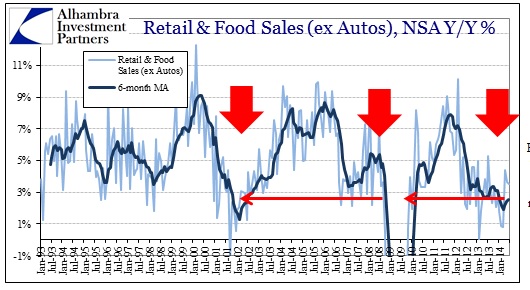

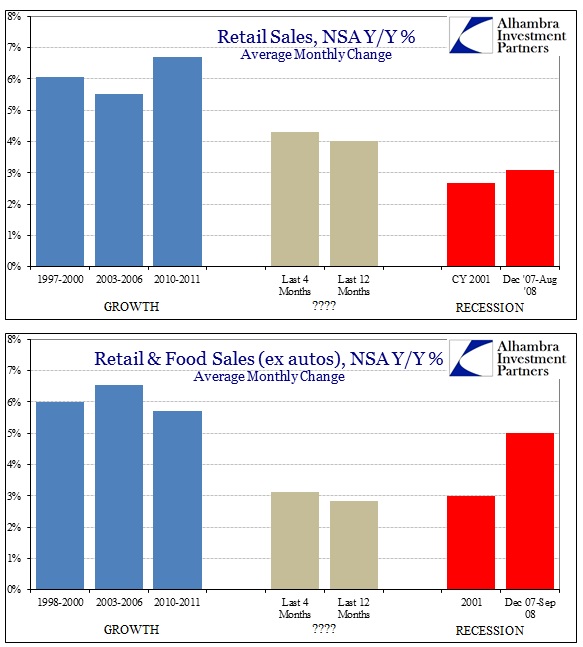

With today’s retail sales report, there is broad confirmation of the diminishing “resilience” of consumer abilities that have been dampening expectations ever since the turn in season failed to produce a massive surge. That is not to say that the past four months have not been better than those just prior, as growth has indeed cleared that low hurdle. It is apparent, or at least should be, that the slowdown in the first quarter was not simply a temporary deviation but rather a continuation of the unstable and unsatisfying economic climate.

There persists a slackened trend in sales that cannot simply be argued as anything other than economic trouble as it both predates and now survives long after changes in weather and season. Whatever cold and snow effects in the earliest part of the year that “temporarily” shifted spending activity has fully passed revealing an uncomfortable trend that stubbornly remains.

This all leaves the first half of 2014 as the weakest since 2009 and not all that much different than 2008 (or 2001) – for the second year running. Whatever has a grip on the household spending trajectory has remained in place without regard to weather changes now going back almost two years.

Even if you remove January and February, growth in retail sales has not been appreciably different in the past four months than in the previous twelve. In other words, once again, there has been no return to what would be consistent with actual self-sustaining growth in spending, only an improvement from really bad to just plainly bad.

As if it needed highlighting above, the only sector keeping retail trends from being downright atrocious overall is automobiles running on subprime credit. That is masking a lot of what is really depressing tendencies in household preferences (or more likely ability).

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com