If the Federal Reserve is on course to “normalize” monetary policy within the context of a self-sustaining recovery, nobody told the credit markets. That isn’t quite true, though, as investors in the credit markets have been inundated with such talk and speculation for a some time; they are apparently just ignoring it. At best, the most that can be said is that investors are unwilling to actually bet in either direction, putting what is likely their own eyes in contradiction to central bank dictation.

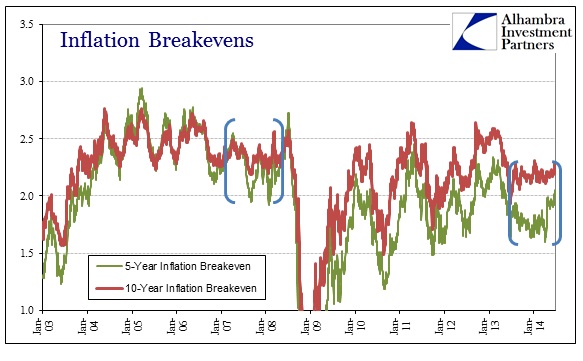

If ever the current FOMC regime needed a reason to further mistrust “markets” this would likely qualify. The rational expectations practitioners have been almost petitioning for the credit markets to assemble themselves as if we are on our way back to 2005 (I doubt they feel confident enough to make a comparison to 1995, and certainly not 1985). Yet the most that has come out of it is the 5-year breakevens moving slightly higher toward where they were for most of the past few years.

Inflation expectations out to the 10-year range continue to hold in that very odd and conspicuous stasis where it is abundantly clear hedging and investment considerations have just given up trying to bet with any conviction. Again, the only comparison since TIPS were introduced is 2007-08.

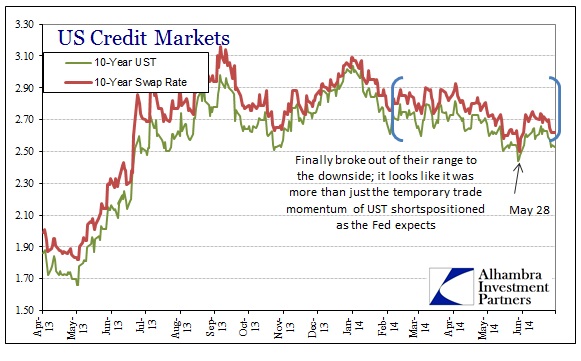

As for funding markets, despite collateral shortages in repo there is nothing anywhere to indicate much by way of strengthening conviction for the orthodox predictions and expectations. Swaps are likewise captured by this highly suspicious lack of volatility; if anything there is actually the slightest predilection toward a compressed spread, which, if it were anything more, would be in expectation of lower policy rates.

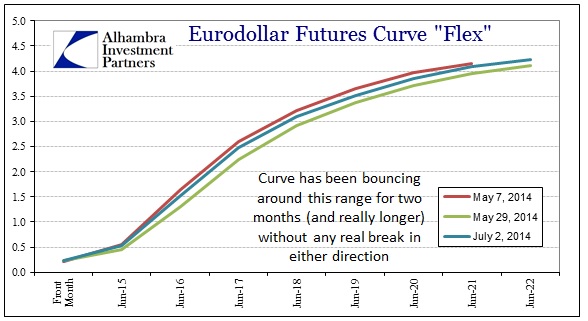

As you would expect from the close association between interest rate swaps and eurodollar futures, the eurodollar curve has also been mostly comatose, bouncing around inside a very narrowly defined range. The only real “action” was at the end of May, when it was clear that some investors positioned for the Fed’s preferred scenario (higher rates in an orderly fashion) were unable to maintain them as the UST curve moved against it.

The appeal to add hedging against lower rates, or to offload short rate positions, clearly showed up here and also in the behavior of the 10-year US treasury. But while that move in late May could be categorized as momentum or trading irregularities, in the weeks since rates have again moved lower below the prior trading range. That would seem to suggest that credit markets again are not much enamored with the idea of growth.

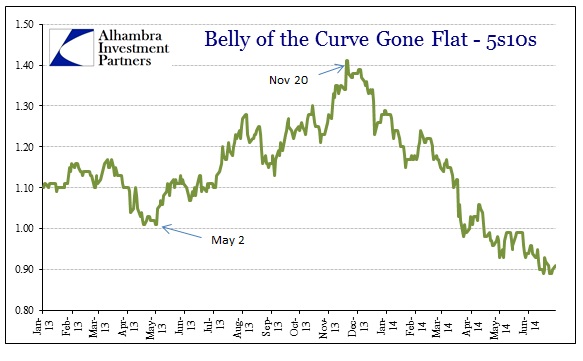

Yet, for all of this, they are still seemingly reticent to jettison the Fed entirely and embrace an actual market stance. The legend of QE seemingly dies hard, with an enthralling hold on the imagination of credit. Despite the minor reproach, the treasury curve still maintains a flattening bias. Again, that suggests economic pessimism – particularly the broad curve shape as it continues to behave as it did after the end of the previous QE’s.

So in one sense, credit markets appear to be onboard with recent inflation as nothing more than “noise”, but that is actually a negative commentary on the economy moving forward. Despite that, however, there is still seemingly so much fear about the Fed and its assumed power to move all of this. If last year’s experience taught us anything, perhaps it is not that the Fed’s economists will clock the economy correctly, but rather that they will blunder again with blunt suggestions and innuendo into proving how little resiliency there is in such a “market” based on confusion, stasis and interventionary threats in both directions. In other words, investors see little to the growth idea, but are positioned in case the Fed screws up again like last year and unleashes more disorderly curve and rate mechanics.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com