The Jackson Hole gathering may end up providing at least some clarification, but not even close to the manner in which everyone seems intent on inferring. With Janet Yellen’s notable absence, there isn’t the same sort of celebrity about what would have been the media hanging upon every word; that is, after all, what the Federal Reserve has become, not an organ of stability or even expertise but a public relations effort aimed squarely at trying to convince everyone possible that it is. Given the unique circumstances at the moment, the real issue is not whether they might raise rates but just how much systemic misdirection has already been revealed even to the least attentive of people.

The retreat at Jackson Hole goes back more than thirty years to the early 1980’s and Paul Volcker’s apparent affinity for fly fishing. It had started more as a very quiet and exclusive affair but for the first time this year there were outside and competing conferences held at the same time in the same place. That configuration, I think, speaks volumes about finally understanding the broad, general terms of what monetary policy actually is.

Apparently, right next to the main central banker conclave, a left-wing group was meeting ostensibly not to target the Fed and its Wall Street bias, perceived or not, but rather to urge it against ending ZIRP.

“The economy has not fully recovered and interest rates should not be raised when racial disparities exist,” said Shawn Sebastian, a policy advocate for the Fed Up Coalition of the Center for Popular Democracy, pointing to continued higher-than-average unemployment rates for black Americans…

As Fed officials hear from central bankers from Switzerland and Chile Friday, they are doing so practically next door to a workshop called “Do Black Lives Matter to the Fed?” sponsored by Sebastian’s group, which wants rates to stay low until wage growth and unemployment improve, especially for minorities.

The Fed Up Coalition is a grab bag of union activists and community organizers, the very sorts that propelled the crude communism of Occupy Wall Street almost five years ago. This is not to say that there might be differences in what becomes embraced on the heavily governmental wing, but for a few generations it had been that Wall Street and “money” were upon the “side” of free market set against those government means of redistribution.

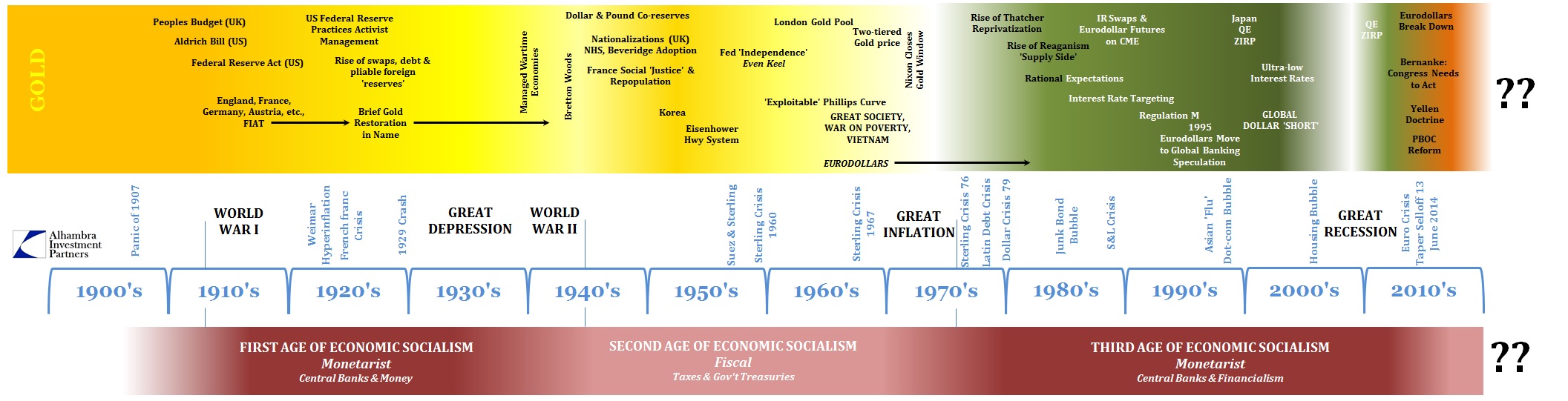

Even the Fed itself, especially under Yellen, has taken up “inequality” as a major emphasis with the same lack of self-awareness that it has operated with for decades. This, however, is not really much of a change as the institution has been the same side of the coin going back to the reformation after the Great Inflation; the ruse about free markets was always that, as monetary policy has never been anything else other than redistribution by other means.

The crude history of the Great “Moderation” gives away the charade, as at the end of the 1970’s there were no more charms in “demand side” economics. Even the great “liberals” of the day had renounced Keynesianism with full vigor, setting up the “supply side” as the great answer to the decade and a half malaise of redistribution experimentation (with the “inflation” part coming as the Fed was monetizing it all). It was so unquestioned that George HW Bush accused Ronald Reagan of risking more “inflation” by including tax cuts for individuals rather than exclusively limiting to the business end; that was the infamous “voodoo economics” that Bush proposed, the historically-invalidated redistribution of the “demand side.”

The idea of “supply side” economics has come to mean, I think, more about tax cuts in general than anything of a true set of economic ideas. That isn’t surprising given politics playing out over more than thirty years, but for me it really comes down to redistribution vs. markets. There is always going to be some of both in any economic system, the question is really about the balance especially at setting the marginal economic changes. In that sense, tax cuts have to be seen in the broader framework of a market-oriented approach rather than their own ends.

What was most devious about monetarism is that it snuck in way under the radar as if it were among those market schemes. A lot of that has to do with the secrecy with which monetary policy was carried and why that was so, but mostly it was Paul Volcker who had, starting in 1979, given the Fed “market” credibility that in hindsight was obviously overstated. It is taken as convention that Volcker “defeated” the “demand side” inflation by placing the US into recession twice. Thereafter would be the “supply side” revolution of “Reaganomics.”

Almost straight away you can see that wasn’t really true; after all, how in the world could this market approach during the Great “Moderation” end up with serial asset bubbles? It never really was truly an embrace of the market format, especially at the Federal Reserve which had already begun to explore means of intruding further and further. The “exploitable” Philips Curve, which had engendered the start of the Great Inflation was monetary policy intent on “aiding” fiscal redistribution (in the form, firstly, of the “Great Society” and even Vietnam), had been replaced, at first in an effort to understand what went wrong, by “rational expectations.” Instead of redistribution by taxation through the Treasury, it was to be monetary redistribution by financialism that wasn’t at all truly a market effort.

In May 1982, the Fed was debating stabilizing markets over what Volcker termed a “rinky dink” firm that had caused trouble for several Wall Street dealers. Rather than let actual markets work out and deal out the discipline, the Fed met in an almost emergency setting where Volcker, the assumed champion of free markets, was already on the side of monetary interference.

VOLCKER Ultimately, if there’s no other solution, we might just have to stabilize this market for a period of time. At least I can see that as a possible scenario. So, I just took this very preliminary step of keeping in touch with the market if it really goes off. I think the next step, if the market comes under more pressure, is that we’ll just have to go in openly and buy some bonds. That is very insufficient knowledge, but it about summarizes what I know, frankly. The other lenders involved in this particular short-selling operation are apparently major security houses in New York. There is a group of 7 or 8 of them; they’re all well-known firms. They should be able to withstand the loss if things ever settle, so far as we know about the loss. But that doesn’t mean it won’t send ripples of very deep concern all through the market.

The very tone and nature of Volcker’s methodology is quite recognizable, isn’t it? Here, in 1982, was the very Fed that we see right now being crafted in secrecy apart from Wall Street which was very much in the loop (as Volcker says above, “I just took this very preliminary step of keeping in touch with the market if it really goes off”). Too big to fail had been embraced in other forms before, even in the 1970’s, but this was very different as it applied not to individual firms but the whole “market.” As I wrote further about this voodoo history, this was perhaps the central point of this coming “moderate” age:

This was just a minor episode of primitive “too big to fail” in its view of “market stability” as a primary function of policy – which opens up the entire so-called market to a central bank determining wholly on its own what counts as “stability” and even where that applies to which “market.” …The Fed was, by the early 1980’s, making plain where its priorities were taking policy and why. Almost at the same moment the “supply side” of economics removed the Keynesian destructiveness from the mainstream the “demand side” had already re-entered the back door of the open Fed.

Once taking the technocratic reins, they have only increased the applications in exactly those terms – deciding, particularly through the Greenspan era, to “stabilize” not just minor bond market perturbations but whole asset markets and actually the entire economy. “Filling in troughs without shaving off the peaks” is exactly this kind of mission creep, where the Fed took it upon itself to “stabilize” the world, all done by monetary redistribution.

As if to emphasize this point beyond any of my own descriptive capabilities, by the time of the dot-com bubble, monetary models and modes of mathematical incorporation had turned back once more toward Keynesian thinking about the mechanics of the economy; the monetarists had not removed the “demand side”, far from it, they only changed the primary manner in which it was to be “stabilized”, going from taxes and treasuries to central banks and financial factors. The voodoo of technocratic redistribution had never actually disappeared, it went underground faking free markets.

I believe that is why we are starting to see another re-alignment at least in perceptibility. The Fed isn’t much fooling anyone about being dedicated to actual markets, at least not to the degree it was taken in the years before 2007. As it is, if you look closely, it has become quite openly hostile to them just as Samuelson and Solow were writing about in 1960. That is why I termed that period of the Great “Moderation” the third age of economic socialism because it was entirely redistribution in the monetary part that had taken over from the fiscal part which had so utterly failed as to be universally rejected in bipartisan fashion. But rather than give way to the free market rebirth as is commonly cited (again, how could free market discipline lead to not just a single asset bubble but rather a series of them globally?) it was just the same voodoo system with different actual incantations.

This political re-alignment is simply another view to what is certainly the end of that third age. Central banking has run itself aground and there isn’t much hiding anymore either that fact or the means by which it has been operating all this time. Hopefully we can yet get it right, that there won’t be any more underground subversion disposed of the same inevitable failings; markets actually work whereas technocracy only ends up with totalitarian (read: unresponsive) disruptiveness and decay. The argument for the technocratic approach, under more honest discussion, has always been that it might achieve less robust growth on the upswings but would be absent the violence and messiness of a purely market regime, a more stable and steady platform as an almost utopian piety.

By 2015, it is beginning to dawn quite widely that instead the redistribution in this form isn’t different at all from the last, delivering instead the same or worse violence and instability only without any of the economic growth. Already, the lines are being drawn in ways in which to go back exclusively to the 1960’s and 1970’s as if it has been markets the problem all along. Properly understanding what has happened is the only in which to understand how to break out of it.