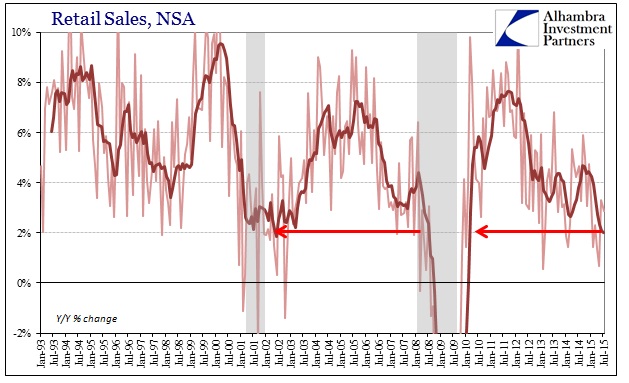

Retail sales for June were revised upward by a significant amount, almost $2 billion, which has had the effect only of shuffling that month’s order among the worst. With higher auto sales growth, June overall retail sales were 3.31% year-over-year which remains about half of what would be considered healthy. For July, retail sales decelerated again, to just 2.86%, which more than suggests just an ebb in the contractionary flow.

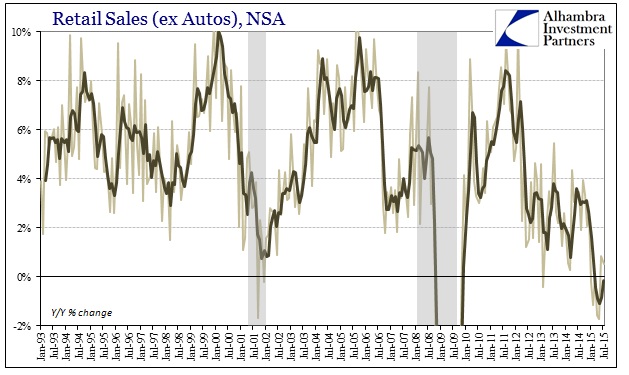

Ex autos, as usual, retail sales were considerably worse. Despite June’s upward revisions, retail sales in that segment were still less than 2%, and thus remained in the contraction “zone.” Ex autos and ex food, retail sales growth was less than 1% for the seventh consecutive month, meaning all of 2015 has been stripped of “demand” growth. Even counting auto sales, the 6-month average overall is in June the worst of the “recovery.”

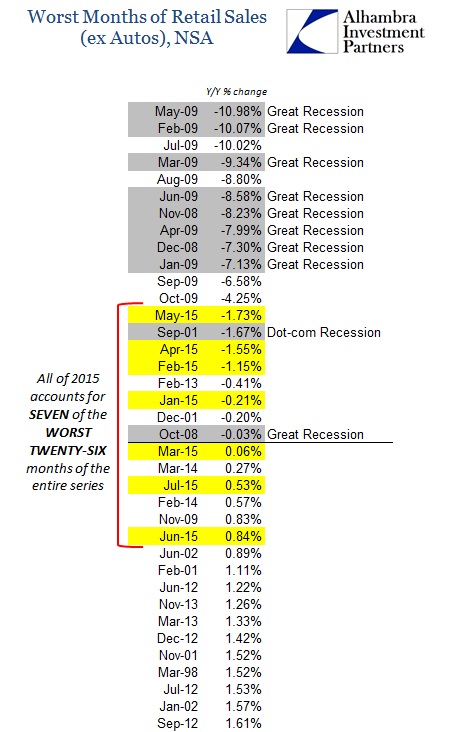

Again, the point about recession is not simply the immediate direction but rather the accumulation and sustaining of atypical weakness. This now the middle of summer, with July figures, and the consumer economy is still stuck at recessionary levels without the hint of turnaround despite everything that is supposedly aligned correctly (Establishment Survey still most of all). It cannot be a healthy economy where all seven months of this year count among the twenty-six worst of the entire data series:

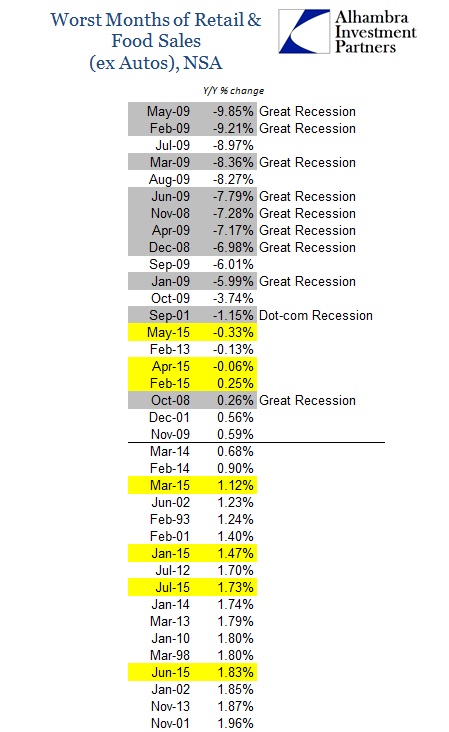

Including food sales improves the comparison only marginally, as 2015’s seven months there fall within the worst thirty-four.

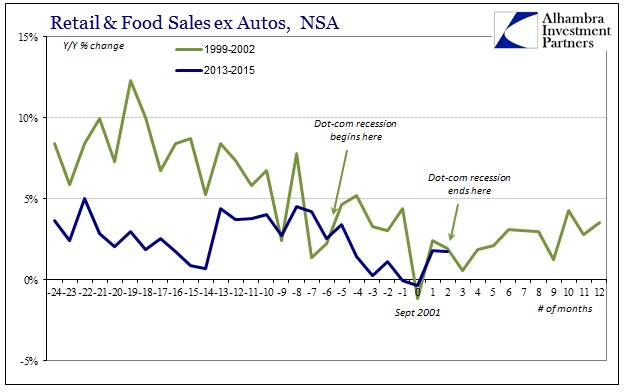

These proportions are far too high at the wrong end to suggest anything but an economy at least remaining in the dangerzone, if not already passed beyond it. Thus, in dead cyclical terms, the June revisions plus July’s equivalence suggest that whether or not consumer recession is already, its worst, the straight-line of the downslope of the “V”, is not yet at hand. That isn’t surprising given a broad sweep of other economic accounts, including the Establishment Survey, or at least its obvious deceleration this year, which is why the comparison to the dot-com recession seems to still accord reasonably well.

The dot-com recession, as the mildest form of one, was like the Great Recession without the second half collapse. In other words, the economy at that time, especially from a productive investment standpoint, got appreciably bad but instead of continuing just stuck in a very-low growth state for longer than the official recession itself – it didn’t get worse, but it didn’t readily improve either. But for all that contraction-but-not-heavy-contraction, economic imbalances were worked out (inventory, wages, etc.).

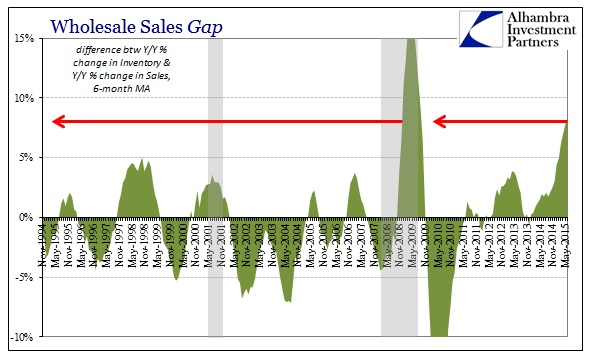

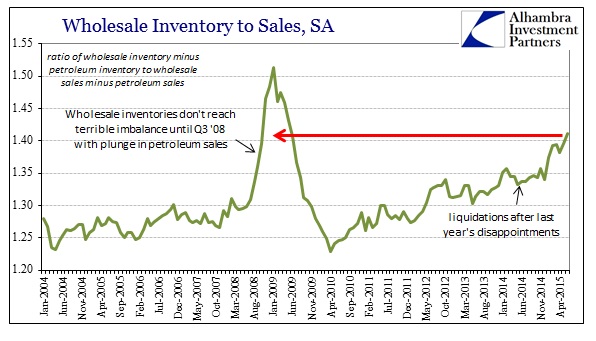

That was the main difference, in economic terms apart from the financial, between the dot-com recession and the Great Recession’s first “half” prior to September 2008. Whereas the dot-com recession cleaned up the imbalances (even if on the part of further financial imbalance) by the time of the panic in 2008 the recession to that point hadn’t made much of a difference; that’s why the total curtailing of even basic financing combined with “demand” contraction into a swift and enormous negative adjustment.

In that light, if we are to classify 2015 so far, ebbs and flows, it seems far more like the first half of the Great Recession than the entirety of the dot-com. Consumer demand may have fallen in line with 2001, but that hasn’t been toward a steadying state of alignment in goods or inventory. With production levels already falling at least gently, but inventory continuing to gain steadily, the adjustment at some point must be made (which usually has a financial trigger or at least parallel, since much of the supply chain is financed and made upon credit). China knows this all too well already.

For the summer of retail sales so far, then, the economic “hole” of 2015 has grown wider if not yet deeper. In plain cycle terms, that isn’t any distinction.