When I wrote on Friday that I was encouraged for the first time in years over the combined rise of Trump and Sanders I meant nothing by way of suggesting either as an actual candidate or what they might do should they pull it out. If anything, I implied that the political situation might have to follow the economy; that it should get a whole lot worse before it gets much better.

The point was not so much about the candidates themselves but the palpable angst that they loosely but clearly represent. It is a growing bipartisan rejection of the status quo as it relates to the economy. For years now, the political class has been lying about the state of the recovery because economists have so fortified their temple. Monetary policy and fiscal “stimulus” are all that there is and nothing else except that which retains the political hierarchy remains. It joins Tea Party and socialists alike, to tell Janet Yellen and/or Wall Street “enough.” The uniting factor is an as-yet amorphous or ephemeral sense that “something” is wrong and that those that continue to press on as if there weren’t need to be removed.

Sanders’ entire script reads as Occupy Wall Street. Therefore, his is the right target if the wrong solutions.

He [Sanders] has called for new spending that (for now!) totals $18 trillion over the next 10 years. This massive sum is to be spent, among other things, on single-payer health care, an expansion of Social Security and a massive taxpayer-funded infrastructure program.

Under his plan, the federal government would directly control 30 percent of spending in the economy, compared to the 20 percent we have seen in recent decades. For a comparison, the European Union’s “federal” budget equals about 1 percent of the economy of its member states.

To “pay” for his redistribution, Sanders apparently looks at the usual and massive tax hikes. Over a ten-year period, AEI tells us, they would amount to $6.5 trillion in new “revenue” taking no account on the non-assumed economic damage. That is 13 times the tax increase of the already-coming Obamacare style.

That may seem like lunacy, but only if you take no account of the basis for comparison. Jeb Bush, in a relevant example, sounds much more conventional and conditioned in his idea of tax cuts, downright palatable to just the sort of mainstream:

What do the Republicans have on offer? To take one example, Governor Jeb! Bush’s tax plan reduces tax revenue by a little over $3 trillion if his streamlining of the system and his reduced rates did nothing to make the economy grow. Of course, a good chunk of that revenue loss will presumably be made up for by the additional revenue generated by the positive growth impact his plans is predicted to have. In addition, the spending cuts necessary to make up for the rest of revenue reduction would be extraordinarily modest in comparison to the Bern’s tax and spending hikes.

How does Jeb “know” that his tax cut idea will produce a “positive growth impact?” He has economists who, get this, didn’t even run it through the usual models (DSGE and its brethren, for all the good that would do) but rather analyzed studies about what past tax cut plans might have done had they been enacted. Seriously:

The economists making the prediction — John Cogan, Martin Feldstein, Glenn Hubbard and Kevin Warsh — did not run Mr. Bush’s tax plan through an economic model before arriving at their 5 percent estimate. Rather, Mr. Hubbard, the dean of Columbia’s business school and a former top economic adviser to George W. Bush and Mitt Romney, said they looked at previous studies in which economists evaluated other tax proposals, and placed Jeb Bush’s tax plan among them in what they thought was approximately the right place.

Which one, then, is truly looney? Economists taking account of a bunch of past regressions producing yet more Garbage Out and then remotely applying their own interpretations of implications to an entirely different set of positions and calling it assured reality, or a populist idea that if there is only to be more conventional, and thus continue on as conventionally bad, why not go full socialist? That is actually the measure of progess; the rejection of the current ideas of the technocracy since they are at the now-exposed root as ridiculous as they sound. This isn’t a one step process, however, as realizing the problem comes before (often long before) recognizing how to get out of it. From Friday’s column:

You might, from that, start toward the impression it may get a lot worse before it gets any better. After all, even with the huge global liquidation on August 24 and 25, “dollar” money rates continue both elevated and unsatisfied. Currencies remain crashing all over the world, even with an emerging nation or Asian flavor this time, and the angry “dollar” is behind it all.

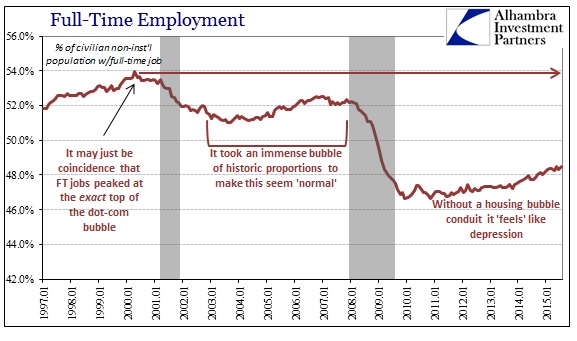

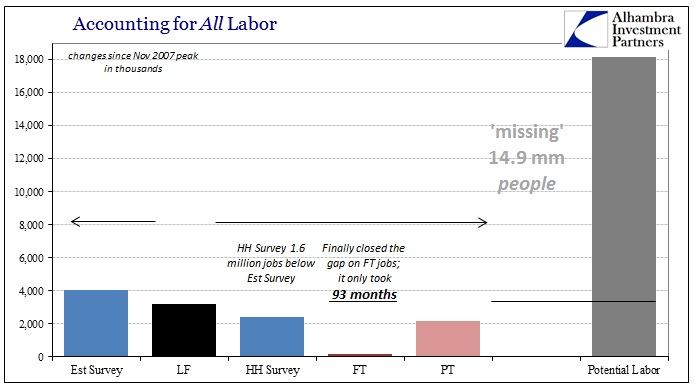

That potential is particularly unwelcome in a state such as now. It is, obviously, unwelcome at any point but more so when the system never reset or recovered. That observation includes not just the eurodollar system and standard but also the global economy, US very much included still at its center. Typically, any business cycle is a full one, where the economy picks itself up, grows for some steady time and is thus re-fortified to withstand the next cycle. That hasn’t occurred this time, as in many ways, increasingly, the US and global economy is revealed both significantly smaller and weaker now than at the start of the Great Recession. The correlation there is no accident, as the economy was financialized these past few decades so that a weak “dollar” system (not the exchange rate of the dollar) would produce little financialized recovery.

The split between “Main Street” and DC/NYC has reached close to its zenith, finally, under just those terms. The political class that enable economists to continue to try to control the economy are losing their grip. There are, obviously, other political issues but this huge groundswell of dissatisfaction has its base and origin in this:

To have the political sideshows, then, become the center ring is actually welcome. Bernie Sanders is no more mysterious in his rise than Donald Trump. You might ascribe Sanders as a function of Hillary Clinton’s penchant for being unable to shake loose from criminal implications, but it is much more than that. Earlier this week, Senator Sanders tweeted that, “it is unacceptable that the typical male worker made $783 less last year than he did 42 years ago.” His huge crowds enthusiastically embrace that populism, which is a direct contradiction to the dominant, complacent rhetoric about the economy parroted out from the FOMC and that which is being similarly claimed by the current administration of his own party.

In finding our way out of the technocratic depression, there is a good and admittedly grim possibility of taking different bad ideas to replace the current set of bad ideas; the dangers of any republic are getting it more wrong before getting it right, if only to unambiguously expose the primary defect as to mark the eventual righteous path. The optimism is in the fact that we are now seriously, by virtue of the Presidential race suffered totally at this point of outsiders, looking elsewhere. We may have to lose yet more to this already “lost decade” of economists’ making, but the possibility of not following Japan has finally risen for the first time since “ultra-low.”

Janet Yellen just doesn’t factor; it has been out of her hands since August 2007. It has taken eight years, but Americans finally seem ready to start to break out. In that respect, the FOMC’s continuing dance of confusion and disarray only helps pinpoint where to begin.