In June 2015, Pew Research Center conducted a poll of citizens in European countries in order to gauge public sentiment of the European integration project. They found what they thought was a rebound in favorability. The survey conducted in 2013 appeared then to have been the low point, with the 2014 update finding an uptick in support. By last year, Pew was confident enough to claim a rebound for the supranational arrangement.

In the wake of the euro currency crisis, public support for the EU and the belief that European economic integration was good for one’s country had declined precipitously across Europe, reaching a low point in 2013.But in 2015, favorable views of the EU and faith in the efficacy of creating a single market are generally rebounding in major EU member states, according to a new survey by the Pew Research Center.

Just one year later, however, Pew now says that the gain in support was “short-lived.” The reasons for it are incredibly simple:

In a number of nations the portion of the public with a favorable view of the Brussels-based institution fell markedly from 2012 to 2013 as the European economy cratered. It subsequently rebounded in 2014 and 2015. But the EU is again experiencing a sharp dip in public support in a number of its largest member states.

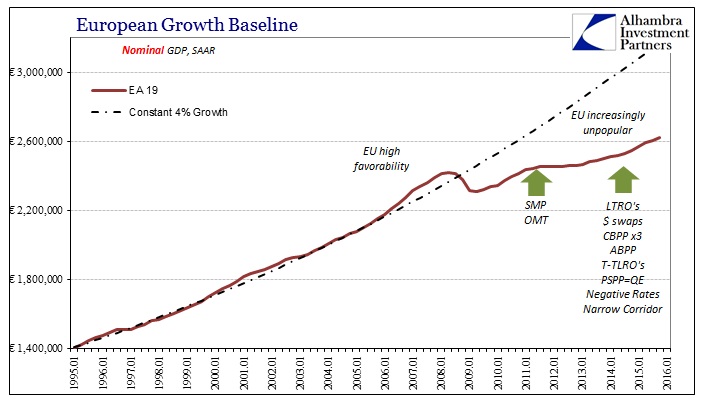

Of the innumerable recoveries that have been declared in the years since the Great Recession, the latest has petered out just as all the rest had. The world is confused about what a recovery actually is since it has been more than a decade since one was experienced. In 2014 and 2015, the ECB did NIRP, T-LTRO’s, CPBB3, ABPP, QE, expanded QE, expanded NIRP, etc., and for a little while there was some small measure of improvement. But that was just the usual unevenness of the slowdown, a fact that has been revealed in the last twelve months of “global turmoil” and increasing doubts and uncertainty.

It’s not just the comparison of recent years, however, that are most striking; it is the change in overall attitude throughout the length of the survey that goes back to the middle of the last decade. In 2007, for instance, 80% of people surveyed in Spain held a favorable view of the EU; only 47% do now. In France in 2004, 69% viewed the EU positively but only 38% did by 2016. What happened between 2007 and 2016?

The entire point of the euro in the first place was much more than political integration through monetary finance. The common currency was meant to challenge the dollar as a global reserve. When people hear the term “reserve currency” they think in only one dimension, as if European countries aimed only to reprice oil in euros rather than dollars. Instead, the euro’s designers meant to reproduce the not the dollar but the eurodollar and all its assumed benefits on their own terms. As former French Foreign Minister Jean Francois-Poncet declared in 1998, “A vast redistribution of the world’s monetary reserves will follow, to the detriment of the dollar and to the profit of the euro, that will oblige the United States to share with Europe the privileges it takes from the international status of its money.”

From the political point of view, European politicians saw very well what was happening in terms of global wholesale finance in “dollars.” Their own banks, in what would be called the “hub and spoke” model, would gather local deposits and turn them into the means by which to participate in global eurodollar transactions (the very ability that Wall Street wanted to gain). So for Europe, that meant financial resources flowing outside (into a US bubble or bubbles) instead of remaining local.

Europe wanted its own wholesale currency to keep some of its liabilities local. Just as European banks were among the primary supporters of the US housing bubble, Europe wanted in on the action – they wanted their own bubbles. Favorability of the bubble economy is not a mystery, as prosperity seemed to have been delivered by the common currency. Because there was no honesty about it then, the public could not foresee how the euro also nothing more than a noose.

This was a global drive, in that Europe for its part created the mechanism for wholesale participation while the US and Wall Street “deregulated.” In February 2009, Senator Phil Gramm (of Gramm-Leach-Bliley) writing in the Wall Street Journal attempted to defend his drastic late 1990’s banking alteration by instead showing his ignorance:

GLB repealed part of the Great Depression era Glass-Steagall Act, and allowed banks, securities companies and insurance companies to affiliate under a Financial Services Holding Company. It seems clear that if GLB was the problem, the crisis would have been expected to have originated in Europe where they never had Glass-Steagall requirements to begin with.

The events of August 9, 2007, and everything thereafter show conclusively that the crisis did originate in Europe. Thus, the dramatic changes of the late 1990’s in global banking, including the advent of the euro, were the last steps in freeing the eurodollar system and all its attachments to achieve its full (destructive) bloom. For those most directly in line of it, especially the EM’s like China that were finding easy “dollar” financing for their industrialization, it was paradise. Even in the US and Europe, it at least appeared to be a stable economic result; and asset bubbles are always fun on the way up.

Brexit and the changing view of the EU is really the growing recognition that there aren’t any economic benefits to the wholesale system, including the euro’s place in it. In reality, there never were. What is left is slow, painful monetary strangulation that in Europe is the embodiment of the EU. Europeans appear set to vote economy and money; feeling the effects is enough of a call to action even if the cause isn’t fully appreciated.

The establishment, however, is intent upon making Brexit (as a warning to any further secession) into an economic apocalypse. From the New York Times:

The economic hazards for the U.K. are pretty clear: A Brexit would almost certainly cut off Britain’s access to the E.U.’s internal market, and definitely impede negotiations over any new political or economic relationship with the E.U. The free movement of goods, services and capital throughout Europe is tied to the free movement of people, and the E.U. would not want to encourage other states to leave the bloc by allowing Britain to leave and still maintain its trading rights.

There are innumerable mainstream articles all over the world claiming much the same. But those all proceed from a false premise, one that the people of Europe are seeing far more clearly than the media who get their economic content from economists who are never wrong (even though they are always wrong). Thus, the choice in Europe is not between the horrible economy of leaving and the terrific, full recovery of staying (just down the road, of course), it is between the uncertainty (at most) of leaving and the continued strangulation of the status quo. Getting out of Europe, for the UK or any countries that follow, might not actually be the answer (and I don’t think it is; the real problem for the global economy is wholesale finance, which is beyond the boundaries of geography) but staying will never be. It is the unwinding of the false promise of the euro itself – that it would only bring shared prosperity. In reality, it didn’t create any prosperity at all, just the typical money illusion that we find time and again throughout history.

To repeat myself, the recovery is entirely political because economists will not change nor stop what they are doing no matter how harmful (and blatantly dishonest) that is. The only way to gain true monetary reform is to break up the political establishment that seeks only to maintain its place – no matter the cost. History is, again, full of these kinds of factors and indeed the history of social and political upheaval is as much economic as anything else. That is why economics was once referred to as “political economy.” The political backlash has only begun because the monetary noose has only tightened.