By David Stockman and Dan Amoss, CFA

The following is our basic recommended portfolio designed to survive and thrive through a crash of today’s central bank-fueled bubble, which we fully anticipate. We call it Stockman’s Contrarian Portfolio and it’s meant to be fully invested and turn very slowly.

As we write in July 2017, the portfolio has not performed well on a trailing-twelve-month basis. In short: the bubble has continued to inflate.

But we remain confident that many of the portfolio holdings outlined below will perform well in the months and years ahead.

All it takes for a surge higher in Stockman’s Contrarian Portfolio is a break in the consensus view that central banks can endlessly create wealth, and that governments can allocate resources efficiently. Both sentiments are delusional.

When bubble psychology breaks, the downside in stock and bond markets will be breathtaking. Popular portfolios will be mauled. Many of the portfolio ideas presented below offer ways to mitigate damage to conventional investment portfolios. If you carefully position these shorts and inverse ETFs (and fully understand the risks involved with each) the ideas below could deliver substantial profits while the global financial bubble pops.

The portfolio stated simply:

25% Gold

10% Short S&P 500

15% Short Chinese A-Shares

10% Short Junk Bond Market

20% Select Stock Shorts

10% Short EM Stocks

10% Cash equivalent

Our essential investor modules will help you understand why we recommend each of these components. You can access each of those modules by clicking here and selecting the one you want. For example, you can read the module on why you should own gold if you’re curious why we recommend owning a 25% allocation and in the form we do.

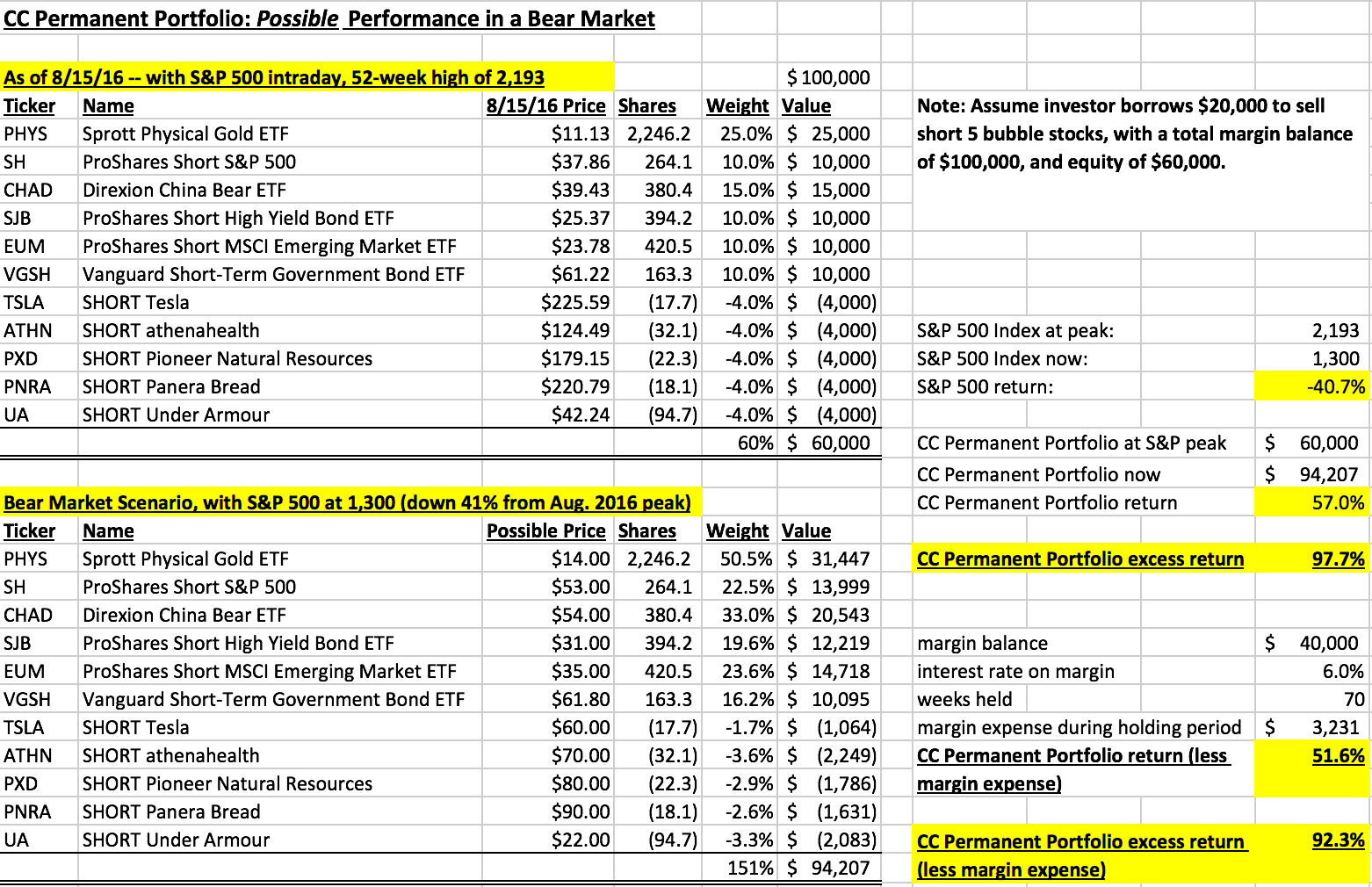

Below, you’ll find the specific recommendation we’ve issued to execute each part of Stockman’s Contrarian Portfolio. At the end, we show screenshots of the permanent portfolio, back-tested the S&P 500’s peak set on 8/15/16. At this point, we believe the latter date marked the top of the massive bubble the Fed and other central banks have been inflating since the crisis bottom in March 2009.

We’ve also modeled a bear market scenario, and what it might mean for the portfolio. In preview it shows an excess return that beats the S&P 500 by 92%.

Please read on…

25% Gold

A good choice for any portfolio’s allocation to gold is the Sprott Physical Gold Trust (PHYS). The closest thing to owning physical gold in your brokerage account is holding shares of the Sprott Physical Gold Trust (PHYS: NYSE, TSX). Sprott provides a secure, liquid alternative for investors interested in holding physical gold bullion without the inconvenience of storage.

The Trust’s physical gold bullion is fully allocated and segregated in a secure third party storage location in Canada.

If conditions get bad enough, and there is a run on physical gold, we could see a default in the gold futures markets; futures contracts would get settled in cash U.S. dollars, even as the physical gold price keeps rising. In such a scenario, it would not be surprising if the largest gold ETF (GLD) will continue to track whatever “paper” gold price prevails in the futures market. For exposure to allocated physical gold in your brokerage account, PHYS is the way to go.

10% Short the S&P 500 Index

The S&P 500 is floating higher in an epic bubble’s last gasp.

Take away the bubble environment, and a realistic value for the S&P 500 index is close to 1,500. A 15 P/E ratio, applied to $100 per share in GAAP earnings for this index, equals 1,500.

So 1,500 is a realistic target for the S&P 500 over the next year. In that case, an inverse ETF stands to make roughly 40% gains. It could be more or less than that, depending on how quickly the S&P reaches fair value of 1,500.

The best way to bet against the S&P 500 Index through an ETF is to buy the ProShares Short S&P 500 ETF (SH: NYSE). SH is a one-times-leveraged inverse ETF. That simply means it returns the inverse of the S&P 500, compounded daily. So on a day when the S&P 500 falls 1%, SH will rise 1% (and vice-versa).

When you’re trading inverse ETFs, you want to avoid those which are two- and three-times leveraged. The leveraged inverse ETFs only work out if your timing is perfect. If you’re too early, and buy a leveraged inverse ETF while a bubble is still inflating, the extra leverage can quickly compound losses on up days in the market.

15% Short Chinese A-Shares

Chinese stocks are objects of speculation for China’s momentum traders. This market has wild swings up followed by horrific crashes. The last bubble peaked in mid-2015, crashed rapidly thereafter. Investors are still working through the bubble hangover.

History shows that policy-driven bubble in Chinese stocks give back most of the bubble gains. Unlike in the U.S., there is no tradition of building shareholder value among Chinese companies.

Chinese traders simply buy stocks due to the perception that the government is supporting stocks. They don’t carefully weigh risk and reward, and they generally do not buy stocks on the basis of a rigorous fundamental analysis.

The Direxion China Bear ETF (CHAD: NYSE) is a good way to bet against the Chinese market. CHAD moves in the opposite direction of the CSI 300 Index. This ETF returns 1x the inverse of the return of the CSI 300 for a single day.

The CSI 300 Index consists of 300 A-share stocks listed on the Shanghai or Shenzhen Stock Exchanges. It has a base level of 1,000, set in Dec. 2004, and is currently near 3,200.

The CSI 300 Index is extremely overweight financial stocks, which make up roughly 40% of the index. After the biggest credit bubble in history (the Red Ponzi), there is a lot of garbage piled up on the balance sheets of banks and insurance companies.

Given the history of the A-share market, and the makeup of the CSI 300 Index, CHAD could rise by 30-40% over the next year.

10% Short the Junk Bond Market

The junk bond market is in an enormous bubble. By pegging short-term interest rates to zero, the Fed has penalized savers. The Fed has sought to prod investors into taking more risk, and they have.

In recent years, savers have piled into anything with a decent yield. To satisfy strong demand for yield, the supply of junk bonds has soared. Even the least creditworthy borrowers have been able to float debt.

This will end badly. As default rates rise, and eat into bond principal, the savers who went out on the risk curve to buy junk bonds and junk bond ETFs will flee the market. Junk bond prices will fall and yields will rise.

The ProShares Short High Yield ETF (SJB: NYSE) offers a way to profit from a panic in the junk bond market. SJB seeks daily investment results corresponding to the inverse (-1x) of the daily performance of the Markit iBoxx Liquid High Yield Index.

As this high yield (or junk) index falls, SJB could rise by 20% or more in value.

10% Short Emerging Market Stocks

Buying the Short MSCI Emerging Market ETF (EUM: NYSE) is a smart way to bet against emerging market stocks.

EUM returns the inverse daily return of the MSCI Emerging Market Index. Here is why we can expect to see a 50% decline in this index…

The MSCI Emerging Markets Index is the popular benchmark in this category of stocks. This index blew an enormous bubble in the mid-2000s. From a low near 275 in March 2003, this index soared nearly 400% to a peak of 1,310 in Oct. 2007. Today, it stands near 1,000, so the bubble is still intact.

However, this index is on shaky ground…

Over the past decade, in emerging markets, the stock of corporate, bank and sovereign debt has grown at an alarming rate.

These debts funded a surge in economic activity — everything from high-rise buildings in China to iron ore mines in Brazil.

When debts stop growing, economic activity slows, borrowers find it hard to refinance and debt defaults rise. This set of circumstances has been in place since mid-2014; it will almost certainly be in place for a few more years.

What is in the MSCI Emerging Markets Index? If you drill down into its stocks, you’ll find many stodgy, low-quality, poorly managed companies. Many of these companies aren’t managed in a manner that maximizes shareholders value. Rather, many of these companies simply pursue growth for growth’s sake. And many of these companies seek to take market share, paying little heed to important concepts like return on invested capital. They’re not shareholder-focused.

Many stocks in the MSCI Emerging Markets Index are mature, slow-growing companies — the types of companies that cannot create much growth on their own. These companies instead rely on a strong global economy to create shareholder value.

The most vulnerable of these companies are located in the following smaller, less-stable emerging markets: Brazil, Egypt, Colombia, Hungary, South Africa, Turkey and Malaysia.

10% Short the Russell 2000 Index

The small-cap Russell 2000 Index is in an even bigger bubble than the large-cap S&P 500 Index.

Take away the bubble environment, and a realistic value for the Russell 2000 Index is close to 700.

As of late 2016, the total market cap of the Russell 2000 Index was $2.5 trillion or 150% higher than it was at the last peak in 2007. Yet reported earnings are now actually 75% lower than they were back then. Furthermore, a huge chunk of the Russell’s earnings comes from small banks. Many of the companies in the index lose money.

In short: The Russell 2000 is overdue for a 50% decline, which would put it near 700, down from today’s level near 1,400.

The best way to bet against the Russell 2000 Index through an ETF is to buy the ProShares Short Russell 2000 ETF (RWM: NYSE). RWM is a one-times-leveraged inverse ETF. That simply means it returns the inverse of the Russell 2000, compounded daily. So on a day when the Russell 2000 falls 1%, RWM will rise 1% (and vice-versa).

When you’re trading inverse ETFs, you want to avoid those which are two- and three-times leveraged. The leveraged inverse ETFs only work out if your timing is perfect. If you’re too early, and buy a leveraged inverse ETF while a bubble is still inflating, the extra leverage can quickly compound losses on up days in the market.

20% Short Basket of Individual Stocks

There are many wildly overvalued individual stocks in the U.S. market. Using reasonable assumptions, the values of these five stocks are anywhere from 50-70% below current prices.

When you build short positions, it’s best to spread your exposure across several stocks — at least five. Below, we feature five compelling short positions. We’d recommend committing no more than 4% of your portfolio to each one, for a total of 20%.

Tesla Motors (TSLA: NASDAQ): 4% Short Position

Tesla Motors (TSLA: NASDAQ) is the darling of electric cars in the stock market. At today’s ludicrous market capitalization of $60 billion, shareholders are anticipating years and years of bountiful profits.

But no profits are on the horizon. And by the time Tesla can build up enough scale to be consistently profitable, the electric vehicle market will be flooded by competition from the likes of Volkswagen, BMW, and Ford.

Today’s Tesla is more of a cash-burning machine than it is a car company. Because it burns cash at such an alarming rate, Tesla must constantly tap the capital markets for new stock offerings.

In 2016, Tesla accelerated its plans to burn cash by bailing out a struggling solar panel installation company, SolarCity. This deal acquisition was ridden with conflicts of interests, given Tesla CEO Elon Musk’s ownership of SolarCity stock.

Tesla risks falling into a negative, self-reinforcing feedback loop. Confidence is fragile, and any number of catalysts could quickly destroy it. Once a critical mass of investors refuses to hold TSLA stock at today’s bubble valuation, the stock will plummet. A lower stock price would in turn make it prohibitively expensive for Tesla to sell new shares.

Completing the feedback loop: The inability to sell shares would quickly send Tesla into financial distress. Such a feedback loop is likely to at any point, so we recommend a 4% short position in TSLA.

athenahealth (ATHN: NASDAQ): 4% Short Position

athenahealth (ATHN: NASDAQ) bills itself as a revolutionary cloud software company with endless growth potential. But it’s nothing of the sort. It’s a glorified outsourcing company that offers billing and collection services for physicians and hospitals.

athenahealth’s business model has led to profitless sales growth. Its growth was originally fueled by crony capitalist handouts from Washington. But it has no competitive moat. Without such a moat, it cannot earn its way into its towering $5 billion valuation over time.

A big risk facing ATHN shareholders is that they underestimate inevitable growing pains. By holding such a highly valued stock, shareholders are essentially walking a tightrope with no safety net. There is no margin of safety. We recommend a 4% short position in ATHN.

Pioneer Natural Resources (PXD: NYSE): 4% Short Position

Without steady growth in the global economy, the oil market is in trouble.

After having reached peak debt — especially in China and other emerging markets — the global economy remains in a funk. Demand for oil will remain weak. That means leaner times ahead for one of the pure-play shale oil companies: Pioneer Natural Resources (PXD: NYSE).

The business of drilling and “fracking” shale oil properties is massively capital-intensive. It’s like trying to make forward progress on a fast-moving treadmill. Production volume from newly fracked shale oil wells declines rapidly after just a few months. If dollars are not relentlessly poured into new drilling projects, oil production falls rapidly.

By drawing attention to operating cash flow, Pioneer executives paint a misleading picture of the company’s creditworthiness. Operating cash flow is basically a mirage, and can’t really be used to service debt. Here’s why: Pioneer must reinvest all their operating cash flow back into drilling just to maintain production.

Free cash flow is a better measure of debt-servicing capacity. Over the past year, PXD’s free cash flow was deeply in the red by $1 billion.

Shareholders will tire of funding Pioneer’s negative-return, cash-burning projects. A deflationary oil price environment would accelerate the stampede out of PXD stock. We recommend a 4% short position in PXD.

CarMax Inc. (KMX: NYSE): 4% Short Position

CarMax Inc. (KMX: NYSE), the largest used car dealer in the country, has two businesses, which work hand-in-hand. CarMax has a retail operation, which buys and sells used cars. And it has a lending operation, which finances its customers’ purchases of used cars.

The two businesses boost each other up during an auto sales boom; but they undermine each other during a bust. The net effect of CarMax’s business model is that it has double leverage to a downturn in the used car market. First, a downturn in used car sales volumes would smash profits in its retail segment. And second, as losses in CarMax Auto Finance (CAF) loan pools rise, they could wipe out the net interest income that has been flowing to KMX shareholders.

CAF’s loan portfolio grew 11% year over year during the quarter ending May 2017, to $10.8 billion. While a loan book is growing this rapidly, its credit quality can look good.

But once growth stops, losses as a percentage of loans typically spike higher. Management’s accounting practices for CAF are backward-looking, so loan loss provision has the potential to rise rapidly in the quarters ahead.

The Fed’s recent interest rate hikes have been quickly priced into auto loan rates. On the conference call for the May 2017 quarter, management reiterated its policy of raising interest rates on auto loans. We doubt the market will allow for much more interest rate hiking on auto loans. We believe that over time, management will sacrifice some profit margin in CAF to keep sales volumes high in CarMax’s retail operation.

That process would involve lowering interest rates on CAF auto loans. Lower interest rates would more closely match what would surely be better financing offers from the franchised auto dealers, who will be more desperate to move metal during an auto sales downturn.

Few investors are negative on KMX now, but this could change quickly in the year ahead. We recommend a 4% short position in KMX.

Under Armour (UA: NASDAQ): 4% Short Position

The Wall Street casino is putting a premium valuation on Under Armour’s (UA: NYSE) buzzwords — not results.

Sales growth at this athletic apparel maker is slowing. Under Armour is hitting the business equivalent of middle age. A premium valuation plus slowing growth is a toxic formula for any highflying stock.

Not only is top line growth slowing, but the quality of Under Armour’s earnings is also deteriorating.

In recent quarters, accounts receivable and inventories have grown at much faster rates than revenues. When that happens, there is a good chance that future revenues and profit margins will continue to disappoint.

Accounts receivables rise when a company ships merchandise to customers on credit. When receivables rise faster than revenue, it’s a warning sign that UA is loosening its payment terms to customers, with the possible motive to hit a certain revenue target. And it leaves an extra bulge of inventory on customers’ balance sheets.

As for the inventory sitting on Under Armour’s balance sheet, that is growing rapidly too. It all adds up to a bigger disappointment when the next downturn hits.

UA is already running into the law of large numbers, and falling short of its internal goals. A weaker global economy won’t help.

For a company at this stage of maturity and this sort of business model, UA stock remains ridiculously overvalued. We recommend a 4% short position in UA stock.

10% Cash Equivalents

As a stock market bubble deflated, cash can provide portfolio stability. It also offers a ready source of dry powder to spend on opportunities that may develop.

That’s why we recommend a 10% position in cash equivalents. This can take the form of a Treasury-only money market fund. If that is not an option in your brokerage account, you can buy an ETF that holds Treasury bills.

We like the Vanguard Short-Term Government Bond ETF (VGSH: NASDAQ). This ETF holds only Treasury bills and notes with 1-3 year maturities, so there is no default risk and very little interest rate risk. The expense ratio for this Vanguard ETF is very low, at just 0.1%. It only yields about 0.75%, but you can treat this ETF as a form of cash. We a 10% of the portfolio to VGSH.

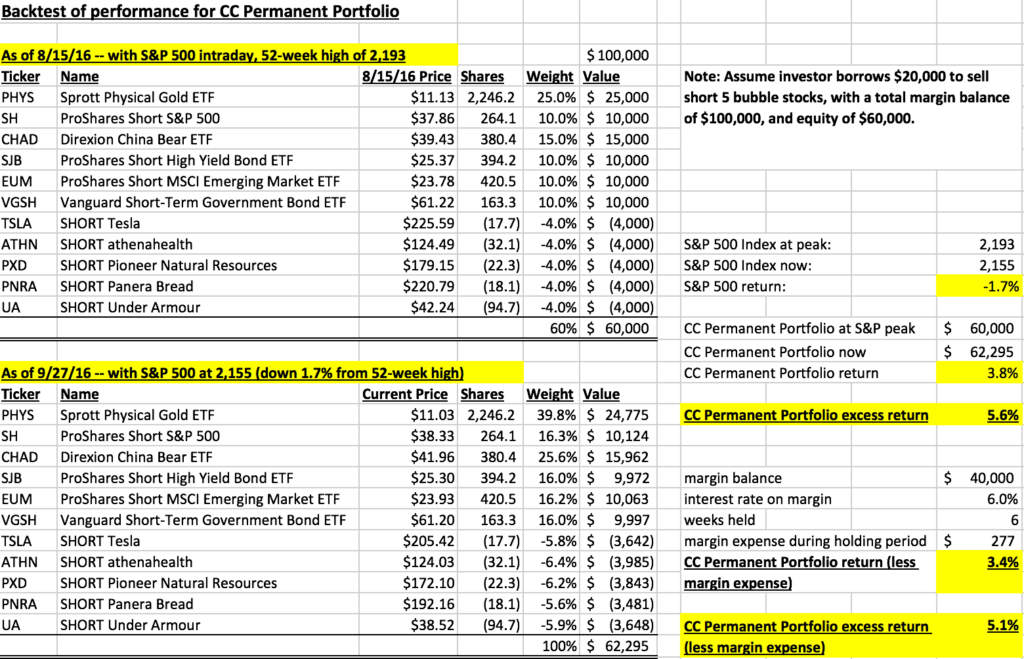

Results from A Back Test of the Permanent Portfolio

The S&P 500 set an intraday high of 2,193 on Aug. 15, 2016. Over the next six weeks, the S&P fell by 1.7%, to 2,155.

During the same time frame, a model version of the permanent portfolio rose by 3.4% (even accounting for the expense of margin interest for the short positions).

The excess return amounted to 5.1% over that six-week time frame. Here is a table showing the details behind the back test:

So we know that this portfolio can deliver good returns in a down market.

How much might it return if the bubble market implodes over the next few years? It’s realistic to expect a total return of 51.6%, net of margin interest expense. And compared to where the S&P 500 is likely to end up (1,300, down 41%), the permanent portfolio could deliver excess returns of 92%.