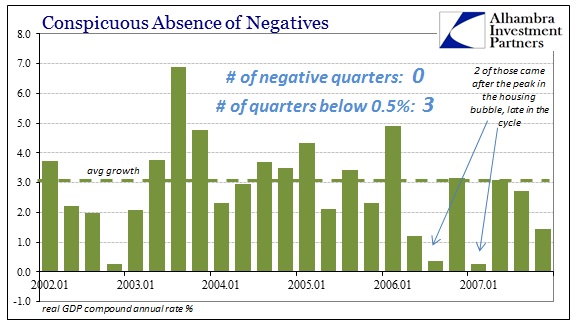

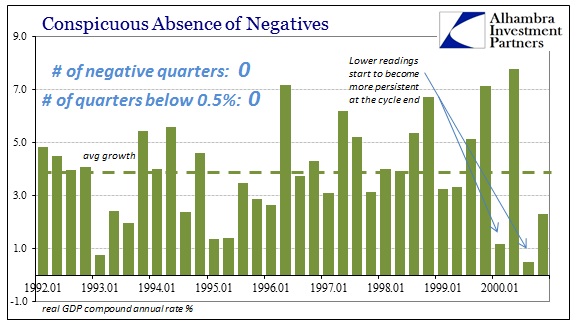

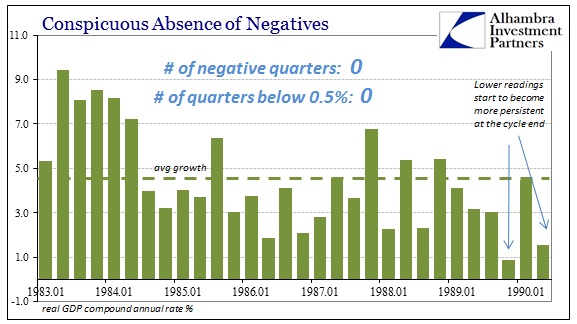

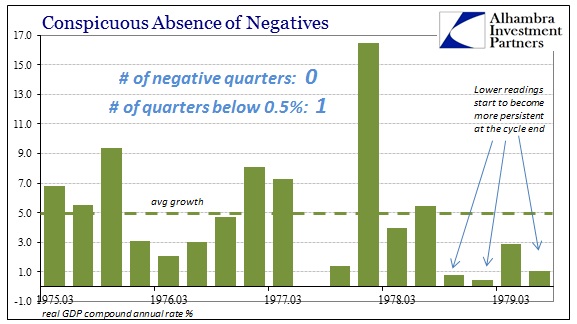

Last year, economists were fed up with winter. They had had enough of Q1’s always lagging, threatening to upend the idea that there is a solid and improving recovery. To drop a negative GDP quarter into that mix was the final straw, since negative quarters are exceedingly rare – they actually don’t occur outside of recession. In the four decades of cycles leading up to this current one, assuming it is one, there have been exactly zero negative quarters during what is officially considered growth periods (those quarters outside declared recession). In fact, there are only four quarters in all those cycles where GDP has been less than +0.5%, and three of those were during the housing bubble era.

Thus, last year’s initial run of estimates for Q1 2015 GDP coming out first weak and then negative and more so, led to the seasonal protestations. The mainstream debate focused on only two potential explanations, the first being “residual” seasonality and the other still more snow. The idea of seasonal adjustments, as with all of these factors, isn’t obviously flawed and holds a very logical base desire. Since there are very defined seasonal patterns (especially the Christmas season and the period immediately following it) in the economy it presents a great difficulty in trying to compare one quarter to the next.

The BEA, indeed all economic effort, attempts to create clinical conditions by which they can isolate only economic performance. In other words, they attempt to turn each quarter into an “ideal” quarter based on past patterns – the goal being to be able to compare any Q4 to its following Q1 on equal terms, to be apples to apples where in reality that just isn’t the case. If consumer spending falls, on average, 10% from Q4 to the next Q1 then it assumed that Q1 is “normally” 10% lower than the preceding Q4. If the next Q1 is only 9% below Q4, then absent other unaccounted factors it can be assumed that there is some significant positive contribution from base economic growth. Indeed, if Q1 consumer spending is just 10% below Q4 like prior history suggests, then it still counts as economic growth consistent with prior baselines so long as that baseline is itself positive.

If consumer spending, however, is 11% or more below Q4, then economists either protest about the inapplicability of prior seasonal patterns or snow because it just “couldn’t” be economic weakness. Several research firms found “evidence” of residual seasonality.

Here we go again: The latest data show the U.S. economy plodding through another weak first quarter.

But it may not be coincidence. A detailed review by CNBC of 30 years of the government’s gross domestic product data, the most followed measure of U.S. growth, suggests a longstanding problem of under-reporting Q1 expansion.

Over some time periods, in fact, first quarter growth is so weak it appears to be measuring a different economy altogether compared to overall growth and the three other quarters.

The BEA apparently concurred because they revised last year’s Q1 to a positive number (but, curiously, not significantly so, leaving Q1 at a still-concerning +0.6%). Others found no evidence of “residual seasonality” at all, instead having pled the case of Old Man Winter. That included the various branches of the Federal Reserve, especially FRBSF and FRBNY.

If this is indeed the case, then the weak readings of the economy in the first quarter give an inaccurate picture of the state of the economy. In this post, we argue that unusually adverse winter weather, rather than imperfect seasonal adjustment by the BEA, was an important factor behind the weak first-quarter GDP data.

Residual seasonality, snow or not, remains in effect which looks like yet another significant problem for “the narrative.” The current estimate provided by the Atlanta Fed’s GDPNow forecast is basically stalled at +0.1% for Q1. There is, of course, volatility to consider in the number itself as there remain several key data points to be updated before the initial BEA estimate is released toward the end of this month; in fact, as you can see below, GDPNow was expecting as much as 2.3% growth for Q1 barely more than a month ago before the most recent data updates crashed it back to reality.

That estimate is actually worse than it appears because not only does it include the “residual seasonality” adjustments of adjustments, “only” -0.7% of that weakness is due to inventory deceleration. That means the economy outside of inventory in Q1 is less than 1% itself, and it takes seasonality excuses to get it even that far.

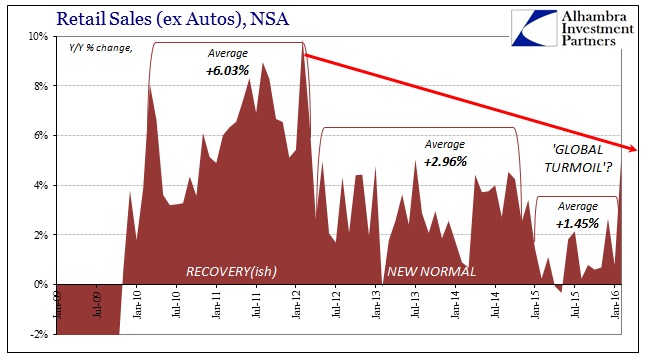

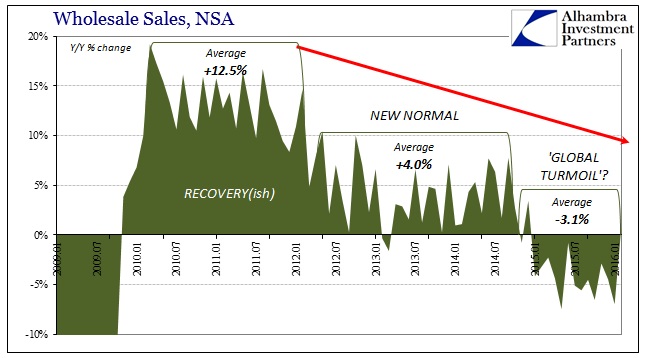

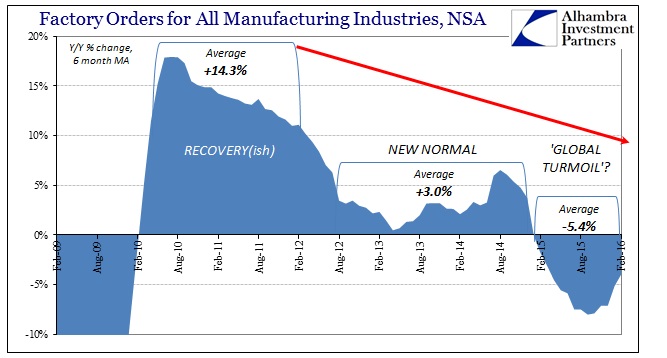

Assuming the current Atlanta Fed forecast is even somewhat close (which doesn’t preclude the possibility of seeing yet another negative quarter, only this time including “residual seasonality”) it leaves last year’s fuss and protests as again nothing more than anti-science distraction. In other words, it would be yet more evidence that the anomalies in this “cycle” are not the low and negative GDP quarters, but rather those that are proudly proclaimed as strong and indicative. By that observation, the entire economic picture shifts though actually in a direction that makes more sense, not less; consistent with broad and widespread (global) observations of continuing slowdown and none other than the dubious unemployment rate to counter it. From there, it was never snow or seasonal factors but rather slow and lack of income which suggested “transitory” was nothing more than wishful thinking.

If GDP in Q1 remains as low as currently suggested, that would make the second consecutive quarter under 1.5% on both sides of the supposed seasonal divide. With 12% of those estimates still under trend-cycle imputations, it doesn’t take much revision to turn them both negative to match the underlying slowdown’s transverse below zero, which, not coincidentally, occurred last Q1! It would catch up GDP with the manufacturing recession that shows no signs of stopping.

In the end, as usual, economists are trying to account for “what should be” instead of analyzing “what is.” Monetary “stimulus” to them always works, therefore they hold no possibility of anything but strong economic growth and are forced to increasingly absurd lengths to explain why that just isn’t the case. GDP was constructed to be the most charitable interpretation of the overall economy and it is no longer in the recovery camp; it hasn’t been for a very long time.

Surprisingly, the Wall Street Journal’s Jon Hilsenrath delivered the most level-headed interpretation of this GDP focus:

This wouldn’t matter so much if the economy were growing faster in the first place. Because the trend is so slow, the growth rate is never very far from zero and seasonal scares get close attention

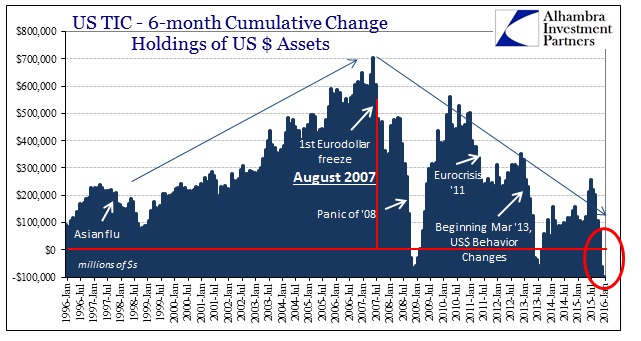

The problem was never weather or seasons, it is and has been money; actual, global money. Trying to figure out whether GDP in Q1’s is slightly negative or slightly positive misses the point. The real comparison or focus should be why it isn’t +4%, or really, considering the extent of the contraction in 2008 and early 2009, +6% quarter after quarter. Again, it is the telling reduction in standards where any positive number is now just accepted as “strong” and the absurd parlor tricks used to wish away a negative sign as if that were all that mattered(s).