The precursor event of every hyperinflationary episode is not as conventional wisdom currently holds. Certainly there are conditions that are present in each and every one, including desperate fiscal imbalances that ultimately become expressed in growing monetarism, but the true cause that turns those troubling circumstances to total and complete wipeout and disaster is tunnel vision.

That was what happened in Germany in 1921, as the Reichsbank under Rudolf Havenstein completely misdiagnosed the economic deficiency of Germany at that point. Havenstein and his fellow policymakers were ardent supporters of “the German school”, who traced much of their views on “money” from, among others, Georg Friedrich Knapp and chartalism. Reading Knapp’s The State Theory of Money, published in 1895, today would seem as if it were a current chapter in the conventional textbook.

Taking chartalism to its ultimate ends (both figuratively and literally as it turned out, at least for German democracy at that point), Havenstein surmised the major part of the economic ills to be totally exogenous. The devaluation of the mark was viewed as a shortage of currency. He believed that the balance of payments caused by war reparations were causing the mark’s depreciation, and thus that rising wages and eventually prices were the result of a shortage of currency.

By refusing to see anything other than the “shortage of money” as causing inflation, Havenstein’s focus broke free of all restraints. Even when he belatedly took marginal steps to quash the spiraling devaluation, there was no turning back (the Reichsbank was discounting bills at only 5% up until July 1922; by September 1923 they were doing so at 90%).

Unfortunately, there was no alternative to Havenstein’s chartalism at that point. Part of this strain (stain, really) of ideology was the “independent” central banker free of government influence (people and markets bad; PhD’s and experts good). In May 1922, in so unfortunately timed action, the Reichsbank was fully shielded from any influence at all under the Reichsbank Autonomy Law; which, of all things, installed Havenstein for life.

I am not claiming that the Bank of Japan and Abenomics is yet in the same class, but all the ingredients are there. Among them is this growing tunnel vision, this time the Bank of Japan does not seem to want to let go of too little “inflation”, or “deflation” more precisely, as the primary cause of all their ills.

BOJ Gov. Haruhiko Kuroda said the increase was required to prevent a reversal into a “deflationary mindset” that the country’s leaders contend has stymied growth for many years. Countering such a trend is “the most important thing we can do,” Kuroda said. “Whatever we can do, we will.”

Once again, the modern chartalists in Japan (Keynesians now, who was also influenced greatly by Knapp) have found themselves enthralled with the wrong problem. “Inflation” is no more the cure in Japan than “money supply” was to hyperinflationary Weimar Germany. But where there is hope in Japan is that this inflation “cure” is being revealed more easily as the new source of economic poison.

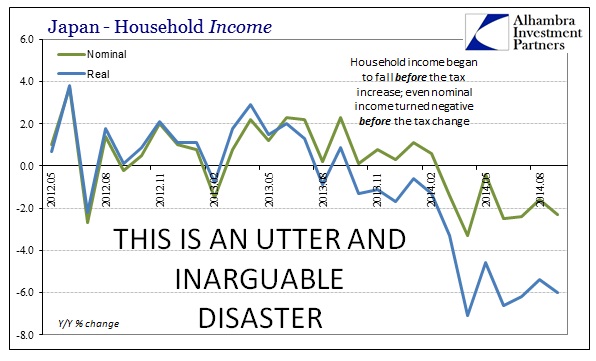

Under these terms we can hope that intervention takes place before the final stage toward currency collapse. It is, however, extremely disheartening (and wrenching to see the Japanese have to go through this) that central banks are so uniform in their prescriptions even when it clearly is the problem. They (economists, mostly) have already begun to blame the tax increase, but Japan’s current “depression” began months before the tax increase actually happened.

Nominal household income fell in nominal terms as early as February 2014, during Q1 which convinced so many of these same economists that Abenomics and “inflation” were working as designed.

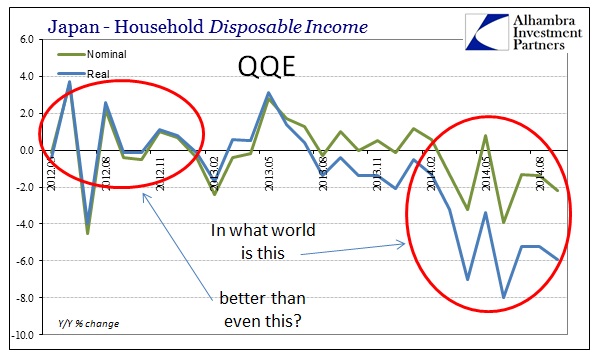

The truth of what just took place in Japan is that BoJ panicked. The incoming data is not just bad, it is atrocious; worse than even the 1997 episode that foretold all of this. Remember, these are the same policymakers that were unshakable in their faith that QQE would work as it was implemented in April 2013. Now they are being totally and empirically rebuked, so they instead retreat back to the tunnel vision of “more inflation.”

At least Japanese stock prices are up big today, so there is something to make at least a very small proportion of Japanese households take a positive view toward “wealth” being “created”; redistribution in any form does tend to concentrate. But that too is a cautionary tale as there was no shortage of the same kind of “returns” taking place in turning Germany to hyperinflation. When Havenstein was still discounting bills at 5% despite the fact that prices were doubling every week or so (and then every day; and then every hour), any business in Germany could purchase goods on credit “supplied” by the Reichsbank at 5% interest. That transferred directly this monetary chartalism foolishness into consumer prices. Borrowers at the central bank only needed to hold those goods for a short while to gain huge returns (nominal), paying back the discounted trade bill with severely devalued currency. Even at that 90% discount, the same trade was still profitable.

Again, the tunnel vision of every participant contributed to break the mark free of restraint and turn what was bad and growing worse into full collapse. Even Zimbabwe’s stock market had tremendous returns during its hyperinflationary episode, demonstrating yet again that stocks and investment returns are not always a discounting mechanism that they are purported to be, rather can be nothing more than a signal of high decay.

For all the assumed progress in “economics” and particularly central bank sophistication, they are no further away from chartalism. Instead it all has been simply rebranded as Keynesian combined with monetarism. Every DSGE model that these central banks use to destroy their own economies as they have done are exactly that – the modern version of chartalism that really isn’t all that modern. Japan is the purest example of that at this moment, and we can only hope that their sinking fate is taken globally as the warning it is.