By ERIC MORATH

Retail sales declined last month for the first time since March and manufacturing production slipped, government data released Thursday showed. Meanwhile, prices businesses receive for their goods and services were unchanged last month, a sign of still-soft demand at home and abroad. Companies also remain cautious about building up too much inventory, new figures showed.

Recent economic gauges, including evidence of a slowdown in August hiring, suggest the economy could be constrained for the rest of the year to a growth rate only slightly above the expansion’s overall 2% pace—the weakest of any since World War II.

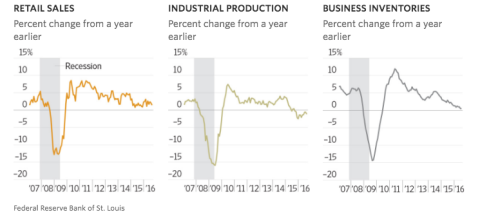

Cooling Indicators Suggest Slower Recovery

Retail sales, a strength of the expansion, have slowed, and industrial output remains in contraction. Meanwhile, businesses have slowed inventory building sharply.

HSBC forecasts the economy to grow at a 2.5% rate in the second half of the year, and 1.8% for the full year. Barclays economists on Thursday lowered their third-quarter forecast for growth by 0.2 percentage point to a 2.6% pace. Macroeconomic Advisers reduced its third-quarter projection to a 3.2% gain from 3.4%.

With few signs of stronger momentum for consumer spending, manufacturing output or hiring emerging in recent data, and still-soft inflation, Mr. Wang and many other economists expect the Fed to hold rates steady at next week’s policy meeting.

It is a familiar story for the U.S. economy since the recession ended in mid-2009. Signs of gathering strength often have failed to yield a sustained acceleration in the expansion. Some firms now see consumers growing more cautious ahead of November’s election.

“We were growing like crazy,” said Jason Hornung, who operates Hornung’s Ace Hardware in Linglestown, Pa. “This year, not so much. It’s been stagnant. That seems to happen around an election year.”

Customers have pared spending on bigger-ticket items such as riding lawn mowers and high-end chain saws, he said. Those purchases can typically be postponed if consumers are uncertain about the future.

Nationally, retail sales declined a seasonally adjusted 0.3% in August from July, the Commerce Department said. Spending at auto dealerships and department stores fell last month. So did sales in the category that includes online purchases with Amazon.com Inc. and its competitors, a bright spot for spending this year.

Consumer spending had helped offset weak manufacturing output early in 2016. A stronger dollar slowed exports and a retrenching energy industry hurt business investment. With energy prices and the dollar mostly stabilizing of late, the drag was expected to ease. But in August, manufacturing output fell 0.4%, and is down by the same amount from a year earlier, according to Fed data released Thursday. The latest drop was led by lower output of consumer goods.

“We have not seen much change in the general economy in North America,” Dave Farr, chief executive of Emerson Electric Co., told investors Wednesday. “On the consumer side of our businesses we’ve seen growth, but even the consumers are being cautious…On the industrial side, companies continue to cut.”

The producer-price index for final demand, measuring changes in the prices that U.S. companies receive for their goods and services, was unchanged in August, both from July and a year earlier, the Labor Department said Thursday.

The Fed’s preferred inflation gauge, the Commerce Department’s price index for personal-consumption expenditures, has undershot the central bank’s 2% annual target for more than four years.

And a separate Commerce Department report showed inventories at U.S. businesses were unchanged in July, an indication firms don’t expect more robust demand in the near future. The paring back of private inventories has been a major drag on overall GDP growth for the past five quarters.

“The U.S. consumer remains particularly fragile,” Clorox Co. Chief Financial Officer Steve Robb told investors last week. “I don’t think it’s any different than a year ago but it means the consumer’s fragile and the U.S. economy remains sluggish.”

—Jeffrey Sparshott contributed to this article.

Write to Eric Morath at eric.morath@wsj.com