The US is not alone in its corporate profit slump. In China, profits at State-Owned Enterprises fell a further 6.5% year-over-year in the January to July period. Estimated to have been RMB 1.31 trillion (about $195 billion), SOE profits are being dragged down by those firms under control of the central government. Locally-administered SOE’s showed net income declining by only 0.3% in the period, whereas the larger, central SOE’s reported a 9% contraction Y/Y.

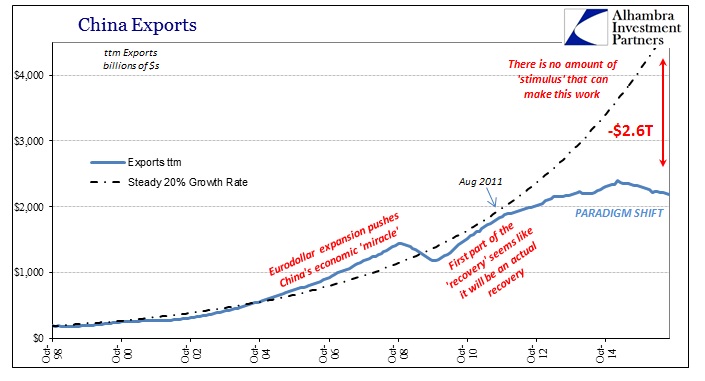

These results aren’t surprising given China’s economic condition, an unending slowdown now dragging into its fifth year. But more than that, this state-structured economic framework is being used once more this year to try to help cushion the blow from the lack of demand that once drove its vast industrial/export engine. Some economists continue to believe that the country is transitioning to an internal, consumer-oriented “model” but the economic results and the pressure that central authorities are putting on especially SOE’s and the overall state-administered sector suggest otherwise.

China is an industrial economy and will sink or float based on global demand for its products. Contrary to economists here (or anywhere, really), the Chinese know very well that Janet Yellen’s economy is a myth, a figment conjured by parsing an often intentionally incomplete economic account (the unemployment rate and “professional forecasters”). Despite the profit pains, the Chinese government has been pushing the state sector to invest where the private sector now openly refuses.

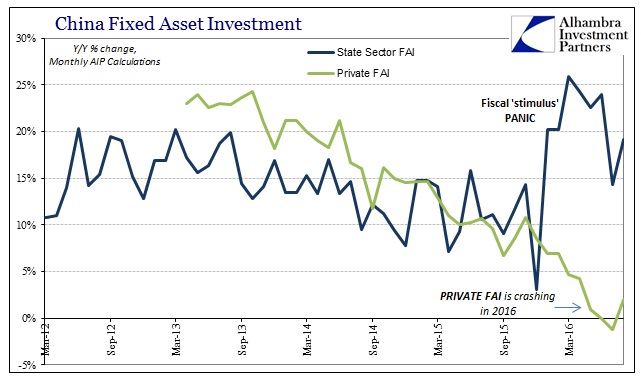

This is a huge problem and again it belies the notion that it is simply an economy in transition. The government’s state-run news site, China Daily, is very explicit about what is now China’s growing investment problem.

The torpid growth of private investment this year has concerned policymakers as the private sector regularly contributes more than 60 percent of China’s GDP growth and provides over 80 percent of jobs.

Some analysts attributed the decline to the slowdown in the export manufacturing and real estate industries, the two sectors most favored by private investors, combined with the deterioration in business confidence over the past few years.

If the Chinese are not building new factories and production facilities, they will not be creating more jobs. The reluctance of the private sector to do so is a matter of pure and simple math; no regressions required. As noted yesterday, the global economy is in a depression, and one that is uniquely binding upon the Chinese as both supply and demand further down the global supply chain.

Without external demand, the internal economic conditions across China’s economy can only slow even further and private businesses know it. That is why they are now declining to add to the productive base that would normally propel the industrial economy and then the rest with it. Until 2016, Chinese authorities appeared perhaps anxiously content to see where this would all end up, finally being convinced by the dangerous conditions at the end of last year and the start of this one to finally act – profits or not.

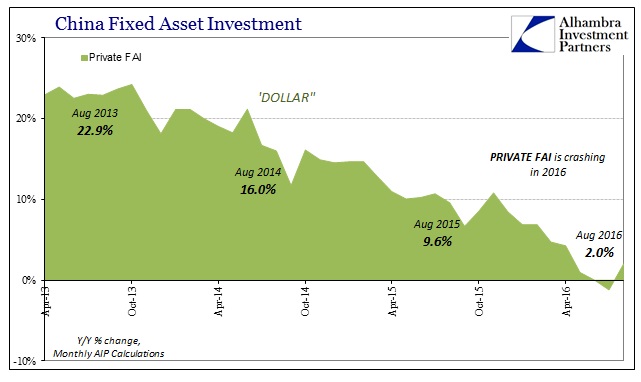

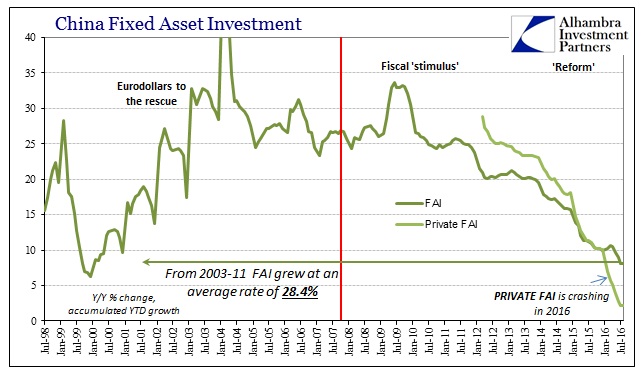

You always have to wonder about the accuracy or even the veracity of Chinese estimates particularly when they repeat. For the second straight month in August, total FAI (on an accumulated basis) was reported to have been 8.1%. Strangely, private FAI (on an accumulated basis) was also reported to have been the same, just 2.1%. Whatever the chances for such coincidence, the trend in fixed asset investment is absolutely clear especially in the private sector. The rest of the economic accounts reflect this reality.

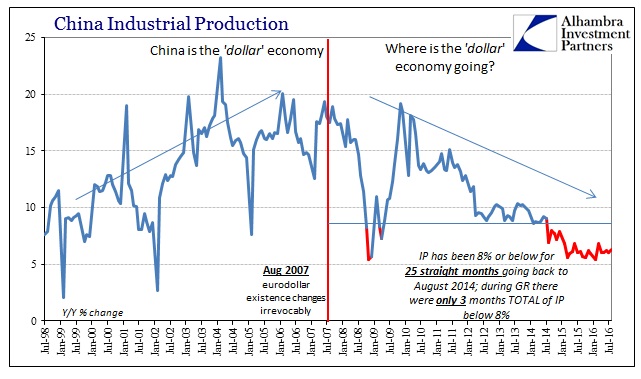

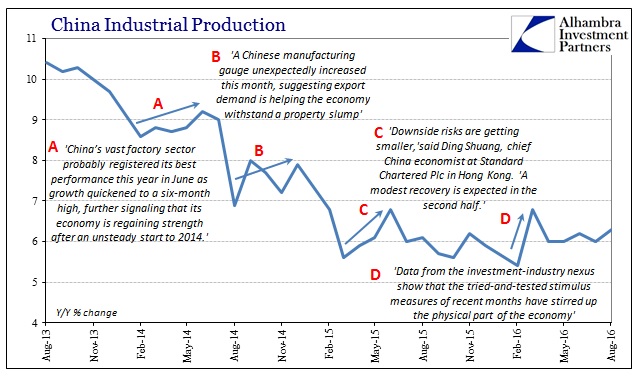

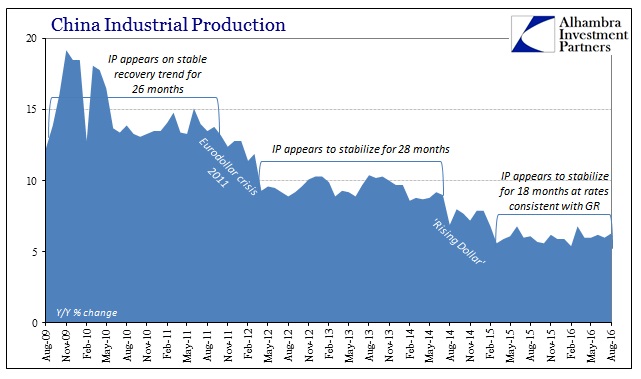

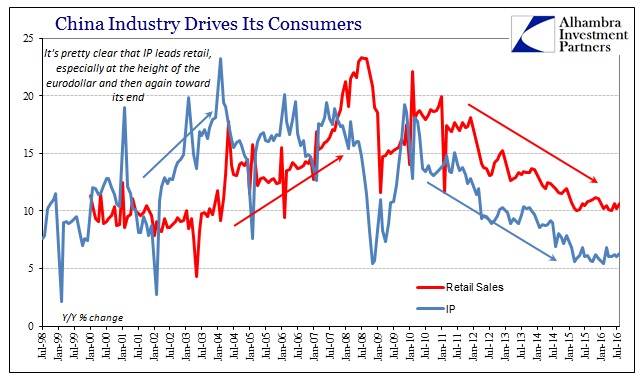

Industrial production in August 2016 was 6.3% and was boosted to some degree by a hot summer and a surge in electricity usage (not industrial). Even if that weren’t the case, 6.3% continues the same low growth that reflects the lack of external demand as well as increasing uncertainties inside the Chinese economy itself. For a year and a half now, China IP has been stuck at levels that were last seen during the depths of the Great Recession; a growth range worse than even the late 1990’s and the Asian flu and its aftermath. Not understanding what is taking place, economists have been quick with each positive variation to herald a new recovery only to find out in short order nothing has changed.

And as industry goes, so does internal “demand.” Retail sales in August grew by 10.6% and matching the high for the year (June), but that rate is still below all of Q4 2015 and like IP stuck in the same low trajectory that “unexpectedly” showed up to start last year.

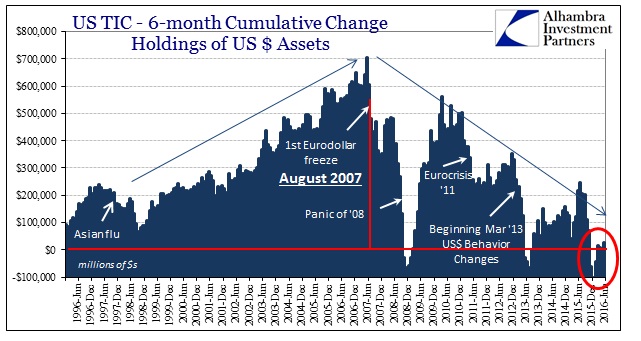

The reaction in FAI is telling, as private FAI reflects this reality where the slowdown is no longer believed as some cyclical problem to be withstood or corrected by “stimulus.” State-sector FAI shows that Chinese authorities are coming to the same conclusion and just don’t know what else to do about it. What can they do? At its heart, it really has nothing to do with China. The Chinese economic “miracle” of the 2000’s was no miracle at all; it was out of control global money growth, Bernanke’s ridiculous “global savings glut” put into action by a monetary system that no longer functions in sufficient capacity to maintain growth. Quite unsurprisingly, we no longer find much growth anywhere in the world even where everyone expects that we “should”, a depression that goes on and on year after year.