By John P. Hussman, Ph.D.

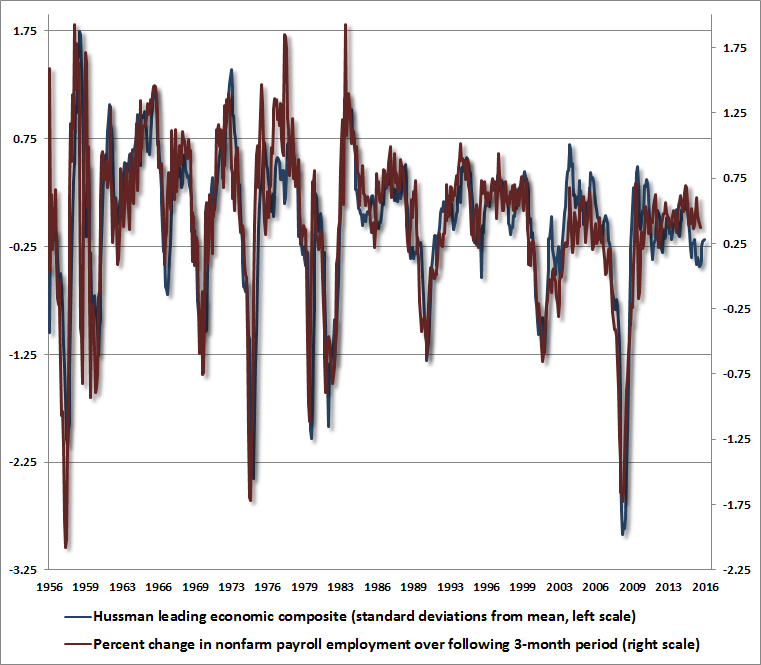

On the basis of leading economic data we find most strongly correlated with actual subsequent economic performance, the underlying strength of the U.S. economy remains tepid at best. Looking beyond the U.S., China’s trade minister over the weekend described the global economic situation, correctly, I think, as “complicated and grim.” The chart below presents our leading economic composite (measured in standard deviations from the mean) along with actual subsequent growth in U.S. non-farm payrolls over the subsequent 3-month period. Despite Friday’s strong payroll showing, the 3-month rate of payroll growth in the U.S. remains on a slowing trajectory.

We’ve observed a very slight pickup in our leading measures since their trough early this year, but thus far, the magnitude of that pickup is indistinguishable from short-term noise (we observed a similar pickup near the 2007 peak). Employment has held up somewhat better than expected in recent quarters, but the prospects for employment growth over the coming months point distinctly lower even with the slight uptick in leading measures. Given clear indications of fresh economic and banking tensions in Europe, Britain, and China, it’s not at all clear that the U.S. has escaped the prospect of oncoming recession. We’re certainly open to that possibility, and are not tied to any particular economic forecast, but there is little indication from reliable data that economic prospects have materially improved. Those in search of rosier views can find that assurance in any random 5-minute segment of financial television. Still, we’ve always insisted that views should be supported with evidence, and that analysts should show their work. “Without data,” as W. Edwards Deming once observed, “you’re just another person with an opinion.”

Race to the bottom

Far from reflecting some renaissance of economic growth, the behavior of the financial markets last week suggests something very different. Specifically, accelerating global economic risks have actually created a short-term yield-seeking panic, which has infected the entire structure of global yields.

To understand what’s happening in the financial markets, it’s important to recognize thesequential nature of yield-seeking speculation. Consider a central bank launching a fresh round of quantitative easing. Initially, central banks focus on purchasing the highest-tier government securities (such as Treasury bonds in the case of the U.S. Federal Reserve). Central banks buy these interest-bearing securities, and pay for them by creating “base money” – currency and bank reserves. That base money takes the place of interest-bearing securities in the hands of the public, and someone then has to hold that amount of zero-interest money at every moment in time until it is actually retired by the central bank.

Now, having traded their high-quality, interest-bearing securities to the central bank in return for zero-interest cash, a portion of those investors will simply hold the cash in the form of currency or bank deposits, but some investors will feel uncomfortable earning nothing on those holdings, and will try to pass the hot potatoes onto someone else. To do so, these investors now have to buy some other security that is lower on the ladder of credit quality, and more speculative. The sellers of those securities then get the zero-interest cash. Some of those sellers, unwilling to reach for yield in even more speculative securities, hold the cash, but some climb out to a further speculative limb. Ultimately, the process stops when yields on speculative securities have fallen low enough that investors are indifferent between holding zero-interest cash and holding low-yielding but more speculative securities. At that point, all of the new base money is passively held by somebody.

What’s happened in recent years is that central banks have insisted on extending this process. With every extension of quantitative easing, the public is left with a lower-quality stock of speculative assets. Indeed, the ECB and the Bank of England have purchased so much government debt that they have recently reached even further down the credit ladder, with the ECB buying corporate bonds, and the Bank of England announcing purchases of “Tier C” assets, which include assets “backed by credit cards; student loans; and consumer debt.” Unfortunately, this isn’t backing at all, as comforting it may be to Jimmy the Weasel to know that his mountain of credit card debt is “backed” by his credit card.

Ultimately, all that quantitative easing does is to remove higher-quality interest-bearing securities from public hands, replace them with zero-interest cash, and leave a remaining stock of lower-quality speculative assets that then have to compete with that cash. To increase the discomfort of investors, the Bank of Japan and the European Central Bank have also begun charging banks on their reserve balances, which has driven interest rates to negative levels across Japan and Europe.

This process of sequential yield-seeking is almost exclusively driving recent market behavior. Specifically, the global economic outlook has experienced a downward shock in recent weeks, largely as a result of the “Brexit” referendum where British citizens voted to exit the European Union, coupled with deterioration in China that has led it to accelerate the depreciation of its currency. That combined deterioration, coupled with expectations of further central bank easing, has resulted in a plunge in global interest rates, with over $13 trillion of government debt (primarily in Japan and Europe) now sporting negative yields. The plunge in yields has also affected U.S. Treasury securities, where the 10-year Treasury bond yield dropped as low as 1.32% last week. This advance in asset prices isn’t a reflection of economic health. To the contrary, it is a yield-seeking race to the bottom resulting from a downward shock to the global economy.

While stocks were down on the week in Japan, Europe, and China, the only wrinkle was this. In the U.S., investors evidently believe that June’s “Goldilocks” employment report takes U.S. economic risk off the table. At the same time, uncertainties about Brexit and China have created expectations that the Fed will abandon any plans to normalize interest rates. As a result, Treasury yields fell despite Friday’s strong employment report (after a brief pop higher), and investors responded to the plunge in yields and the perception of U.S. economic “resilience” by chasing risk-assets across the board, including junk debt and equities. My impression is that this optimistic response is a mistake. In any event, however, it’s important to understand that the main factor driving financial markets here is a yield-seeking race to the bottom.

Yield-seeking, valuations, and the investment outlook

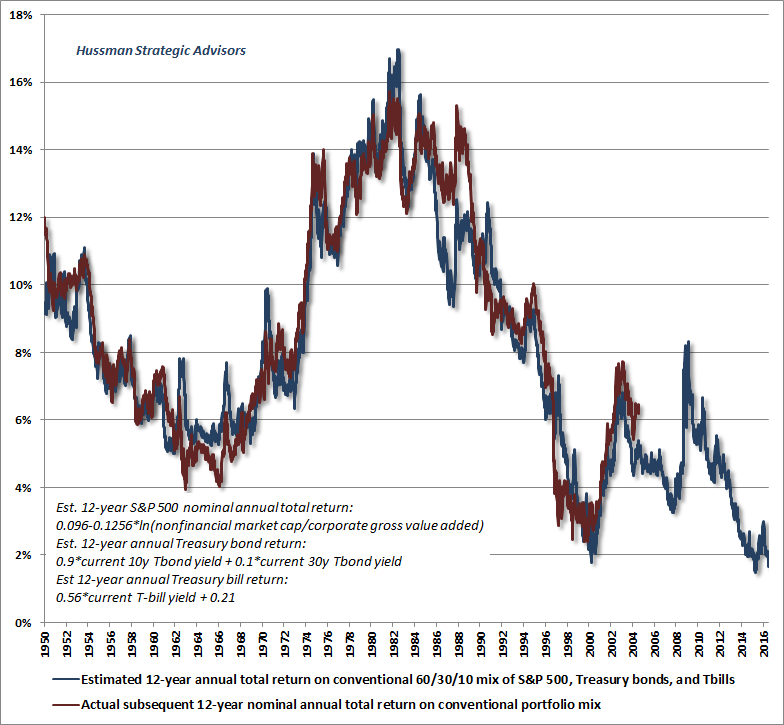

The temporary but glorious feature of this yield-seeking is that as yields are driven lower, valuations and prices are driven higher. The long-term side of this same coin, however, is that as valuations and prices are driven higher, future prospects for investment returns are obliterated. Indeed, based on valuation measures we find most strongly correlated withactual subsequent investment returns, we currently estimate that investors stand to earn less than 2% annually (nominal) on a conventional 60/30/10 portfolio mix of stocks, Treasury bonds, and T-bills over the coming 12-year period. The chart below presents the basis for this expectation. Again, those who have different views are encouraged to present their data and show their work. Otherwise, those views are merely opinion.

All of this said, we have to distinguish between long-term and near-term investment prospects. See, valuations reliably drive long-term returns, but short-term returns are driven by the inclination of investors toward speculation or risk-aversion, and that disposition is almost wholly psychological. Historically, we find that the most reliable measure of those speculative inclinations is the uniformity or divergence of market internals across a broad range of individual stocks, industries, sectors, and security types, including debt of varying creditworthiness (when investors are inclined to speculate, they tend to be indiscriminate about it).

As I’ve regularly noted since mid-2014, if we learned one lesson from our own challenges in the half-cycle since 2009, it was that the Fed’s recklessly experimental policy of quantitative easing was able to encourage yield-seeking speculation long after the emergence of warning signs that were reliably followed by market plunges in previous market cycles across history. As a result, one had to wait for market internals to deteriorate explicitly before adopting a hard-negative market outlook. We need no further lessons on that subject. For a complete narrative of that episode, see the “Box” in The Next Big Short.

Currently, enough trend-following components have improved on that front to hold us to a fairly neutral near-term outlook, despite the 40-55% market loss we anticipate for the S&P 500 over the completion of this cycle, and the already terrible 10-12 year returns that are baked in the cake. Further uniformity, particularly across economically sensitive and international markets, could create a speculative environment that, despite wicked valuations, could support an outlook that might be described as “constructive with a safety net.” We might prefer to completely rule out the possibility of further extremes, but we can’t because risk-seeking is psychological in nature. Still, our measures of market internals don’t yet suggest that recent speculation is durable – the current return/risk profile we identify is still associated with negative expected near-term returns. But those prospects are just close enough to zero to keep us from banging our fists about imminent near-term market risks.

I have little doubt that future generations will look at the reckless arrogance of today’s central bankers no differently than we view speculators in the South Sea Bubble and the Dutch Tulip-mania. Unfortunately, there is no mechanism by which historically-informed pleas of “no, stop, don’t!” will penetrate their dogmatic conceit. Nor can we change the psychology of investors. The best we can do is to monitor the best measures we can identify of risk-seeking or risk-aversion.

Meanwhile, in the face all this yield-seeking speculation, investors seem to have forgotten how securities actually work. Understand that by purchasing securities at extreme valuations, you are necessarily playing a “greater fool” game that relies on a) successfully exiting at some point and; b) exiting at higher valuations and even lower long-term expected returns than those that are baked into the cake already. Not content with the current obscene overvaluation of the financial markets, central banks have tried to extend this game by driving bond yields negative. But those who buy a negative yielding asset, by definition, are locking in a loss if they hold to maturity, so in order to attain even a zero return, those investors have to rely on a greater fool to buy the bonds at yet deeper negative interest rates before they mature.

In that environment, it’s certainly possible that the current 1.36% yield on 10-year Treasury bonds will be driven even lower, and that equity valuations that are already more than double their historical norms will be driven even higher. We’d give greater odds to Treasury bonds, largely because U.S. economic weakness could create a flight to safety in Treasuries (while stocks and credit-sensitive debt would be vulnerable). But then what?

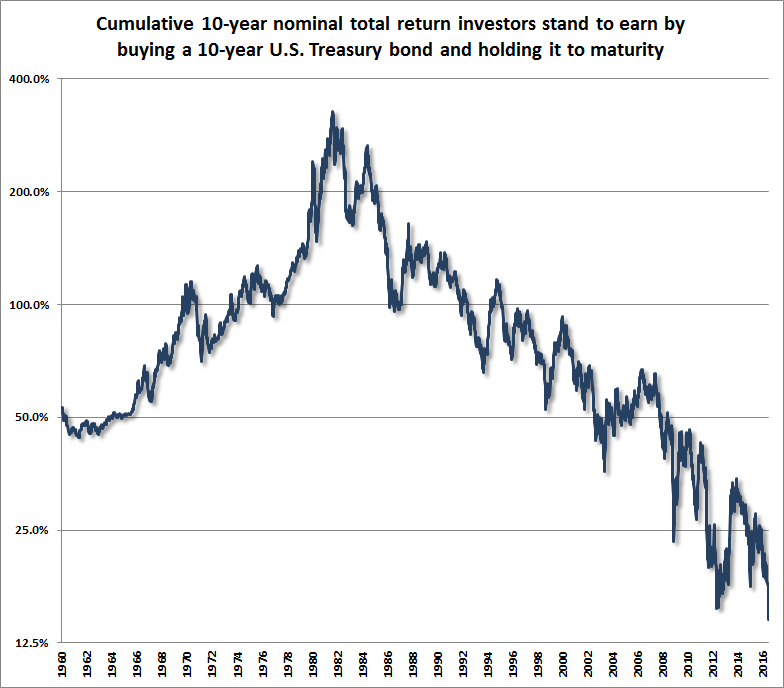

Recognize that any long-term holder of these securities is already doomed. For any unhedged holder of stocks and bonds, avoiding dismal long-term returns now requires their ability and willingness to exit, before the moment that no greater fools than themselves can be found. As a reminder of the bargain that investors are accepting here, the chart below (presented on log-scale) shows the cumulative nominal total return that investors have stood to earn, at various points across history, by buying a 10-year Treasury bond and holding it to maturity. The remaining cumulative total return to maturity available to investors is now at the lowest point in the history of the United States. Do investors really believe that equities, corporate bonds, junk debt and other risky asset classes, already at record highs, have escaped an equivalent fate?

Look, we know quite well that this game could continue in the near-term, and we’ll read the speculative inclinations of investors from market internals. Even if market internals do improve further, it would be historically ill-advised to accept more than a moderate exposure to market risk given present valuations and global economic headwinds. We’ve learned not to push against a herd as it races toward a cliff, lest we be crushed, but we also know that at this altitude, it is best to patiently let others pass us as they race toward the edge, and to carry a parachute in any event. It’s essential to maintain tight safety nets; ideally ones that don’t rely on “stop-loss” orders. I continue to believe that when enough trend-followers are inclined to hit the sell button simultaneously (a point that we would still place about the 1980 level on the S&P 500), the coordinated attempts to exit will make execution impossible anywhere near that level.

In market cycles across history, the best opportunity to increase market exposure, at a dramatically higher expected return/risk profiles, has been after a material retreat in valuations is joined by an early improvement in market action. These opportunities have emerged during the completion of every cycle, and I remain convinced that this one will be no different. In the meantime, realize that low-yielding cash has now become quite competitive with the prospective return/risk profiles of far riskier assets. We strongly encourage investors to continue to save in a disciplined way, but to lean strongly toward conservative assets including cash (yes, cash), hedged-equity, modest exposure to precious metals, and substantially reduced exposure to unhedged conventional assets such as stocks and bonds.

At present, valuations are obscene, but market internals are mixed, largely due to an improvement in trend-following measures, holding us to a fairly neutral near-term view at the moment, despite wicked downside prospects over the completion of the current market cycle. Our view will revert to hard-negative on moderate weakness, and could shift to a slightly more constructive outlook (akin to holding a small call option position) if we observe broader uniformity, however much we might disagree with the “theme” driving that speculation. Either outcome would demand a strong safety net at current extremes. I’m convinced that investors who ignore the need for a strong safety net here have a misplaced confidence in the ability of monetary easing to support stocks. As I’ve demonstrated in both U.S. and Japanese data, the fact is that monetary easing only supports stocks when investors are already inclined to embrace risk. Once risk-aversion sets in, all bets are off. We’ll take our evidence as it comes.

Injuring the real economy with paper “wealth”

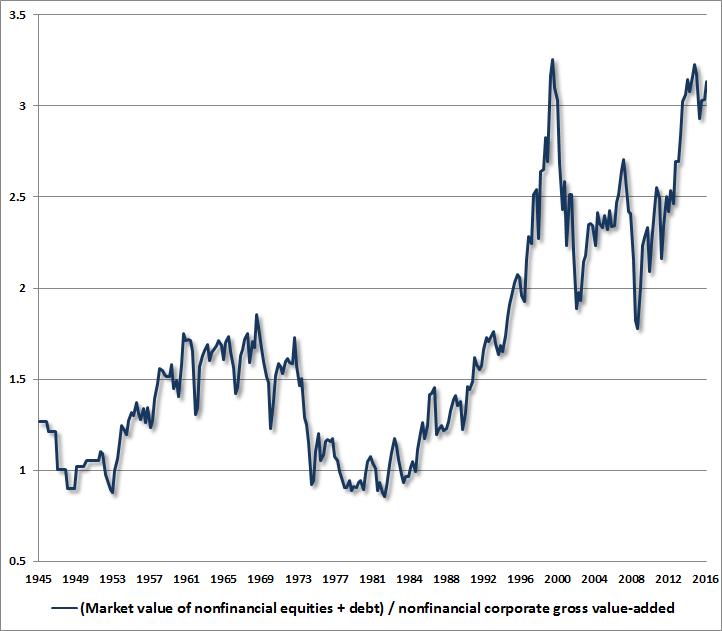

One of the hallmarks of the bubble period since the late-1990’s is that the growth rate of real U.S. gross domestic investment has slowed to less than one-quarter of the rate it enjoyed in the preceding half-century. Yet because central banks have stomped on the accelerator at every turn, the quantity of outstanding debt has never been higher, and the combined value of corporate equities and debt (“enterprise value”) is now at the highest multiple of corporate gross value-added since the 2000 bubble extreme. The chart below illustrates the current situation. While this might be incorrectly seen as a sign of corporate strength, it turns out that just like the ratio of household financial wealth to household disposable income, this ratio has a powerful and negative correlation with actual subsequent investment returns.

The Iron Law of Valuation is simple: the higher the price investors pay for a given stream of future cash flows, the lower their future returns will be. Because profit margins are highly variable across the economic cycle, the fact is that corporate gross value-added is a dramatically more reliable “sufficient statistic” for that future stream of cash flows than any earnings measure available (see Choose Your Weapon for a review of various valuation measures, ranked by their correlation with actual subsequent market returns).

As a Stanford-trained economist (with the good fortune to have John Taylor, Thomas Sargent, Ronald McKinnon, Robert Hall, and Joseph Stiglitz as my doctoral committee) and former professor of economics and international finance at the University of Michigan and Michigan Business School, I wince at the Federal Reserve’s nearly complete disregard of the link between financial speculation and subsequent economic injury. Instead, central bankers seem to view elevated security valuations as “wealth.” The longer this fallacy persists, the worse the subsequent fallout will be. It will help to review how financial securities are actually linked to the real economy.

Securities are created by the act of transferring some amount of savings that was withheld from consumption, and instead providing it to someone else. A security is no more and no less than a claim on some expected stream of future cash flows, in return for the funds provided today. In prior commentaries, I’ve observed that because every security is an asset to the holder and a liability to the issuer, financial securities actually net out to zero in the calculation of a nation’s wealth. Instead, the true wealth of a nation is embodied in itscapacity to produce, as measured by the stock of real investment (productive capital, stored resources, infrastructure, knowledge) it has accumulated as a result of prior saving.

It’s not a theory, but an accounting identity, that total saving in an economy is equal to total real investment. By “investment” here, we’re talking about goods and services that are not consumed – real investment – as opposed to financial investment. That distinction is important, because the gross issuance of securities in an economy can be many times the amount of underlying saving. That’s because securities are issued every time funds are intermediated, whether or not they are used to finance real investment. Suppose, for example, that someone borrows money and spends it on consumption goods. In that case, the lender may be a saver, the borrower is a “dis-saver,” and a loan is created even though the total saving (and the total real investment) in the economy is zero.

In a healthy economy, savings are channeled to productive investment, and the new securities that are issued in the process are evidence of that transfer. In an unhealthy economy, and particularly one with very large wealth disparities, a large volume of securities may be created, but they are often simply a way of supporting debt-financed consumption. As a result, no productive investment occurs, and no national “wealth” is created. All that occurs is a wealth transfer from savers to dis-savers. Over the past 16 years, U.S. real gross domestic investment has crawled at a growth rate of just 1.0% annually, compared with a growth rate of 4.6% annually over the preceding half-century. There’s your trouble.

Instead of productive saving and investment raising the U.S. standard of living through growth, the primary way that Americans have maintained their standard of living in recent years is through debt-financed consumption. Enormous “intra-sectoral” deficits and surpluses have been created in the process, which have sustained the distortions, but only temporarily. See, deficits in one sector of the economy have to be matched, in equilibrium, by mirror-image surpluses in other sectors. In the years following the financial crisis, weak household savings and large government budget deficits created a huge, mirror image surplus: specifically, a historically unsustainable surplus in the corporate sector (which was observed as record profit margins).

Essentially, wages and salaries as a share of the economy collapsed, but government transfer payments and debt-financed consumption filled the void, so companies were able to sell the same amount of goods and services, even though their wage costs were dramatically below historical norms. In recent quarters, that situation has begun to normalize, with household savings increasing and government budget deficits narrowing. The combined effect, of course, is that corporate profits have hit the skids. Unfortunately, debt has been created, and equity valuations have been elevated, under the delusion that those elevated profit margins were permanent. Likewise, suppressed interest rates enabled an enormous quantity of low-quality “covenant lite” debt to be created, even though U.S. real gross domestic investment has grown at a rate of just 0.24% annually – literally one-nineteenth of its pre-2000 growth rate – over the past decade.

The key point here is that rampant issuance of securities, without real investment, is symptomatic of a distorted, unhealthy economy, and of broad wealth disparities. The problem is that future obligations are created without creating the productive means to service them. Worse, when central banks encourage yield-seeking speculation in the financial markets, valuations are driven up so that investors are offered the illusion of “paper wealth,” even though long-term stream of cash flows represented by those securities (which embody the actual “value” of a security) hasn’t changed at all. As speculative yield-seeking continues, and as valuations increase, the long-term stream of cash flows underlying those securities becomes smaller and smaller per dollar of paper “wealth.” Ultimately, the outlook for the future features nothing other than poor long-term returns and defaults.

While it’s certainly possible for any individual holder to sell their overvalued holdings, equilibrium requires that someone else, by necessity, has to buy those same securities. It’s essential to recognize that yield-seeking speculation doesn’t create wealth. It only creates the opportunity for wealth transfer – primarily away from speculators who buy those securities at extreme valuations, and toward the previous holders with the foresight to sell to those “greater fools.”

Simply put, the only thing QE really does is to distort the financial side of the economy, enabling and encouraging yield-seeking speculation and massive sectoral imbalances that we observe as wealth disparities and bizarrely distorted securities markets. The proper course of economic policy is to expand productive investment at every level of the economy through the action of Congress (including infrastructure investment, corporate investment tax incentives, workforce development credits, and other measures ideally tied to the creation of new jobs). The Federal Reserve is not a source of prosperity. It is the single most dangerous and unregulated risk factor in the U.S. economy. We should have learned that during the yield-seeking mortgage bubble and the collapse that followed. We have not, so we now face the equivalent prospect again.

Illusory prosperity, cheap money, and the road to financial crisis

“Credit expansion cannot increase the supply of real goods. It merely brings about a rearrangement. It diverts capital investment away from the course prescribed by the state of economic wealth and market conditions. It causes production to pursue paths which it would not follow unless the economy were to acquire an increase in material goods. As a result, the upswing lacks a solid base. It is not a real prosperity. It is illusory prosperity. It did not develop from an increase in economic wealth [i.e. the accumulation of savings made available for productive investment]. Rather, it arose because the credit expansion created the illusion of such an increase. Sooner or later, it must become apparent that this economic situation is built on sand.”

Ludwig von Mises, The Causes of Economic Crisis (1931)

Historical note: The stock market would go on to lose two-thirds of its value over the following year, bringing the cumulative market loss from the 1929 peak to -89%.

In the current cycle, the question of “sooner or later” has been answered by sequentially kicking the consequences further and further down the road, as global central banks initiate ever larger interventions at every turn. When will it end? Unfortunately, it’s unlikely to end by central bankers suddenly seeing the light, by recognizing the weak correlation between activist monetary policy and the real economy, or by recognizing that the race to the bottom of zero and even negative interest rates only brings financial distortion. Instead, it will end as credit defaults rise, bank bailouts become necessary, covenant lite debt proves to be, indeed, lite on covenants, and financial assets pushed to zero long-term yields prove, indeed, to yield zero returns over the long-term.

We’ve learned quite well that speculative psychology can outweigh even warning signals that were regularly followed by vertical losses in prior market cycles, and we’ve adapted our discipline to reflect that lesson. Quantitative easing has certainly deferred the consequences of extreme valuations and persistent speculation, but I believe that investors would be foolish to assume that those consequences will not arrive. It’s easy to understand the concept of yield-seeking, and the allure of “front running” a race to the bottom in yields. Still, it’s unrealistic to believe that credit defaults will not accelerate on the massive volume of low-grade, “covenant lite” debt that has been issued in this cycle. It’s equally unrealistic to believe that every shock to the global economy can be fixed by the act of central banks buying assets and creating more zero-interest paper. If one understands history, one should recognize that financial distortion and malinvestment always ends in tears, and the longer it continues, the worse the outcomes are likely to be.

A lot of future misery could be avoided if the Congress and the general public recognized the risks the Fed has created, and abandoned the ridiculous concept that it is somehow a third rail of “political influence” to place boundaries on the recklessness of the Federal Reserve. These boundaries are essential for the public good, and perhaps even the economic survival of the nation. The American public should never, never, abdicate the right to restrain the behavior and assert checks and balances on an unelected agency of the government. Yet even if this recklessness brings another global financial crisis or depression, my sense is that the Fed will again be called on to “save” the economy with exactly the same poison that has created recurrent bubbles and collapses in the first place. In the financial markets, we’ve learned our lessons from QE and made our adaptations, and I expect we’ll navigate the cycles ahead just fine. What I worry about is the human impact of the collapse of this speculative episode. Aside from the short-term prospect of even greater speculative yield-seeking (which will only make the ultimate consequences worse), I believe that such a collapse is now unavoidable.

The Austrian economist Ludwig von Mises (1881-1973) was virtually alone in anticipating the Great Depression. He never lived to witness the current episode of deranged experimental recklessness that central banks have unleashed on the global economy. He was spared the spectacle of watching the grotesque brainchild of Ben Bernanke’s warped misconceptions swelling to a foul monstrosity. But he instantly would have recognized and anticipated the ultimate consequences. He had already seen those consequences accurately played out in episodes across history, the worst being the Depression and the Weimar hyperinflation. In describing the economic consequences of cheap money, he may as well have been writing about today. Read slowly, and take in every sentence:

“If the market rate of interest is reduced by credit expansion, many projects which were previously deemed unprofitable get the appearance of profitability. The entrepreneur who embarks upon their execution must, however, very soon discover that his calculations were based on erroneous assumptions. However, as the banks do not stop expanding credit and providing business with ‘easy money,’ the entrepreneurs see no cause to worry. Everybody feels happy and is convinced that now finally mankind has overcome the gloomy state of scarcity and reached everlasting prosperity.

“In fact, all this amazing wealth is fragile, a castle built on the sands of illusion. The artificial prosperity cannot last because the lowering of the rate of interest, purely technical as it was and not corresponding to the real state of the market data, has misled entrepreneurial calculations. Deluded by false reckoning, businessmen have expanded their activities beyond the limits drawn by the state of society’s wealth. In short, they have squandered scarce capital by malinvestment.

“The sooner one stops, the less grievous are the damages inflicted and the losses suffered. Public opinion is utterly wrong in its appraisal of the cycle. The artificial boom is not prosperity, but the deceptive appearance of good business. Its illusions lead people astray and cause malinvestment and the consumption of unreal apparent gains which amount to virtual consumption of capital. The depression is the necessary process of readjusting the structure of business activities to the real state of the market data, i.e., the supply of capital goods and the valuations of the public. The depression is the first step on the return to normal conditions, the beginning of recovery and the foundation of real prosperity based on the solid production of goods and not on the sands of credit expansion.

“It is vain to object that the public favors the policy of cheap money. The masses are misled by the assertions of pseudo-experts that cheap money can make them prosperous at no expense whatever. They do not realize that investment can be expanded only to the extent that more capital is accumulated by savings. What counts in reality is not fairy tales, but people’s conduct. If men are not prepared to save more by cutting down their current consumption, the means for a substantial expansion of investment are lacking. These means cannot be provided by printing banknotes or by loans on the bank books.

“If one does not terminate the expansionist policy in time by a return to balanced budgets, by abstaining from government borrowing, and by letting the market determine the height of interest rates, one chooses the German way of 1923.”

Ludwig von Mises, The Trade Cycle and Credit Expansion: The Economic Consequences of Cheap Money

The foregoing comments represent the general investment analysis and economic views of the Advisor, and are provided solely for the purpose of information, instruction and discourse. Please see periodic remarks on the Fund Notes and Commentary page for discussion relating specifically to the Hussman Funds and the investment positions of the Funds.

Source: Race to the Bottom: Injuring the Real Economy with Paper “Wealth”