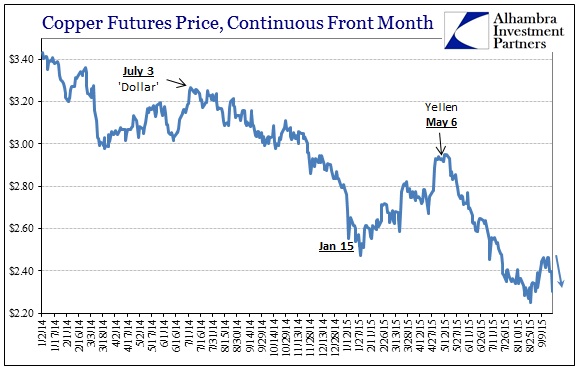

Copper prices are getting pummeled this morning. Since copper is somewhat unique in its setting between wholesale finance and the real economy, but most especially what might fairly be termed the Asian dollar, it functions not just as a “dollar” proxy but perhaps more focused than that. We can assume by copper’s selloff today (the price for October futures delivery is down more than 9 cents to barely above $2.30 again) that wholesale finance surrounding China’s connection to the “dollar” is again disturbed (and disturbing).

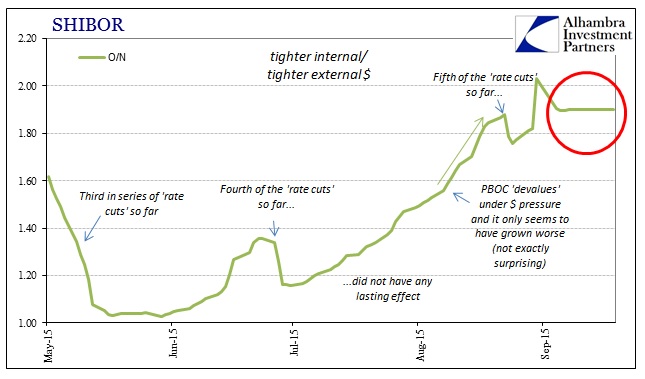

As noted yesterday, that would not be clear via the SHIBOR rate since the PBOC has certainly taken to targeting at least its O/N maturity. Today, again, O/N SHIBOR barely moved, setting at 1.901% (the last eight trading days are, in order: 1.899%, 1.9001%, 1.899%, 1.899%, 1.90%, and now 1.901%).

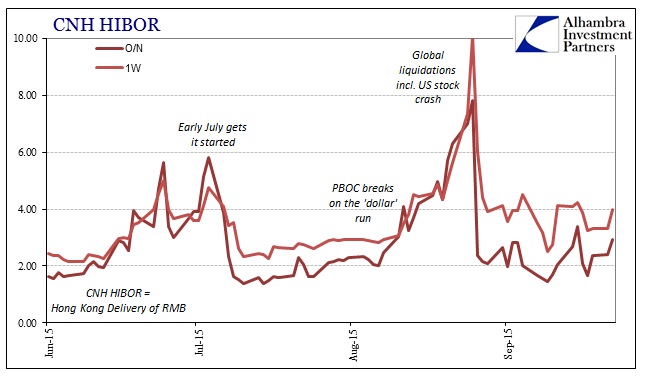

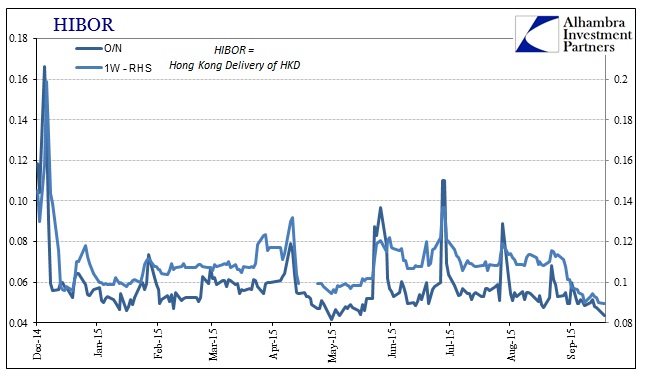

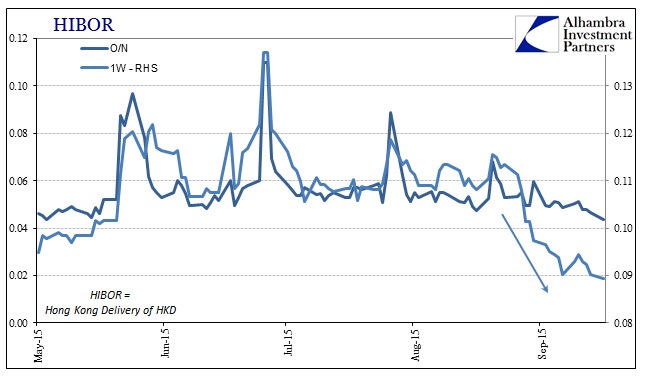

The yuan/dollar cross, however, has “devalued” in serious fashion which belies the artificial lack of volatility in internal yuan liquidity. The point of yesterday’s discussion was that central bank suppression of volatility only moves it someplace else; the central bank betting that “someplace else” is less noticed or considerably less alarming. In the case of Chinese currency, that place seems to be offshore renminbi. As Paul Mylchreest of ADM ISI pointed out to me, it’s worth a look at HIBOR rates to see this strain manifesting wherever it can break out from the PBOC’s direct path.

CNH HIBOR rates, like O/N SHIBOR, were clearly showing visible strain even where the PBOC was holding CNY to the dollar steady. That is perfectly consistent with the Asian dollar, where yuan liquidity is, for all our purposes, derivative of “dollar” strain. It also shows, for the nth time, this was not Chinese devaluation but a multi-dimensional wholesale run; centered upon the Asian dollar (which is still part of the overall eurodollar scheme; Asian dollar is my term for the rise and shift in banking resources toward Asia, mostly Hong Kong now, that participate in the eurodollar).

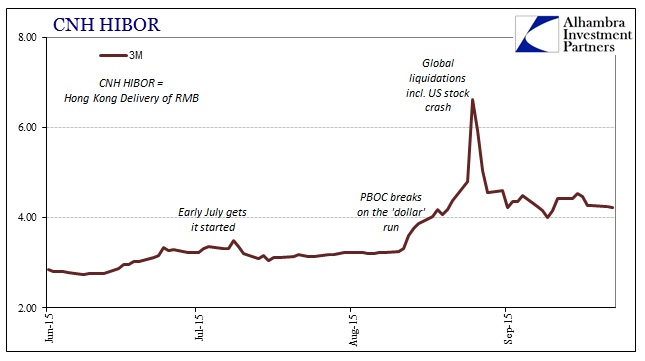

Despite the PBOC’s obvious presence in onshore renminbi, interbank rates offshore remain perilously elevated. That “tightening” is much clearer in longer CNH HIBOR maturities, such as the 3-month tenor.

From early June before this latest “dollar” wave got started, 3-month CNH HIBOR is about 150 bps higher, representing a serious tightening of yuan liquidity offshore to go with artificial subdual of illiquidity-driven volatility onshore. The concurrent drop, more recently, of now HIBOR (Hong Kong delivery of Hong Kong dollars HKD, not to be confused, though it is easy, with Hong Kong delivery of US dollars USD, or CNH HIBOR which is Hong Kong delivery of renminbi) especially at the shorter maturities would suggest Asian banks cutting back wholesale offering to Chinese exposure but maintaining at least some offered liquidity in the vicinity.

The short version of all this is that the “dollar”, particularly the Asian dollar, has really screwed up China’s wholesale finance flow and the PBOC doesn’t appear to be helping. The more general conclusion is the importance of Asian banks in the post-2008 wholesale system and how disruption in the Asian dollar can no longer be limited to Asia. Just as wholesale problems with European banks are big trouble for the eurodollar, wholesale problems with Asian banks are as much if not more so in this reconstituted decay.

What is a related but somewhat separate issue is how the structural withdrawal of global banks more broadly is affecting the Asian dollar; and thus how the more acute feedback from this Hong Kong node becomes self-reinforcing as global volatility. Is it merely the primary channel more recently for increasing illiquidity in the broader eurodollar, or are there detached mechanisms that actually and distinctly set this arena apart? The very heavy presence of the PBOC and its relationship of yuan to dollar might argue in that favor, but that is an unformed possibility as we haven’t seen this magnitude of stress before. The fact that disorder in the Asian dollar can affect a run or broad liquidation globally suggests that there is still harmony to the eurodollar (in attached disharmony, anyway) but this is a serious question where there are no solid conclusions to be made at this point.

In other words, if the Asian dollar is even partially its own amorphous conglomeration then that creates the potential for yet another geographic bottleneck. It was that distinction that created the condition for the last great panic (between NYC and London starting August 9, 2007; a sudden and maniacal distinction between traded eurodollars and the “real” dollar of federal funds and even domestic repo collateral chains that had always existed but never seemed to matter until it was all that mattered).