By Tyler Durden at ZeroHedge

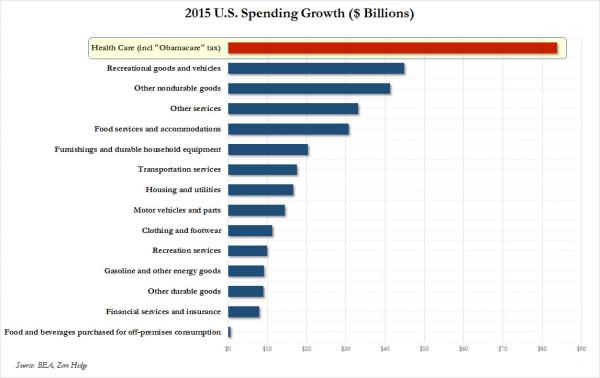

Following yesterday’s breakdown of 2015 GDP growth components, there was little surprise that the biggest source of “growth” for the US economy in the past year was healthcare growing at an absolute dollar pace nearly double that the second highest category (recreational vehicles of all things, because in the eyes of the BEA the US has gone on unprecedented Winnebago spending spree).

It was also no surprise that the biggest source of “growth” within healthcare was the tax known as the “Affordable Care Act”, which of course is woefully named: as we reported yesterday, a recent report from Freedom Partners Health found that health insurance premiums have increased faster than wages and inflation in recent years, rising an average of 28 percent from 2009 to 2014 despite the enactment of Obamacare, “or rather “because of.”

Ironically, without the Obamacare tax, US growth in 2015 would have been as much as 0.5% lower, pushing GDP down from the upwardly revised 2.4% to 1.9% or lower.

But while we knew that on the margin the biggest source of growth in the US economy is now a tax cleverly masked as “discretionary spending”, how does healthcare stack up in absolute dollar terms.

It is here where we were genuinely surprised because what we found was disturbing.

It has long been known that of the real $16.5 trillion in US GDP, some 70% is due to personal consumption and spending (68.8% to be precise), and that the single biggest component of US consumer spending has for decades been housing. After all there is a reason why the saying “American Dream” implies the purchase of a house (sadly this has been downgraded to renting in recent “New Normal years). And, in Q4 this was still the case: some $1.973 trillion of the total annualized spending (aka growth) came from outlays on housing and utilities.

What was troubling is that over the past 5 years there has been virtually no growth when it comes to spending on housing.

What was even more troubling is that the second highest spending category, Health Care at $1.9 trillion, has been soaring in recent years, more than offsetting the housing weakness, and as the chart below shows, the US economy is within 2-3 quarters of the moment when outlays on healthcare (and Obamacare) will surpass spending on Housing.

Which means that some time in 2017 (if not this year), the components of US GDP will be such that the biggest source of “growth” will be a mandatory tax, if only for “Supreme Court purposes”, while appearing in the GDP calculation as the biggest component in both absolute and growth terms when it comes to discretionary consumer spending.

To this we can only say: well done to the “free market economists” in charge of US growth.

Source: Healthcare is About to Surpass Housing as The Biggest Source of American “Growth” – ZeroHedge