Payroll Friday lived up to its recent billing, offering those who see the economy as booming their headlines while providing nothing beyond that by which to confirm it. There is maybe a growing sense, given market action (especially bonds), that the headlines are becoming less “moving” and that this disparity has been internalized more so than at any time in the recent past. That is particularly true whenever job growth was reported, strenuously and repeatedly, as extremely robust but wages still declined.

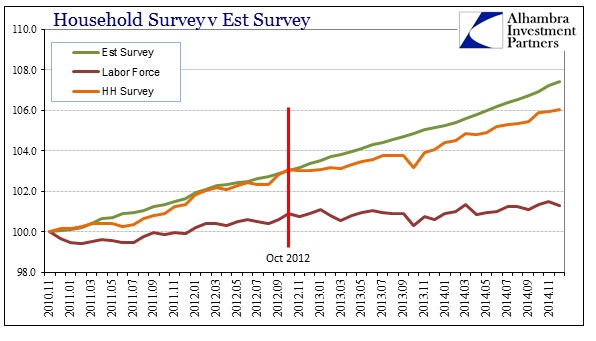

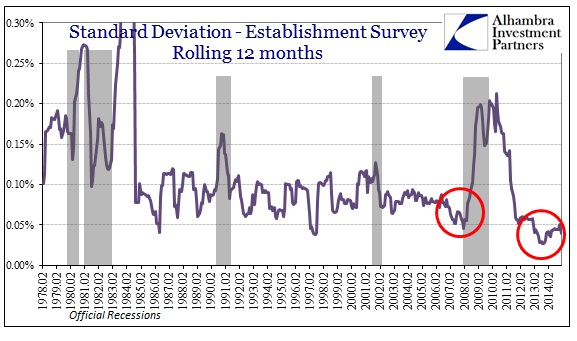

The Establishment Survey continues on as it has since 2012 in an apparently unalterable straight line upward. The lack of variation means that either the BLS has gotten extremely good at estimating jobs or that they have yet to come around to serious revisions to results and processes. Whatever the case may ultimately be, the labor market itself, including the dearth of wages, is not complementary.

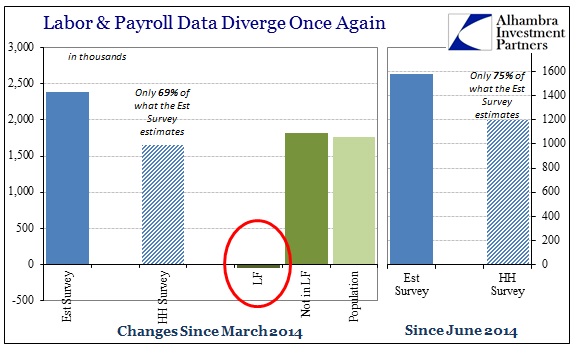

Supposedly the economy picked up steam after the atrocious winter weather, so that around March jobs became very plentiful and employment vigorous. Yet for all that “booming” there has been no additional labor force growth.

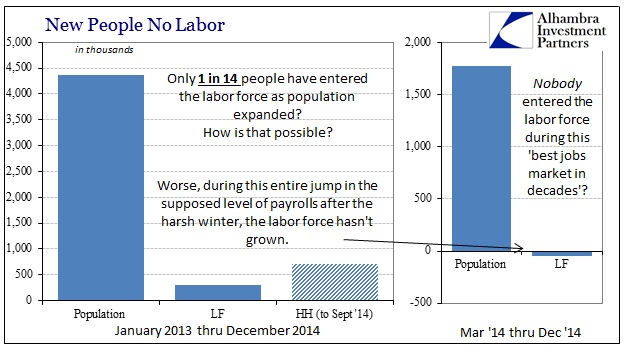

Even factoring monthly volatility in the Household Survey, it is exceedingly difficult to believe that the best jobs market in two decades enticed exactly no one to enter the labor force. Going back to the beginning of 2013, when QE 4 met its first operational settlement, the payroll expansion purportedly began and picked up all throughout those months. And, as the credit markets grew increasingly and now exceedingly bearish, so too did potential labor entrants. The population is estimated to have risen by some 4.4 million people in those two years but only 1 in 14 bothered to look for a job?

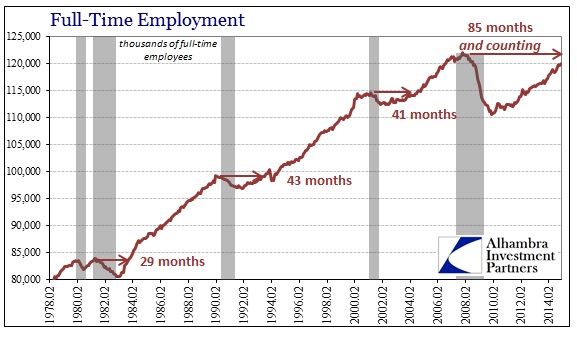

The harsh reality of even the best case for jobs entering 2015 is that there may indeed be payroll expansion these days but it is still simply overwhelmed by past economic transgression. For all the hoopla about robust growth, the sad fact is full-time employment is still almost 2 million jobs behind the November 2007 peak. Yet, over the same period the population grew by 16.1 million! These are not the results of any true economic expansion, leaving only artificial conditions (at best) to explain the appearance of such.

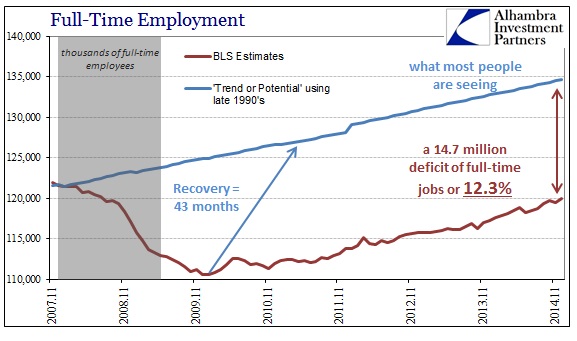

That is what is left out of mainstream analysis, a kind of economic relativity that is simply ignored for the convenience of raw numbers. There are no absolutes in economic activity, especially given the scale of the decline during the Great Recession and its immediate aftermath. Job growth of +5% sounds terrific on its own, but is sorely disappointing if it follows a 20% decline – context matters and not just in an academic sense but likely in the calculation of labor market “slack” among potential participants themselves.

Again, there may actually be an expansion of full-time jobs available right now, but that isn’t nearly enough. Given the conspicuous indifference of the labor force, I highly doubt any payroll expansion is anything more than a plug line in the BLS regressions or, in a more real context, the continuation of asset inflation incongruence – the only jobs that show up are the lowest paying to service the asymmetry of the bifurcated economy. That would certainly make the most sense in an economy that only seems to partly grow (and partly shrink, which is the bond market’s growing doubt).

A robust economy must always be placed in that context, as any healthy expansion would do far more than erase past losses.

The decrepit state of labor aligns far more closely to the dearth of actual recovery than anything describing a “boom.” That is the problem with modern economics as it has substituted mathematic variables for actual economic progress (including GDP). True expansion would be following the blue line above, not the red line as it is, even though the BLS has estimated positive growth in even full-time jobs these past two years. Given that disparity between jobs and population, the most basic of underlying expansion principles, it is quite revealing that the current economy cannot find as much for these non-working people to do as it did prior to the Great Recession.

That would solidly imply there is less “economy” now still than in 2007; recent growth or not.