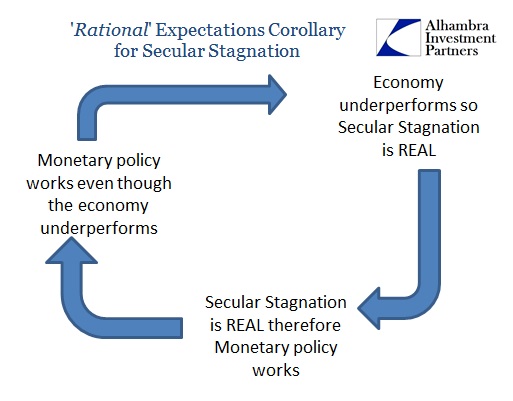

The worst part of this stilted or stunted economy is that it isn’t nearly good enough to produce widespread prosperity (with very real questions as to whether it produces any prosperity at all). It has become self-reinforcing, however, to the point of circular logic. We (economists) are now so conditioned by the low, unstable growth that we are supposed to just accept it. Furthermore, because growth remains low it, for the mainstream, must mean that not only is this is as good as it gets but also that it is somehow evidence that it won’t get worse.

“Get used to it,” said Ethan Harris, co-head of global economics research at Bank of America Merrill Lynch in New York. “We’re just a lower-growth economy now. Within the random noise of the data, in any given year, it’ll be normal to get a near-zero quarter every year. It won’t necessarily be the sign of something bad happening.”

The fact that this has become “normal” is already a “sign of something bad happening”! Economists have convinced themselves that there is nothing wrong with an economy that can only manage to sputter. In any other setting, instability of this sort would raise eyebrows as well as expectations for ultimate failure. The more we see this kind of negative variability the greater (not less) the danger of suffering a full break or dislocation.

That is because the cost of failure only adds up and does so in compounding, geometric fashion. Time is the greatest enemy and the longer this reduced growth habit remains the worse it will get in both actual immediate circumstances as well as potential. Because, it seems, everyone has forgotten what growth actually looks like the current economy can be described as consistent with it when it is more so aligned with only trouble. In “growth” periods of past cycles, barely positive GDP was exceedingly rare. Because it is no longer rare, and without defining why it has become so, that doesn’t suggest we change the very definition of what counts as “growth.” It demands inquiry, not a disinterested shrug.

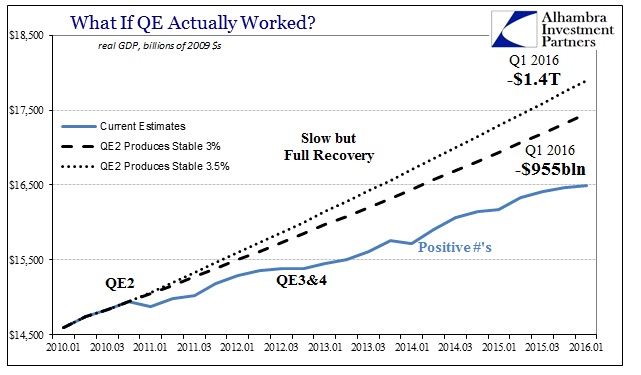

If QE2 had actually worked and produced a stable baseline of 3% GDP growth, real GDP would be almost $1 trillion more than the $16.5 trillion figured for Q1. At just 0.5% more, the difference is an additional lost half trillion. Again, the unstable, inconsistent, and low growth rates of this “recovery” are the problem. That would be true in any cycle, but is even more awkward given the further asymmetry of the recession that preceded it. We should not be in any way relieved that Q1 was weak again as if that were noise, we should be further concerned that it is so without yet featuring the worst kinds of recessionary circumstances (widespread and sustained heavy job cuts and capex collapse). In other words, how would an obviously weakened economy perform under real pressure.

Despite continued “stimulus” there has been no recorded response (outside the labor stats). In fact, by count of GDP, the economy has slowed even more over the past year and a half which you can actually observe on the chart above.

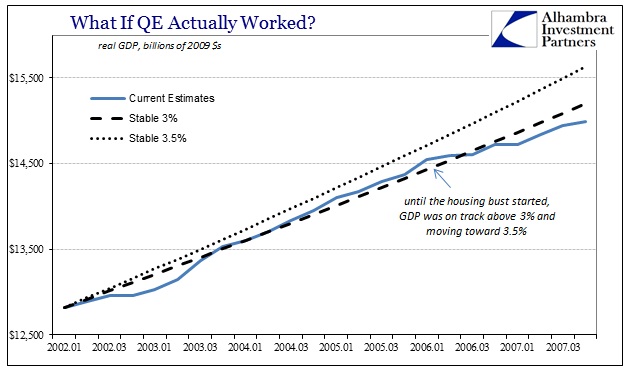

This is utterly inconsistent with past “cycles.” In the recovery after the dot-com recession, GDP was relative weak in its own right but still managed along the path or corridor between 3% and 3.5%.

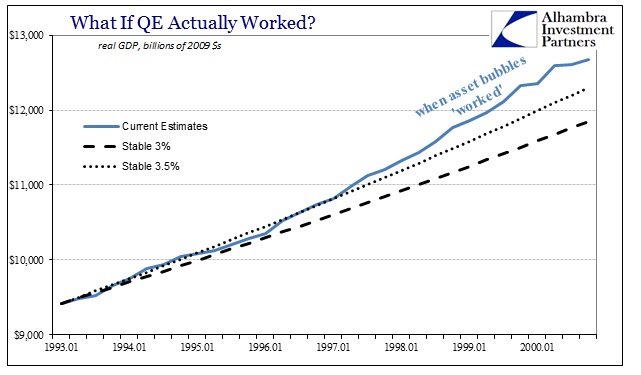

It wasn’t until the housing bust in 2006, and the effects first upon consumers, that GDP began to run shallow to the lower end baseline (before seriously deviating into the Great Recession and then the circumstances of no actual recovery thereafter). In the 1990’s, by contrast, GDP grew consistently better than this corridor especially during the later years of the full dot-com bubble.

From late 1995 forward, GDP advanced at only a faster rate than set out by these parameters. From that we can more readily appreciate just how badly the current economy has misfired especially in light of the continued and increasing (intended) financialism and “stimulus” within each period. From the mainstream view, however, we are apparently just supposed to accept that the economy suddenly “forgot” how to grow.

That just isn’t a realistic assessment, nor is “secular stagnation” which in general terms suggests exactly that kind of unexplained absurdity. The ongoing struggle exhibited by GDP, especially as it relates to worse possibilities brought up by other economic accounts, is only the rising cost of broad, sustained monetary failure. The longer it goes, the greater the inevitable bill. As shown above, the imposition of lost time is already enormous and it is doing incalculable damage to the actual economic foundation.

We are not in any way “just a lower-growth economy now”, at least not in terms of the actual economy. By any reasonable expectation, suggesting something along those lines raises more questions than provides any answers let alone some kind of twisted comfort. If that is so, and growth is durably perhaps permanently stunted, it is only so by deliverance of further disaster. These continual unstable quarters only confirm that in view of the slowdown getting worse. Ritual weakness is far more about the ritual than the weakness.