Not much new commentary is needed with the new home sales data from the Census Bureau since analysis of the NAR home sale data last week also applies in full part here.

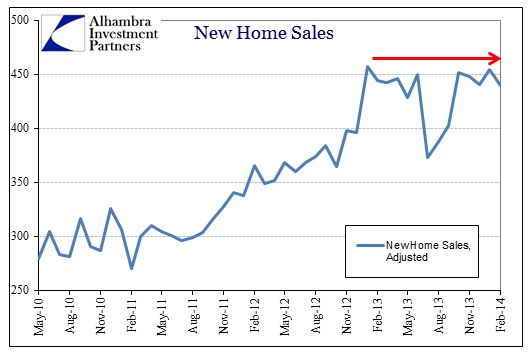

It does bear repeating, however, that the turn in housing is obvious and coincides with the dawn of 2013. No doubt the rapid appreciation in prices played a role in terms of affordability, though some of that was diminished by mortgage rates that were, at that time, still falling. That would suggest only a partial explanation for the turn in new home sales. Given what we know of the massive economic slowdown in the early to middle part of 2012, feeding the coincident divergence between the Establishment Survey and Household Survey as job growth appears far weaker than on the surface, there seems to be a very good likelihood of a heavy macro component to what we see above.

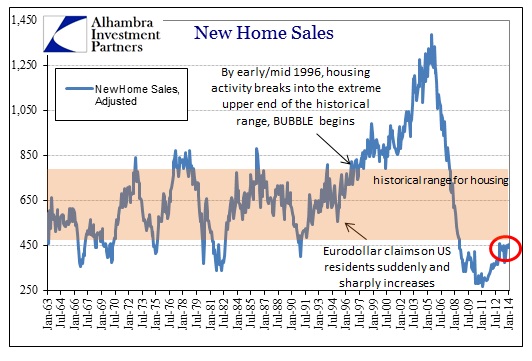

It’s also quite conspicuous that it took a mini-bubble just to re-attain a sales pace only close to the lower bounds of what might be called the historic range.

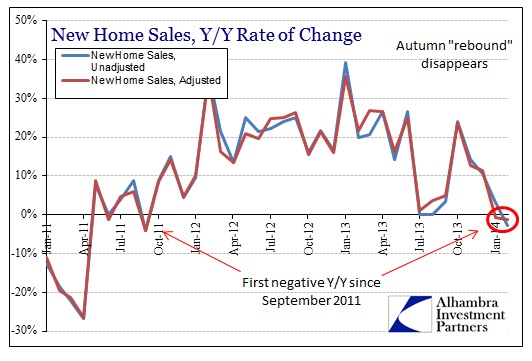

As if there were any doubts about where this was going, home sales, both adjusted and unadjusted, are now negative Y/Y.

What should be most concerning in terms of macro factors is that house prices, at least according to this series, are also pointing to a down trend. That is a disturbing development for those positioned (again) in a bubble dynamic, but also for the broader concept of consumerism based on the nefarious “wealth effect.”

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com