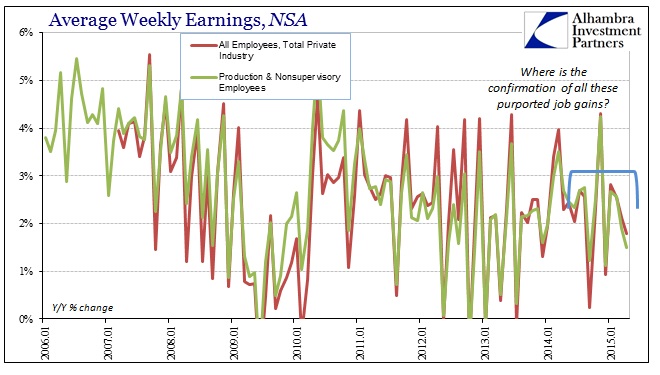

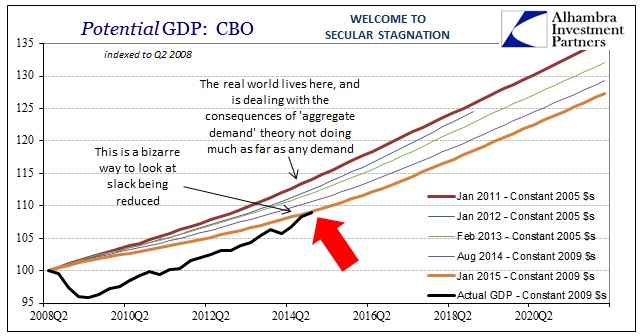

One more point for Payroll Friday: we have the productivity problem and the spending problem but there is also the wage problem. Despite what the raw, quantitative count of jobs is in the main surveys there are no wage gains associated with them. That is itself highly curious as wages overall have been locked into a narrow range since the start of the 2012 slowdown. The preeminent explanation is “slack”, that highly pliable concept that superficially suffers (benefits?) from Larry Summers’ style of hysteresis. Apparently, once the economy passes the mystical point of launch, wage growth will explode because utilization will have come taught.

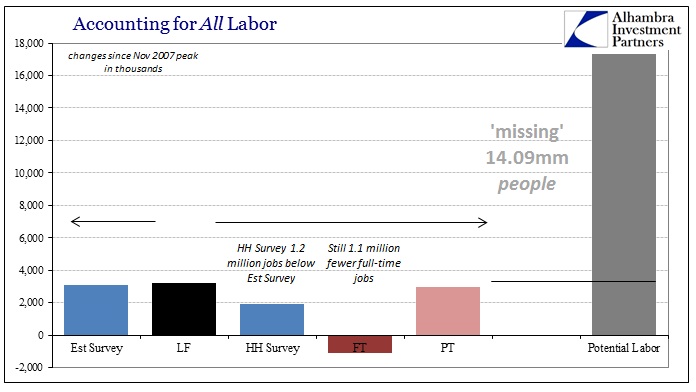

Given that idea, it amazes that anyone out there actually believes that such “slack” would be near enough sufficiently drained by now. Throw out the unemployment rate view, there are 14 million people in the potential labor force simply not counted because there is no labor to be had – or had at what is deemed a worthwhile price. There are the clues to the economic “mystery” about slack, meaning that again there is at least a high rate of deficiency in viewing the employment count all by itself.

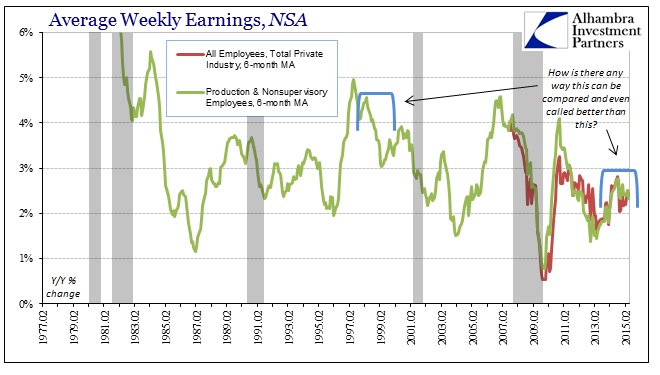

Wage rates, shown here below, are far more consistent with spending rates than the Establishment Survey.

No matter your view on “inflation”, since the economic world is inhabited nominally, there is no comparison between 2014-15 and 1998-99. The conventional view on payroll expansion takes the last year or so as to be the best since that point, yet the disparity in incomes is enormous. Whereas wage rates were gaining regularly 4-4.5% they do so now only at 2-2.5% (and less than 2% even in this celebrated April relief). That 2% gap is far more than the CPI, and it is a huge disparity. Incomes growing at 4.5% will double in about 16 years, while those growing at 2.5% double in 28. Over time, that diminished rate amounts to a huge opportunity cost, one that is showing up pretty much everywhere but the BLS’s highly-adjusted trend-cycle estimates.

Slack or not, there is no real wage growth and without it there won’t be any “demand.” If that is due to slack then the well of idle labor is so enormous now (opportunity cost) that it may yet take decades to wind out. That alone argues for something far more sinister than just your run-of-the-mill cyclical issues. You could actually make the case for a sort of reverse hysteresis process, where wages languish so long without even the smallest hint of an upside that households pass over into a permanent or semi-permanent state of much reduced proclivities toward spending; just as what occurred in the 1930’s.

At that point, recovery in its proper definition and characteristics would be nigh impossible and it would take smaller and smaller “shocks” with which to knock over the economy out of such instability into dislocation or discrete decline.