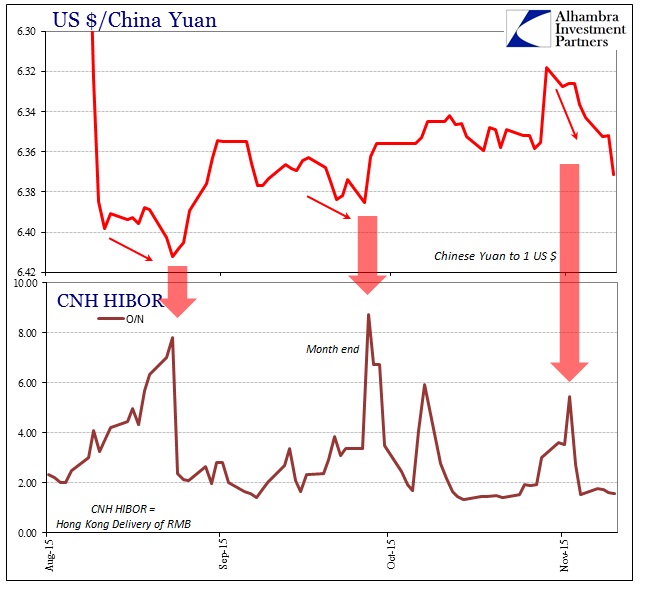

It was that week that precipitated the last of the PBOC’s rate cuts, which also coincided with an obvious official attempt to appreciate CNY (not depreciate). By count of at least offshore CNH, if not the bill rates shown here, that was not a wise choice. The PBOC has since relented on the yuan which, as pointed out yesterday, is really the price at which wholesale funding in “dollars” are attained. That price for eurodollar funding has steadily moved upward (depreciation in CNY) which would very much agree with the view from LIBOR ,as well as the suggestion of T-bill rates as to what the PBOC might itself still be undertaking in (intentionally) hidden capacity.

There isn’t much to advise which is cause and which is effect (as is China’s “regular” wholesale operation the catalyst for instability or merely one of its main and focused victims?) but in the end it may not truly matter. The reprieve of the Golden Week might propose the Asian “dollar” as the nexus of disorder, which would explain quite a bit about conditions in October thereafter but then the date of October 15, being related to that quarter-end repetitive eurodollar case, might suggest otherwise. In either case, the funding strain is once again more obvious and its reach growing.