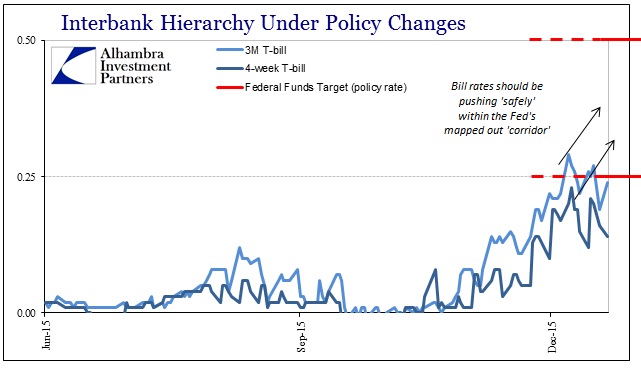

Picking up on the money market(s) discussion from this morning, bill rates once again were suggestively shallow. The 4-week T-bill was just 14 bps in “yield”, well below the Fed’s new “floor” of 25 bps; the 3-month bill was just 24 bps and behaving nothing like what would be expected. Federal funds remain well-behaved but that isn’t a major component any longer. Further, today’s RRP ticked up to just $160.6 billion among 55 bidders. My overriding concern this morning was money market fragmentation; this isn’t suggestive of anything else. More here (subscription required).