I have little doubt that the most perverse aspect of orthodox economics is the idea of monetary neutrality. Taken as nothing more than an article of faith, monetary practitioners use the principle as cover to undertake drastic and blunt intrusions into markets and economies, with no guilt over having done so because they can simply invoke neutrality and proclaim some other “mysterious” and convoluted culprit. Usually, however, it never gets that far since accountability typically fails to get beyond “the benefits outweigh any potential short-run disruptions.”

There is nothing by way of empiricism to prove neutrality, since it entirely depends upon semantics and definitions. But we have a grand experiment with almost pure “laboratory” conditions with which to see neutrality fail spectacularly. Unfortunately, the Japanese people are forced to be the unwitting lab rats, though without the “benefit” of having been given the placebo instead. Churchill was right in that democracy is the worst form of government except all others that have been tried, but I’m not so sure how central banks fit into that calculation, which is particularly dubious where neutrality is uncovered as simple academic make-believe.

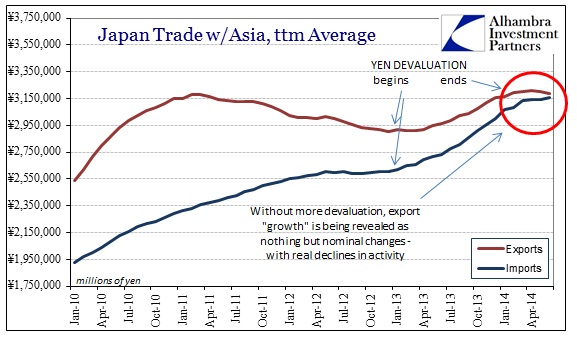

The primary premise of yen devaluation, purposeful and heavy intervention, was exports, exports, exports. More than a full year into the tenth and largest QE episode, Japan’s once salvationary trade machine, the Japan Inc of lore, is but a figment of past imagination. What little room Japan had left for a possible re-entry into economic health has been squandered, taken asunder by the very same yen intentions that were unequivocally believed to be the solution. And now Japan faces utter impoverishment as exports decline (not expand), imports accelerate (not decline) and real wages collapse.

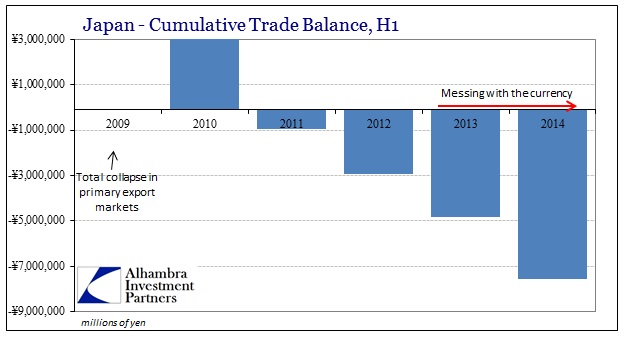

June is typically a seasonally strong month, with large surpluses for most of its history. Even in 2013, with a good measure of yen “stimulus” under way, the trade deficit in June was nearly balanced. But 2014 shows just how far conditions have removed, with the now-inexorable decay clearly on display.

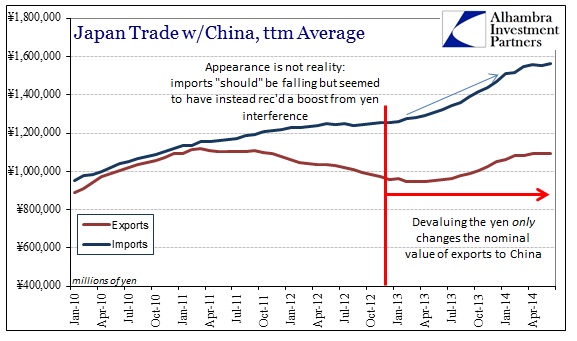

Without the nominal “boost” of further yen devaluation, the actual rot is revealed since nominal changes in imports receive too little currency adjustment to “hide” the decline.

There is no mystery as to why Japan is suffering in direct contrast to intended and predicted outcomes. Monetary policy is a corrosive agent that transforms business decisions from more centrally focused on business toward an undue financial influence. Since orthodox economics always assumes a closed system, the “modeled” pathways of policy influence only calculates among very few options, despite the utter complexity of the real world.

The monetarists simply assumed that Japanese businesses would gain more business from their products being cheaper overseas, coupled with the rising cost of imported material, and would thus have “no choice” but to increase production, including the deployment of otherwise idle labor, leading to the mathematical recovery of myth. Japanese businesses, instead operating outside of the classroom and all the smoothing assumptions that make the math “workable”, responded to real pressures.

Japanese production has been flowing overseas, which actually makes logical sense. But even I am surprised at the speed and breadth at which it was accomplished – invalidating monetary neutrality since this is real world production capacity that has been quite visibly altered by nothing more than currency instability created by central bankers.

It is Asia and China that have been the true “beneficiaries” of the Bank of Japan’s textbook maneuvers. The trade surplus Japan once enjoyed from the rest of Asia outside of China has steadily eroded and will largely disappear, without a significant shift, in only a few years. China now exports far more goods to Japan than in the other direction, a conspicuous change that coincides with Abe’s “arrows.”

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com