By Jeffrey P. Snider

There are sentiment surveys and then there are real dollars. The sentiment surveys are holding their own, but there is nothing they can tell us about absolute levels of growth. Further, sentiment surveys were designed and calibrated under far different conditions than what we experience today. As much as even the major statistical releases are struggling with faded correlations, that is much more of a problem in sentiment.

If you look at tax data, for example, there is no correlation problem because it is hard dollars that compare to previous levels of actual collections. Only a few weeks ago, Pew Charitable Trusts noted that 26 states still have not re-attained their pre-cycle peaks in “revenue.” And for those that have reached fully recovered, the new peak is often attributable to increases in legislation and tax rates rather than simply growth in economic activity.

That rates as the structural side of the problem, as it has been clear for some time that growth on this upslope of the cycle is “mysteriously” depressed by any relevant measure, especially historical experience. In addition to that, coincident to many other hard $ indications, there is a growing sense of a cyclical element or inflection.

According to the Rockefeller Institute of Government, state tax receipts are running very low so far this year. Overall tax receipts for 46 states show no growth (+0.7%) in the first uater – the lowest increase since the end of 2009. That is due to depressed levels of sales taxes and personal income taxes.

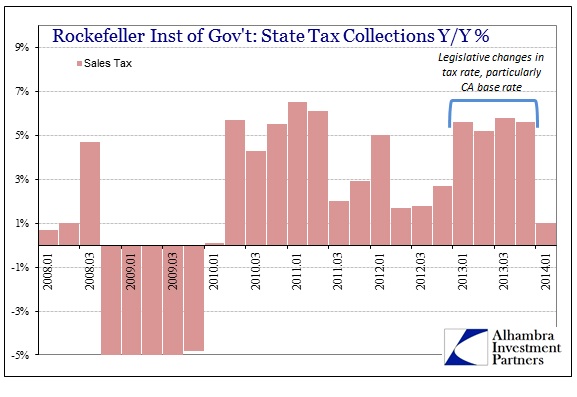

On the sales tax side, most directly related to economic condition, growth in the first quarter was the lowest since the first quarter of 2010.

There are tax rate differences to keep in mind, including, as the Rockefeller report points out, the expiration of a temporary boost to sales tax rates in Arizona, but overall the tax environment does not indicate the kind of growth that is being used as a mainstream prop. You can blame the weather in Q1 for “depressed shopping” as the Institute does, but even in 2013 the level of sales tax growth hardly advanced above the change in tax rates (particularly in the immense economy of California).

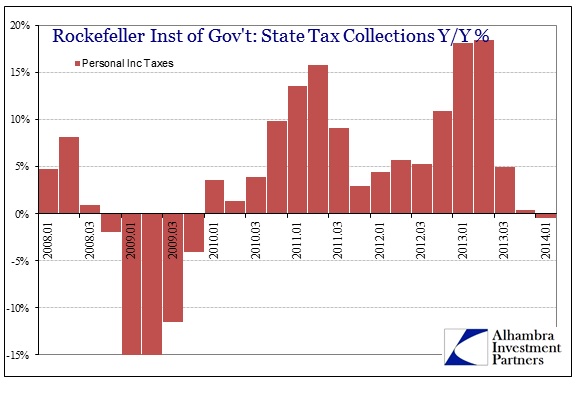

That is reinforced by Personal Income Tax (PIT) receipts. While the payout of income in late 2012 due to federal tax rate and law changes had volatile effects on state income tax collections, there is no concurring reason for the slowdown in PIT receipts in the second half of 2013 – leading to an actual decline so far in 2014.

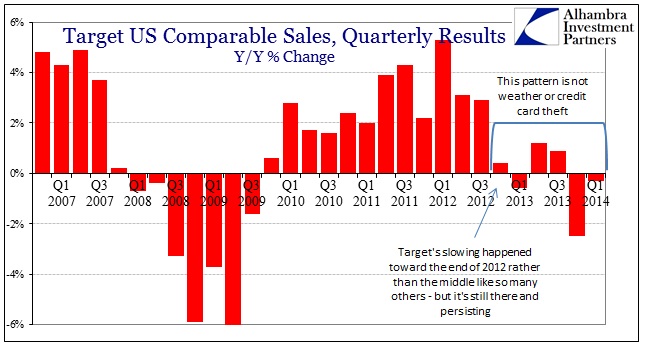

There is no doubt that last year’s federal tax changes are playing a role here, but it is interesting that the first quarter looks so similar to the fourth quarter of last year. That would suggest, volatility aside, that taxes are not nearly as robust as would be expected from the kind of accelerating economy of recent lore. Beyond that, the pessimistic view of tax collections (less due to volatility, more due to economy) actually matches the state of the retail industry.

Even considering the lumpiness of the tax data, the lack of distinct upward bias to me reinforces the lack of growth being displayed by the retail industry, and thus of consumer spending. Without this kind of revenue growth, businesses are going to be more than reluctant to increase productive capacity (more on that in durable goods).