Wall Street pundits showed some consternation about the year to year decline in May auto sales last week but they missed the big picture. In the Tale of Two Economies, while the owners of stocks and bonds get richer and make the top lines of many economic data series look ok, Americans by and large are doing persistently worse. The middle class is not only shrinking as more people drop from its ranks, the purchasing power of what remains of the middle is is shrinking.

We have all seen the charts of the long term decline in real median household incomes. This decline is apparent in other ways as well. A few days ago I posted a chart of the growth of that part of the population engaged in “forced leisure,” a trend that has accelerated since the Fed instituted ZIRP and QE. Last week’s release of monthly auto sales also shows in stark relief the deeply embedded trend of the decline in purchasing power and living standards in the US.

Stockholders, particularly the leveraged speculators with access to the never ending stream of free central bank printed money, party on while stocks hover at new highs. Oceans of central bank printed cash and free financing for speculative schemes have stopped every stock market selloff and driven every rally higher in spite of weakening fundamentals. As stock and bond prices have surged, the benefits have accrued to only a few. More and more Americans find the going getting tougher, with increasing percentages of people falling through the economic cracks. This trend isn’t new. It has been in force for 40 years.

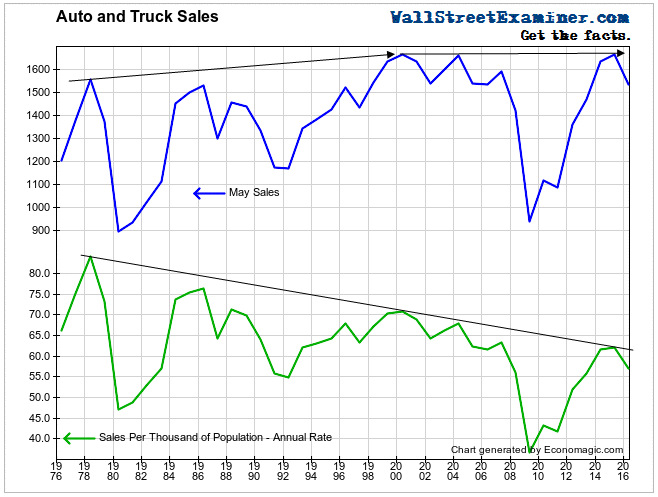

Auto sales data perfectly illustrates this trend. While total auto sales rose until 2000 they did not keep pace with population growth. Sales then fell off a cliff in the recession from 2007-2009. The resulting pent up demand drove a recovery in total sales back to the previous peak levels in 2015. That looks ok if you only consider total sales. The picture looks very different when sales are viewed in the context of steadily growing US population.

Like previous recoveries, the 2009-2014 recovery did not keep pace with population growth. The ratio of sales to population continued its long term decline. Sales have fallen from a peak annual rate 90 sales per thousand of population in May 1978 to just 62 per thousand at the May 2015 peak. This year, May sales have fallen to a rate of 57 per thousand. This continues a 40 year trend of more and more Americans becoming unable to buy a new car. The sales rate today is barely higher than at the bottom of the 1992 recession.

For Americans, the purchase of a new car has long been a symbol of success and economic well being. There is no better representation of the decline of US living standards than that this symbol is increasingly out of reach for an ever growing segment of the American people.

The world’s central banks have built their policies of money printing and zero or negative interest rates on the idea these policies would drive securities prices higher and that the rising tide of securities prices would lift all boats. The “wealth” the central banks created by pumping up that ocean of liquidity has certainly resulted in bigger and bigger yachts. But that rising liquidity hasn’t lifted the small boats. It has swamped them. Central bank policies have written A Tale of Two Economies, a long running sad story for a growing number of Americans.

Meanwhile, the leveraged speculators who have access to all that free central bank printed money, party on. Saner observers can only look on in horror, vigilant for the signs that an ever weakening economic foundation no longer supports an increasingly top heavy structure.