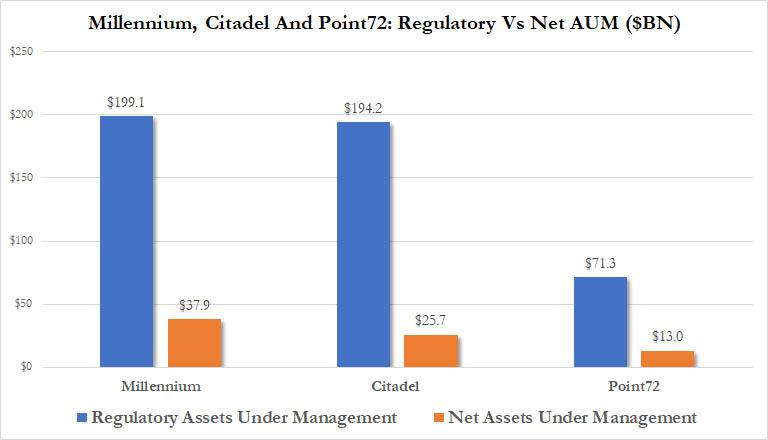

The BIS’s finding is novel, and surprising, as they highlight the “growing clout of hedge funds in the repo market” according to the FT, which notes something we pointed out one year ago: hedge funds such as Millennium, Citadel and Point 72 are not only active in the repo market, they are also the most heavily leveraged multi-strat funds in the world, taking something like $20-$30 billion in net AUM and levering it up to $200 billion. They achieve said leverage using repo.