To preserve any idea that the US is not heading into recession, the FOMC is now wholly reliant on statistical processes within the BEA’s use of the Census Bureau’s updated ARIMA-X13 modeling system. It is amazing to see this policy body that once proclaimed, unequivocally and forcefully, that it could perform the monetary equivalent of sorcery and alchemy reduced to quivering about winter. The latest policy statement, a silly farce of its own accord, is, quite simply, an embarrassment.

That starts with the fact that the Fed’s own academics both proved and disproved this seasonal adjustment gremlin. The San Francisco Fed thought it might be revealing to double the seasonal adjustment factor, which would bring GDP in Q1 up from +0.2% to +1.8%; or from pretty bad and awkward to plainly bad and still awkward. However, after figuring in likely revisions in the upcoming advance release for Q1, this double adjustment fantasy might be enough to take a -1.5% to about where GDP is right now. In other words, the FOMC is counting on statistical impropriety just to get back to where they already are – and that counts as reassuring?

Furthermore, a pattern observed in previous years of the current expansion was that the first quarter of the year tended to have weaker seasonally adjusted readings on economicgrowth than did the subsequent quarters. This tendency supported the expectation that economic growth would return to a moderate pace over the rest of this year.

The other parts of the Fed suggested instead that there is no adjustment problem only a problem of admitting and contemplating that QE and monetarism in general just doesn’t work. That “study” showed that there is no seasonal problem when you take out the negative first quarters of 2011 and 2014. In short, the Fed sees trouble only when the economy deviates vastly off course, a tendency that seems to be increasing in frequence of late.

Apart from more charitable number crunching, the most the FOMC could dwell upon was, as usual, sentiment:

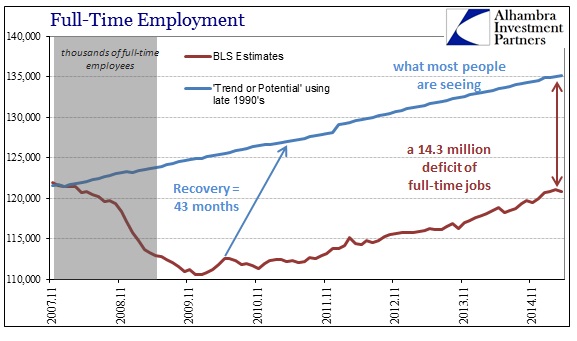

Participants also pointed to other reasons for anticipating that the weakness seen in the first quarter would not endure. A number of the fundamental factors that drive consumer spending remained favorable, among them low interest rates, high consumer confidence, and rising household real income. In addition, business contacts in several parts of the country continued to be optimistic and expected sales, investment, and hiring to expand over the rest of the year.

I suppose there is some minimal value in having the Fed’s closest contacts tell them that they are still optimistic despite all actual corporate reports overly ubiquitous with terms like “cost cutting” and “dollar”, but to remain ebullient upon low interest rates and consumer confidence? That really is reaching, especially since actual consumer “demand” has had no relationship whatsoever to either of those for years now – but it sounds good.

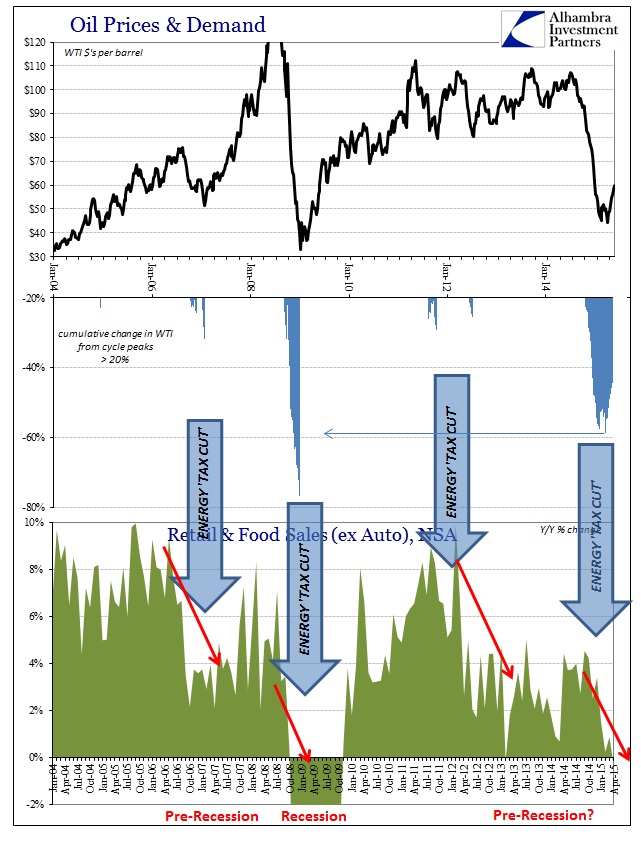

That last factor, “rising household real income”, is the worst part of this entire affair. Orthodox economics detests, absolutely detests, low “inflation” so for them to now place a very important crutch upon “disinflation” in this circumstance is low. The FOMC has and will do everything in its power to ensure that does not remain. If the inflation rate were to head back up toward their very own target (which they have “somehow” missed for years on end now) real incomes would not rise they would actually decline once more since nominal wages and incomes are at best stagnant. To depend on something that you so actively seek to erase is rather disingenuous, as it leads directly to pointing out the inconsistency – if rising real incomes are so very beneficial then why try for any “inflation” at all?

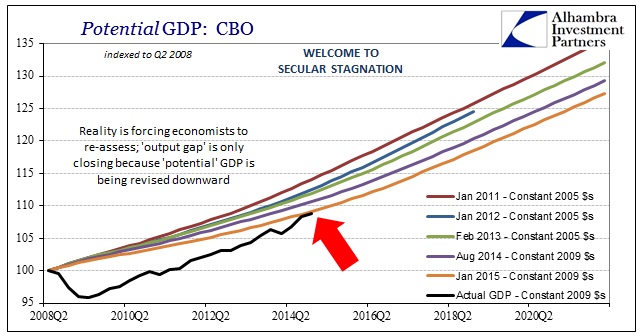

The answer to that has always been, in the orthodox view, that “demand” is a creature of nominal gains and thus inflation needs to be slightly positive. Yet the more they seek to attain this “inflation” miracle the further we get from it. To the FOMC it might seem a paradox, but in the case of common sense it is simple logic. You cannot stimulate a full and sustainable economic advance by actively seeking a preponderance of negative factors. The instability in even the GDP view of the economy relates exactly to that part – the “strong” dollar that nobody talks about anymore is, in fact, just another expression of how monetary intentions are ultimately self-defeating.

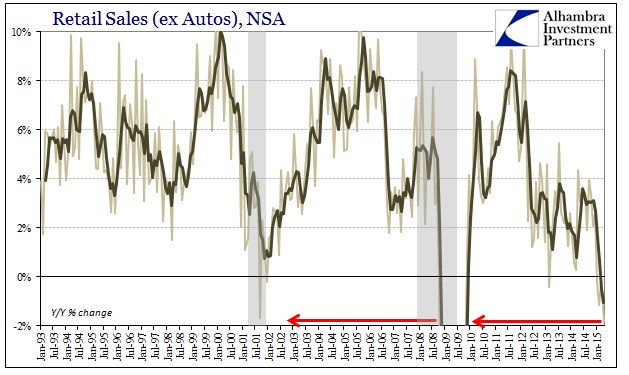

They really do believe that the more instability they input the more stability will itself output. At some point that may be proven correct, but likely not in the direction they have been seeking. Consumer confidence is at a multi-year high while retail sales are among the worst in the entire series; and low interest rates have been around for so long that nobody seems to be able to account for how to end them. Like Ben Bernanke’s desperate selection of the unemployment rate in his favor, and that of QE itself, it is very revealing that the FOMC is left with nothing but some very feeble excuses for misjudging yet again how an economy actually works.

These people were once taken as the fullest expression of the “best and brightest”, commanding unequivocal faith almost universally in everything said and done. If ever there were higher favor toward a technocracy, the Federal Reserve was once its best hope and example. We have gone from analyzing the color of Greenspan’s briefcase and the hand in which he carried it to sniveling about whether the BEA could fake GDP just a little more. It is certainly unseemly, but far too appropriate. Serial bubbles, and the increasingly unstable and dilapidated economy that comes with them, will do that.