There is little for me to say about the GDP figures from Europe, released this week to much shock and discomfort, as I am frankly tired of GDP and eagerly await the unhonored end of its continued mainstream “significance.” The largest problem with it is that its correlation with actual economic results has clearly broken down from whatever it had to begin with. It was designed as a measure of Keynesian understanding of economic function (governments add to the economy?), but for the most part during the post-war period there was at least stronger ties to the general ideas of economy. We are, however, in a new paradigm that has changed, structurally, almost every facet of economic function.

Yet, a positive number on a GDP report is still taken as a definitive sign that all is well, and any system with it is on the road to recovery and eventually true growth. Some of that is the embedded tendency (desire) for econometrics to extrapolate in a straight line, but it is equally if not more so the deficiency of trying to put a dollar (or euro) figure on the assumed value of everything produced and traded as if that were the ultimate aim of an economic system. In that case, what are we really measuring, the economy or the dollar (or euro)? From the Wall Street Journal:

Germany’s economy, long Europe’s growth engine, shrank for the first time in more than a year, a development economists largely attributed to a mild winter that boosted activity in the first quarter at the expense of the second. The bigger concerns, they say, are France and Italy, where respectable rates of growth aren’t even in sight.

“The euro-zone recovery never really got going, and now it appears to be petering out,” said Simon Tilford, deputy director of the Centre for European Reform, a nonpartisan London think tank.

Setting aside how “at the expense of the second” might actually make sense in an economic context, the reason “it appears to be petering out” is simply that it was never there to begin with. Sure, some central bank centrally planned to redistribute some piece of finance from another piece, and believed that would create positive numbers for measuring the euro-value of traded entities, but no wealth has been created and it is quite likely the fact that such redistribution actually eroded further existing wealth. The persistence of such corrosion is the continually sinking of economic function, with generalized interruptions in that downward course mistaken for “recovery.”

To that end, credit markets in Europe are now looking at a much different future than last year’s GDP panacea. The ECB promised to save the euro in July 2012 and it is looking increasingly as if that promise might finally be tested. The German bund curve is once more showing negative tendencies, with near-zero rates all the way out to 3 years now, and the 10-year “threatening” to dive below 1%.

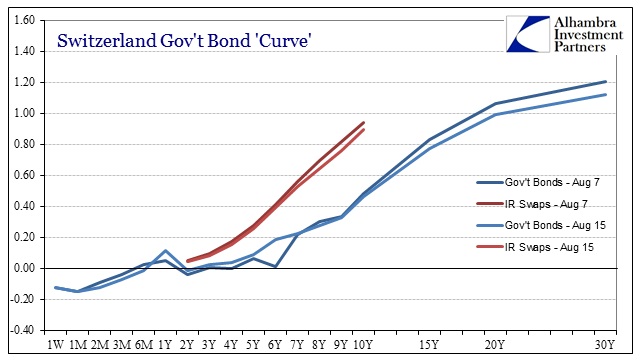

That itself is beyond extraordinary and contradicts everything Mario Draghi has been trying to desperately engineer by greater and greater proportions of financial repression; repression being the operative word. But it is this Swiss curve(s) that strongly draws my attention. As much as there is significance in Germany’s curve, and there really is, it is still inside the euro currency bloc. The Swiss, however, are outside but almost equally as tied into the fortunes of Europe. That extra little factor, I believe, adds a lot to the impression of financials in Europe.

In the past week, the Swiss curve has grown flatter at the longer ends, but steeper in parts of the short end. At the same time, swap rates have come down, compressing spreads very much in the short end. That is a curious result and offers a couple potential interpretations, clouded somewhat by the odd shape and odd changes to that odd shape, not the least of which is further expectations of more “money” moving into Switzerland. That would seem to suggest exactly that idea of testing the ECB’s resolve to “do what it takes” to “save” Europe and “its” euro.

Further than that, as some doubt undoubtedly creeps back into Europe, that will extend elsewhere, including the US due to the close financial integration. But the means of that extension is not just, in my opinion, European banks or investors fearful of European consequences, but more broadly that the monetary experiment in Europe failed rather obviously, and that interpretation is not likely isolated geographically. What’s true of Europe is true for everywhere else that used and uses what are really the same blunt and inappropriate tools. From Japan to Europe to the US (and what we can tell of China and Brazil), the idea that central banks would create enduring prosperity has not just begun to erode, as I think that happened at least last year in the incongruity of the taper selloff that flowed globally, but rather has shifted into a second phase of doubt and ultimately growing despair.

France called on the European Central Bank (ECB) to do more to tackle the risk of deflation and bring the euro to a more competitive level as it posted zero GDP growth for the second consecutive quarter.

The answer is always “more”, yet the results never change, though GDP often does.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com