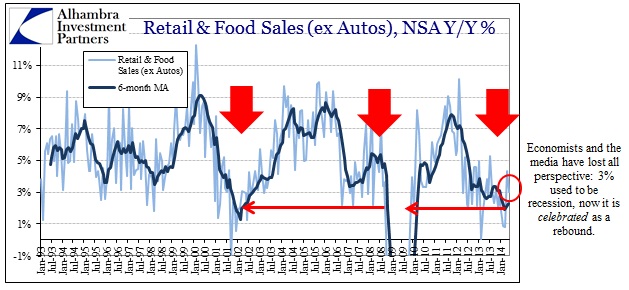

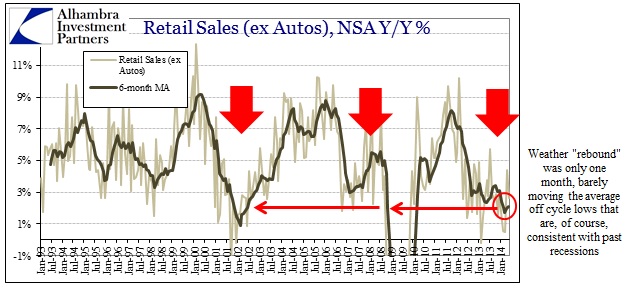

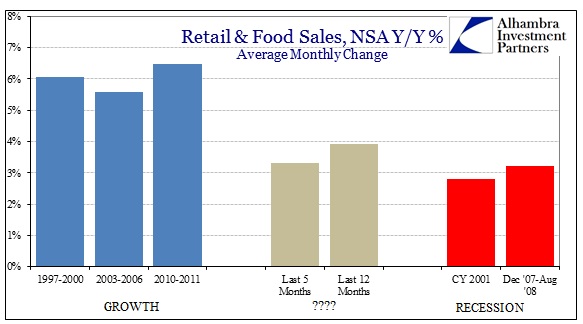

Anyone waiting on the warmer weather to bring out shoppers proving the existence of the mythical resilient consumer is going to be very disappointed with retail sales in May. The rebound from January and February isn’t much of anything other than a resumption of the prior trend – and that is a problem itself. In other words, if there was a weather effect, it only made a bad situation worse.

That is really the larger point, that the economy continues to move along not in a muddle, but in a “bad situation” both with and without the meteorology. That’s not much to place hopes for a springboard to the long-awaited recovery.

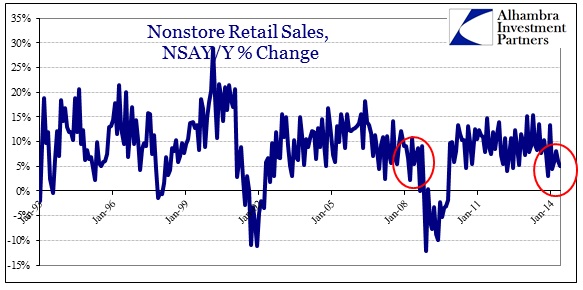

Curiously, and importantly, Nonstore retailers (which includes the Census Bureau estimates for online commerce) has not rebounded at all this year regardless of outdoor temperatures. The growth rate in this segment has been almost uniformly robust prior to 2014, as you would expect since underlying growth here is not being driven by economy as much as industry changes and shifting consumer preferences, but has underperformed noticeably since the Christmas season. Year-over-year growth averaged 11.4% in the first five months of 2013, which also included winter and weather excuses, but has only averaged a paltry 5.9% so far this year.

That may be the most telling piece of the May retail sales figures, as most of the rest has been quite typical of this slowdown that began in 2012. That nonstore/online retailing may be finally joining the recessionary growth rates of its sales brethren could be another warning about households (coupled to revolving credit lately). There isn’t enough here to make a solid determination, and will need further scrutiny in the coming months, but my initial sense is that this certainly leans in that direction (unless there exists an industry specific trend that I am missing).

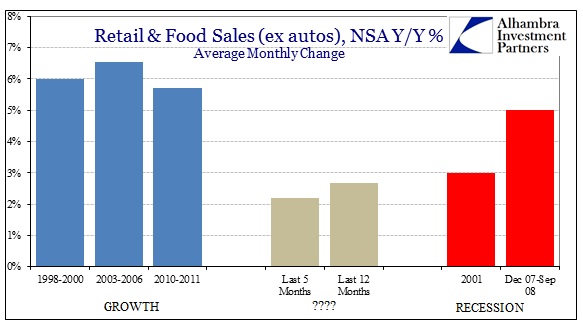

To show the lack of weather effect on sales as a whole, we need only compare the last five months with the last 12 months. What you see is that there is only a slight decline in the recent track versus the established trend. In other words, the problems with the retail industry predate any change in calendar seasons.

Auto sales are included in the figures above, showing that the “stimulus” aspect of this most credit-sensitive segment does not seem to hold much of a forward and positive “multiplier.” That would strongly suggest that boosting auto sales may not be having the intended economic boost, priming the pump as the Keynesians say, as the rest of the economy clearly continues to sink:

Take out auto sales and the more organic portion of the economy (which is the vast majority) is barely growing at 2.5% nominally. The “weather effect” here was trivial, knocking only 0.5% off the previous trajectory. There are much larger cyclical and structural problems evident here.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com