For most of the world’s inhabitants, so long as they reside connected to some form of modern economy inflation is an unwelcome event even in the smallest doses. Central banks have made it their very business to control it, or at least its form in consumer prices, in order that their assessment of the Great Depression might not be ever repeated. From that mistaken view of history, which only serves to carve out a more than technical role for economists within the political structure, almost everything a central bank does is in some way related to “controlled” price increases.

The obvious rebuke to that effort has been the obvious destruction caused by asset bubbles in the 21st century whereby central banking is and has been at its highest settings. In the latest “cycle”, that point has been pushed beyond excess to extreme levels and yet there is startlingly little of it (official count of consumer prices, anyway). Not only does that betray the philosophical arrangement that supports the entire monetarist framework (“easing”) it might actually and completely substantiate that central banks don’t really know what they are doing.

Again, this is not a unique situation where other geographies are sailing along with QE-inspired monetary debasement; the debasement continues but without that expected “beneficial” byproduct. From Europe to Japan to America to China, all with central banks actively promoting consumer prices via rational expectations, this year continues to progress in the opposite as if the real economy and any anticipated financial mechanisms are truly unimpressed.

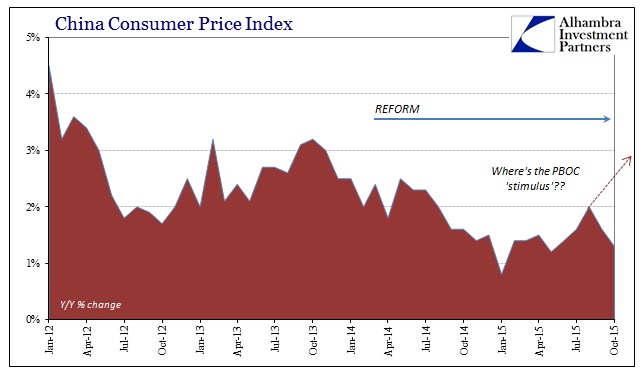

The latest “unexpected” setback came from the one country that finds itself at the very center of the gathering economic storm. Thus, “inflation” is not just a mangled attempt at measuring the idea with a degree of precision, it is and has become the very point of monetarism itself. The People’s Bank of China, self-described, has been dishing out monetary “stimulus” for almost a full year now. That has taken the form of six rate cuts and 300 bps in unleashed reserve requirements. And still “inflation” surrenders to none of it.

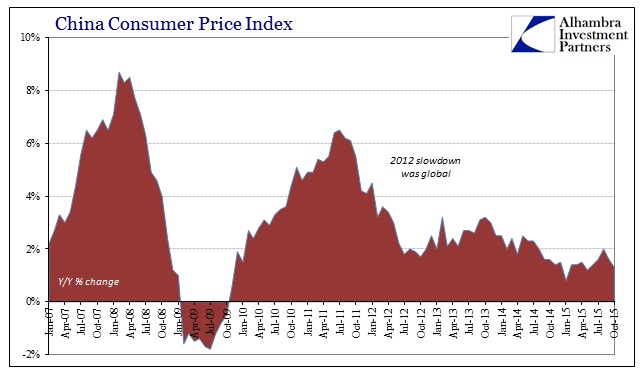

For the month of October, China’s CPI decelerated to just 1.3%; that nearly matches the extremely low level of May 2015, just above the “transitory” 0.8% from January. With everything that is supposed to be going in China’s orthodox direction (from the purported, though not, end of “capital outflows” in October to PBOC easing to every monthly upward variation) the downward tick of the CPI yet again dismisses only more faith in the whole monetary works.

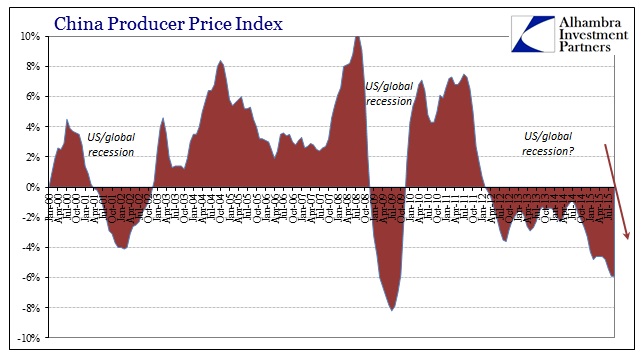

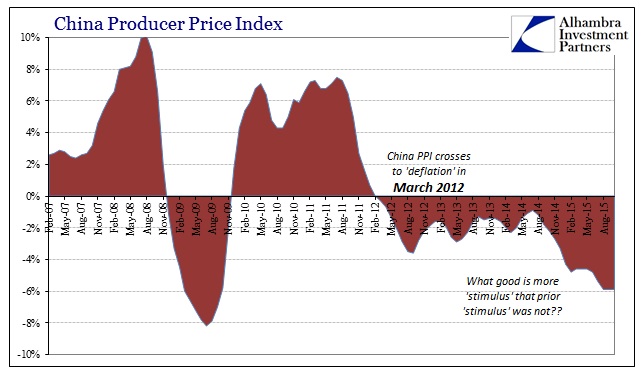

That the CPI is the third lowest of this entire recovery cycle is not actually the primary endeavor in China. The PPI, which measures more of the true engine of both China’s growth and the global economy as a traded whole, remained stuck at -5.9% for the third straight month. It is producer prices, along with factory gate prices, that suggest the very manner of deficiency with monetarism as a comprehensive agent. When China’s PPI first fell into decline in March 2012, it occurred with massive PBOC and government “stimulus” fully embraced and engaged. Thus, China’s industrial capacity was still being expanded though utilization was, at that moment in 2012, being undercut by “demand” that suddenly cooled.

The point of the PPI, then, is to suggest that grand imbalance that has never been rectified; indeed, the track of the PPI has been persistently negative for all those forty-four months. Even as, under the Chinese reform agenda aimed at the prior asset bubbles, production capacity itself finally slowed, overcapacity remained the one settled state – again, demand as being sufficiently below capacity so that Chinese factories are forced to cut prices to really just meet basic costs including and especially debt service.

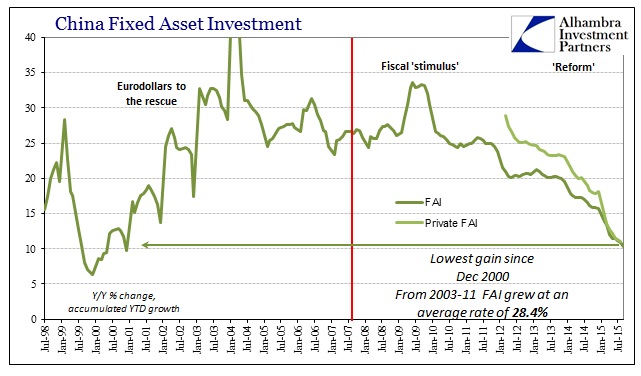

The point of 2015’s sudden lurch more negative, and deeply so since the PPI already almost matches the lowest of China’s experience of the Great Recession, is that demand component. Like oil, prices are trying to find a clearing level but remain unable even as production capacity slows sharply and broadly (which is what China’s Fixed Asset Investment trend tells us). And so China’s internal dynamics are truly just one form of the external global economy’s descent, including and especially China’s biggest trading partner (on the export side) the United States. Combined, China is truly a comprehensive reflection of American economic dynamics and animating “dollar” behavior.

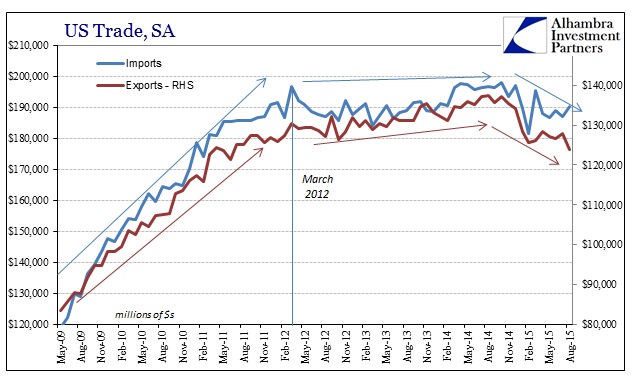

That point could not be clearer given the turn in US imports from China (and elsewhere) that began in also March 2012. We need not search for some hidden or ephemeral decline in demand to aid in explaining China’s predicament, it is right here:

Were it just the US that inflected at that point it would have been a serious blow to all the economic and monetary efforts, but the US was not alone in being suddenly truncated – the global unification in that manner and timing destroys orthodox ideas of closed systems and points the finger of blame squarely upon the amalgamating financial mechanism that passes for a reserve currency. It leaves China’s economy unable to perform the global supply chain’s transmission, since without full and complete monetary backing of the PBOC, adding more production capacity at this late stage under these circumstances amounts to business suicide. China’s reform is but recognition of this global and US demand shift as both an end to the cycle’s recovery and a prolonged, serious structural decay (the great mystery to orthodox economists and their secular stagnation).

With production capacity investment declining to Asia flu-type rates and still producer prices decline by nearly 6% month after month, that more than suggests the drastic change in global demand. Against that backdrop, and the endless circle of “dollar” complications plaguing even the internal RMB liquidity network, expecting “stimulus” to have any effect at all is plain absurdity. Such a lucid view will not, of course, stop certain markets from their dutiful cheeriness at each discrete “injection” even though it may only be temporarily so received and eventually displaced in the same manner as all the prior attempts before it.

By the full weight of all these heavy factors, there is but a sense of inevitability here beyond even what transpired in early 2009. After all, the Great Recession was at least cyclical in its negativity; short, sharp. This is something altogether different and more insipid, as the drag of economic decay just goes on and on. You might be forgiven for thinking that suggests something wrong with the economy, as economists do, until you truly examine these various threads and find them all leading back to the same monetarist source.