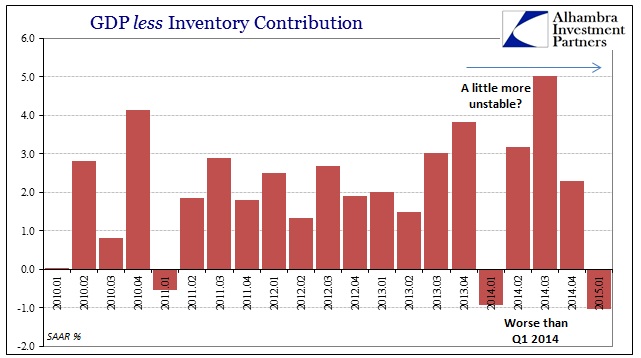

A couple more points about GDP revisions and the outlook for Q2. First, with inventory revisions factored, GDP less the inventory contribution was -1.03%; worse than last year’s polar vortex problem. It was the worst quarterly result since the Great Recession, which more than suggests economic weakness as more than just winter or seasonal adjustments. If there is any seasonal problem here it relates more to the exhausted state of consumers who hit their maximum just at Christmas and then are forced into hibernation for an extended period thereafter. The fact that this hibernation is deeper now is not, again, a problem of statistics but, as the dismal Christmas numbers show, of economy.

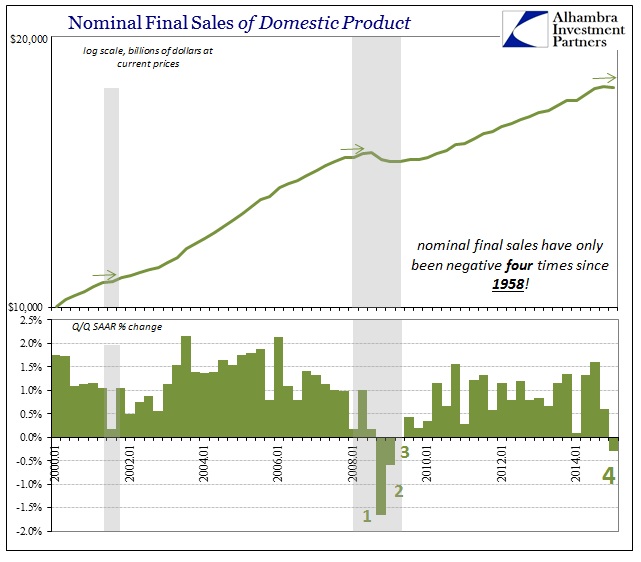

To make that even more plain and obvious, nominal final sales (a much better, if still flawed, view of the economy than GDP) were revised down by almost $30 billion. That doesn’t sound like a lot, but it is a massive downgrade for a first revision. Nominal final sales had already been negative for only the fourth time in the last five decades (with the other three being in the Great Recession itself), going from just slightly negative to now no doubt.

Again, that makes it difficult to accept that a sharp rebound is coming this very quarter, instead placing much more emphasis on the Atlanta Fed’s current estimate of just 0.8% for Q2 – particularly since, as of these revisions, it will take 0.8% just to get the economy back to zero for all of H1. So far the revisions suggest even that might be optimistic, as well as the current state of data coming in for April and now May.

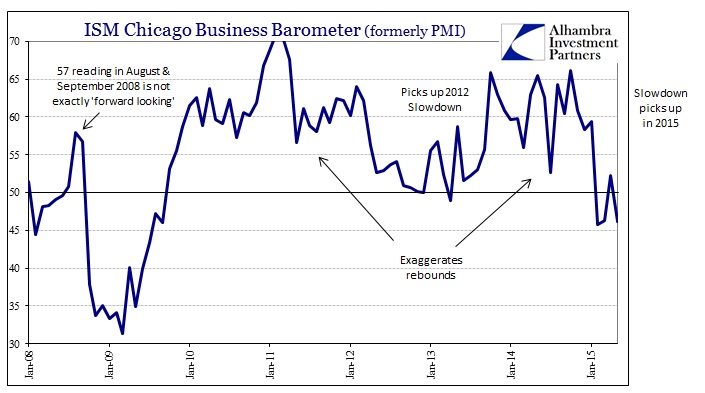

The Chicago Business Barometer (formerly PMI) fell back into deep contraction in May after rising somewhat optimistically in April. Along with various Fed manufacturing surveys of late, especially the Dallas Fed’s view on Texas, the contraction or slump is still around and maybe even gaining to the downside. Recessions are accumulations of negative pressures, and all these figures collectively assert a growing preponderance of negativity that isn’t abating as commanded and expected.

The Chicago BB has been near or below 46 for three of the past four months, with May far, far beyond the reach of winter and snow. Altogether, that leaves the economy with both a sharp drop in momentum and an extended stay for it. As I said above, 0.8% looks a little optimistic at this point.

From the ISM:

The Chicago Business Barometer fell sharply back into contraction in May, reversing all of April’s gain and casting doubt on the strength of the widely expected bounceback in the US economy in the second quarter.

The Barometer fell 6.1 points to 46.2 in May from 52.3 in April. All five components of the Barometer weakened with three dropping by more than 10% and all of them now below the 50 breakeven mark.

April’s positive move had suggested that the first quarter slowdown was transitory and had been impacted by the cold snap and port strikes. May’s weakness points to a more fundamental slowdown with the Barometer running only slightly above February’s 5½-year low of 45.8.