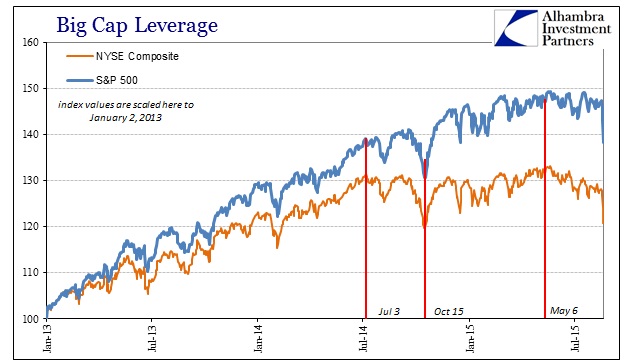

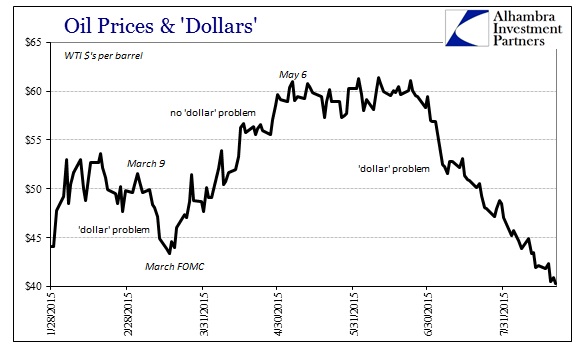

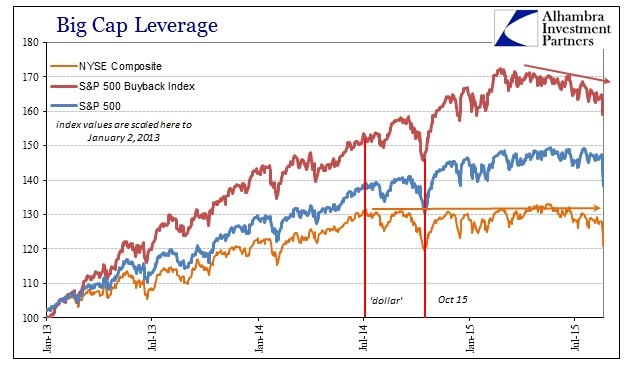

Stocks aren’t quite as immune to financial disruption in the middle of 2015 as they had been previously. The last major, comprehensive selloff was also in tandem with “dollar” disorder back last October 15. This time, the motion was more erosion than “event”; at least until the past week. Just like crude oil, stocks lost their momentum back in early May (and broader index price indications dating back to last July and the first “dollar” rumble) and had more or less been stuck like the yuan doing nothing until the open break recently.

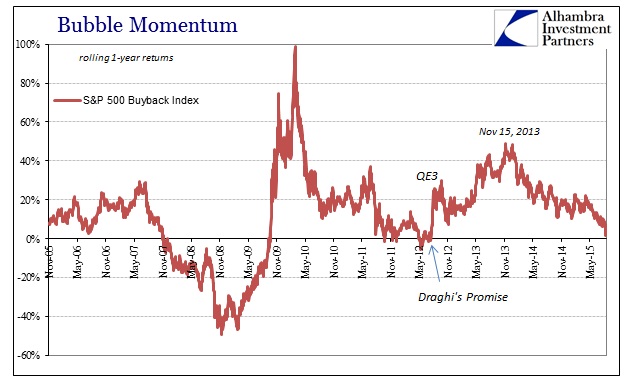

What may, in the intermediate term, be much more significant is that the S&P Buyback Index has been sinking during the whole of that interim period. Whether or not that indicates less actual buyback activity is not clear, but the suggestion is more than reasonable given the buyback scheme as a separate equity liquidity junction. That it has continued since really March brings up more economic and corporate cash flow factors (another facet in the “dollar”, both as earnings and debt opportunity) in these companies than financial issues with the “markets” more broadly.

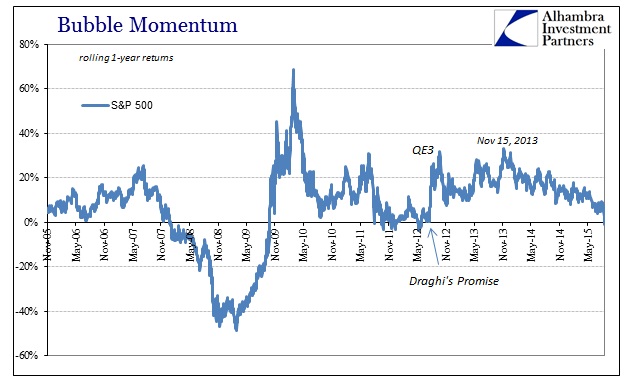

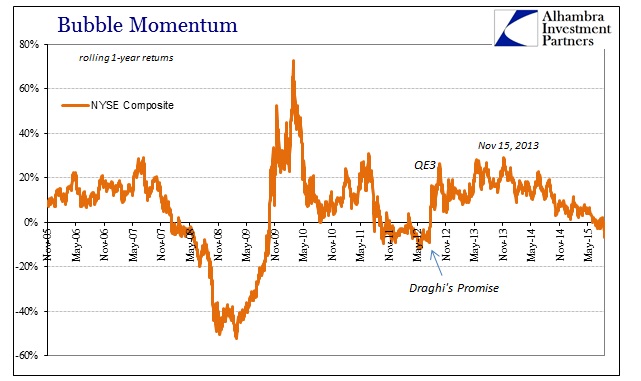

Whatever the case, for the first time since 2012, after today’s robust selling, the S&P 500 is negative on a yearly basis. The Buyback Index is likely showing the same lack of momentum, though that is an assumption as the final index value for today’s trading hasn’t been posted.

The broader NYSE Composite is down 7.2% on a yearly basis and 8.2% since last July 3 at the “dollar’s” outset.

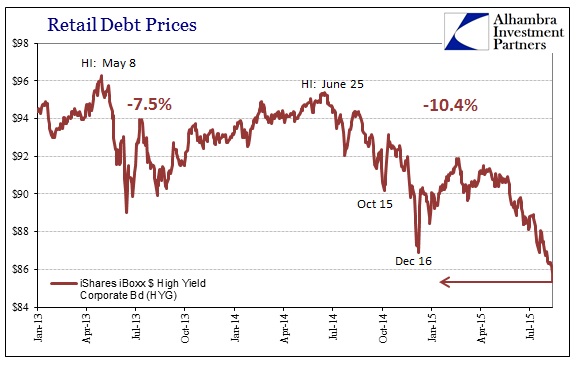

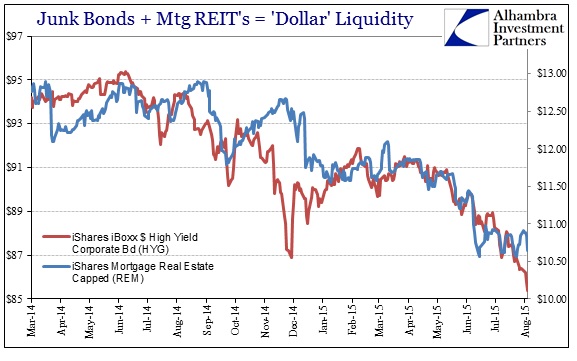

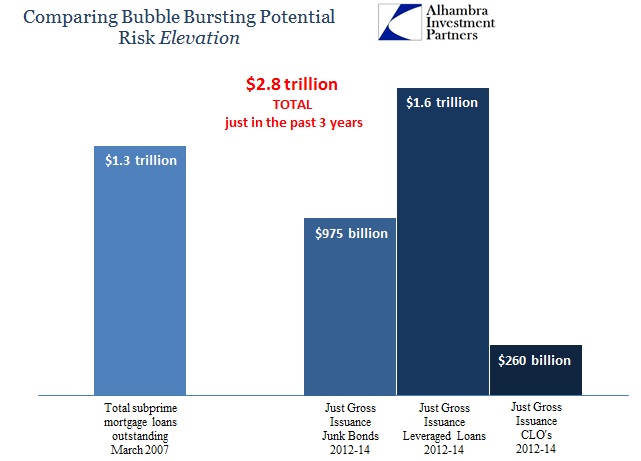

That brings stocks back into the same discussion as the corporate credit bubble. Junk prices continue to sell down, both retail and institutional. The HYG mutual fund broke to a new low again today, down over 10% since its high back on June 25, 2014. There are clear liquidity indications in that price as well as a fundamental shift in overall risk perceptions.

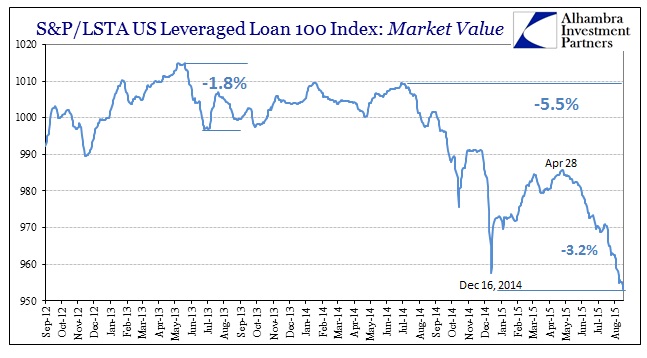

The Leveraged Loan Index, as HYG, continues to drop to new multi-year lows. The last time the market value component was at 953 was January 5, 2012! As usual, since these are the most liquid 100 names in leveraged loans, it is almost certainly the best case for the class; with leveraged loan prices elsewhere likely much more dramatic.

I think we are starting to see the legend of QE fade into nothing more than memory, exposing all these “markets” to the very real dangers of the fundamental economy, globally, that never joined the hype. As noted this morning, it was perhaps a bit “easier” to ignore the first “dollar” wave as it crashed into January as though it were just a bump on the road to sufficiency, but this second crash is both more severe and constraining; not the least of which because, as it takes on new and greater proportions than the first, it demonstrates pretty conclusively all that was wrong about the suppositions that supported rationalizations for so long.

Does that mean QE5? It might, but at this point is there any illusion left? After all, this broad selloff comes just as this week market perceptions turned the FOMC supposedly “dovish” once more. In the past that would have been at least a more than one-day rally, and a sharp one, but again I think the entire focus has changed from “accommodation” even in potential to simple confirmation of the no longer abstract economic and financial danger. I have no idea if that means a top, but this market increasingly looks very, very tired if not seriously wounded.