With the “dollar” off the ledger as far as a menacing factor, perceptions have begun to shift toward different if still-confused rhetoric. Figuring out fixed income isn’t always straightforward to begin with, but as the “unexpected” flirtation with deflation over the past few months threw a huge wrench into the economic boom supposedly forming the world over, the temptation now to revisit that idea is proving too much. Setting aside, apparently, that some of the most vital and relevant figures are persisting as delirium for even April, the stretch of oil prices in particular is alluring. That idea itself showcases the questionable foundation for all of this, as it was oil prices that were supposedly not very meaningful on the way down but everything on the way up (whether they last in that position is for someone else to worry about).

The question is how to read the various signals as they are being redefined by the next stage after the “dollar” ran into March 18:

“You’re in the midst of a reflation trade,” said Brent Schutte, senior investment strategist at BMO Global Asset Management in Chicago. The firm manages about $240 billion. “People are beginning to think that global growth may improve toward the end of the year, or at least the deflationary forces that are artificially driving things down are now ebbing.”

That is a sentiment that is gaining across economic forecasting, despite the rather obvious contradictions that remain. It is easy to dismiss those, however, when falling into past bad habits.

“There is more inflation being built into the steeper yield, and a steeper yield curve has been a missing component of the financial sector backdrop for years,” Joe Quinlan, New York-based chief market strategist at U.S. Trust, which oversees about $391 billion, said by phone. “The U.S. economy saved the rest of the world in the second half of last year and now the rest of the world will return the favor to the U.S.”

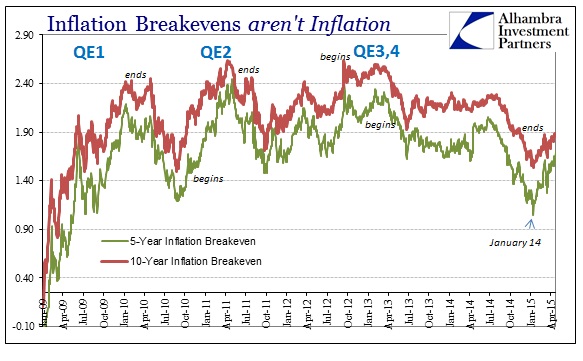

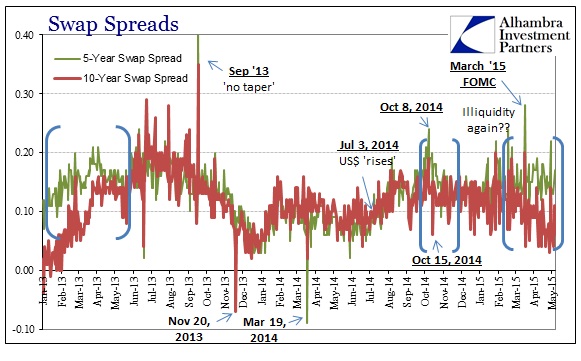

I raised this issue a few weeks ago as inflation breakevens in particular have stood out since January 15. Whereas it is simply enough to think of inflation breakevens forecasting something of market expectations for inflation, the history under QE/ZIRP more than suggests that TIPS hedging is being used against monetary policy instead. I don’t think that is especially controversial of a claim, as the ups and downs in breakevens match very closely the ins and outs of the QE’s. The timing of this latest uptick echoes signals from the swaps market that looks more and more like “money curve” investors are hedging in that same direction – not of inflation but of the next QE.

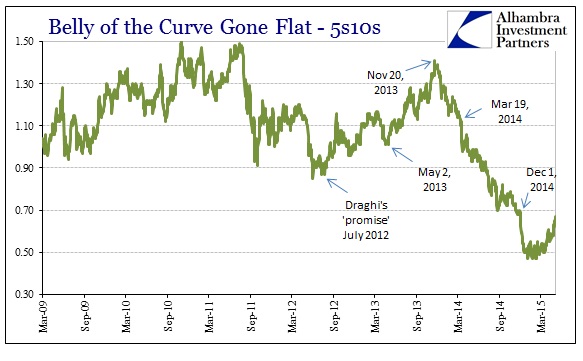

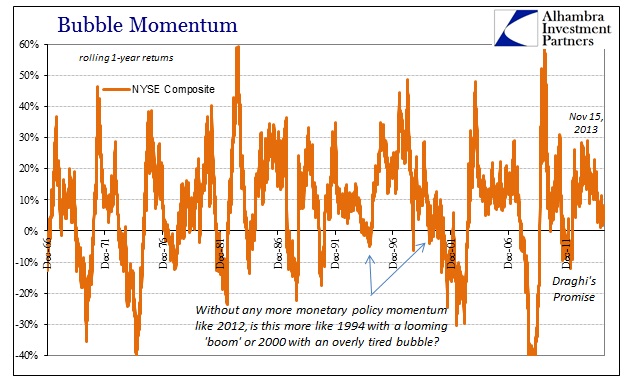

It is true that the yield curve shape has taken on more steepening in this recent bond selloff, but again that doesn’t necessarily have to have much to do with “inflation.” When the curve last did so starting in the middle of 2012, both breakevens and yield steepening were taking place just as economic growth and the CPI/PCE deflator started in the opposite direction. That yield curve movement was, however, perfectly timed for expectations about what central banks were doing or were about to do.

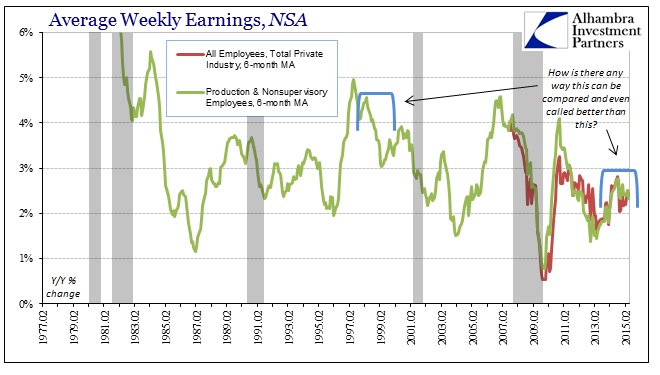

And I think, as I said, that is the first part of the contradictions at the center of any idea about “reflation” as it relates to anything in the real economy. The most recent data on incomes, which are the basis for all orthodox treatment and associations for “inflation”, bely the notion of any pickup now or even for the near future. You could make the case, as is noted in the quotes above, that the second half of the year will be much more favorable, but again the persistence of economic weakness right now is proving highly contradictory to both economists’ abilities in forecasting and how the first half might unfold in the expected nonthreatening “slump.”

Even within the stock market itself, the run over the past few months in certain sectors is highly suggestive of that certain stratification:

It’s happening in the Standard & Poor’s 500 Index, where banks and insurers have rallied for five of the last six weeks as drugmakers and household product manufacturers were left behind. Dividend-paying companies such as utilities and property owners, normally considered havens in times of turbulence, have suffered some of the worst losses in years.

In other words, stocks of companies more attached to the real economy (or the trade extrapolations of the “dollar”) are faring much less favorably than financial firms. Into that is a weak to desperately weak economic backdrop where even wages oppose the mainstream employment view. So we have the cumulative situation where banks and financials are doing quite well while the breakevens and even the yield curve are behaving the same way (for now, at least) as they did in the middle of 2012? I suppose there are extrapolations that might lead from that to an economic boom scenario, but the more logical interpretation is that markets, and a growing number and the breadth within them, might be repositioning for the next QE.

Who would benefit if that were to occur? Certainly bank and financial stocks would, if only initially as a matter of past performance. There is still enthusiasm as to how QE might be received (look at Europe’s further insanity), and breakevens and even the yield curve of late are falling into that pattern. But I think the real difference is that that view undercounts the severity of what might be building – the view of just a bad “slump” vs. a full-blown and even severe recession. In other words, all these markets, even stocks in their own way, seem to be recognizing that the recovery idea as it came out of QE3 and QE4 is over, finished in looking ahead to what might come next.

What that means for the depths in the real economy in the near and intermediate terms isn’t quite so solidified, and thus it isn’t surprising to see “markets” follow the initial stages of what happened in the buildup to that last time. That makes at least some sense with oil prices more buoyant as the potential darker times look less dark, but the history of these kinds of trajectories is never close to a straight line. In short, right now it looks like the “slump” is severe enough, in the perception of market agents, to have knocked some “sense” into an otherwise “suicidal” FOMC and put them back on track to what these “markets” love best; no matter how foul that is to the sensibilities of actual investing. It also isn’t so severe apparently, in perception and interpretation, to have changed the common view of QE itself. It would be easy for “everyone” to entertain the idea that the slump itself is not an organic decline but just the absence of QE (which disqualifies QE from its own stated purposes, but these post-crisis “markets” are forgiving such contradiction).

In my view, all of this suggests that markets having been worried about the FOMC raising rates while the economy tails off are now factoring in an almost Goldilocks scenario where the slump is just right to get the policy everyone seems to want but not too deep as to endanger even when that happens. In other words, while there is now rather widespread recognition that the last burst of QE’s failed to do much of anything, they didn’t fail “enough” as to disprove the whole of the trick. That would leave enough room, so to speak, for markets to accept that failure while still holding hope that the next (which is increasingly being priced) will do what the last did not (old dogs and new tricks, apparently) – or even to not care at all about the economy and long-term health as long as we all get another shot of QE.

That would further suggest that the only way to stay in that preferred state is if the economy gets neither worse nor any better too soon. The real downside, then, is not the robust economy but rather a bad enough “slump” that discredits QE for good. That would seem to place markets and the economy in the most precarious position since the Great Recession: if QE3 and QE4 are accepted as not effective enough to have kept us out of a “slump” and that “slump” turns out much, much worse, then what good will QE5 be? For now, that scenario is being given an almost ostrich treatment but the longer this persists you have to wonder just how much hope another QE might provide apart from the usual detached, initial burst.

It is perhaps an emblematic description for our current bubble age; QE doesn’t work but “we” can’t wait for more. Maybe that is just the logical evolution of monetary magic, since QE was brought on with almost mythical properties that were going to cure a lot of financial and economic ills (Bernanke the former). Now resignation (Bernanke the latter) has left it with only the hope that it can just save us from the worst downside, even without any real expectation of a true upside in the economy. In other words, markets hope for the QE zombie, where the economy is kept from death by it, with full recognition now that it will never regain full life either. It’s a new take, surely, on Wall Street vs. Main Street.