In February 1999, the Bank of Japan announced that its call money rate would be zero “until deflationary concerns subside.” Other than a temporary shift in 2001 and 2006, deflationary concerns remain. How effective was monetary policy? That point has been partially answered by the introduction of QE over and over and over again. The zero lower bound is to orthodox economists a major problem. They do not, however, have an answer for why it is now a global problem as the ZLB spread out everywhere.

In a speech to the ASSA in Boston, MA, in January 2000, Princeton professor Ben Bernanke criticized the Bank of Japan for its, in his view, reluctance to act. Though he applauded ZIRP and BoJ’s announced intention to keep it in place for as long as “necessary” (without addressing why that might be forever forward), it was nearly enough as he said in conclusion:

Policy options exist that could greatly reduce these [economic] losses. Why isn’t more happening? To this outsider, at least, Japanese monetary policy seems paralyzed, with a paralysis that is largely self-induced. Most striking is the apparent unwillingness of the monetary authorities to experiment, to try anything that isn’t absolutely guaranteed to work.

There is enormous conceit in that statement, compelled by an inflated sense of duty. Why, if monetary policy isn’t working, does that necessarily lead to more of it? The easy answer is because that is the task central banks have given themselves, covered politically by governmental paralysis on any central bank question. The more central banks fail, the easier they cry “independence.”

The danger of central banking was never that they might someday be used for partisan purposes, but rather that they would become so insular as to continue harmful activities far longer than any reasonable accountability scheme would have otherwise allowed. Any sane person would first question the suitability of open experimentation on any economy, let alone the second largest in the world. In the case of orthodox monetary theory, Bernanke’s speech provided a very simple (Japanese) example to debate the objection:

Consider a hypothetical small borrower who took out a loan in 1991 with some land as collateral. The longterm prime rate at the end of 1991 was 6.95% (Table 1, column 3).3 Such a borrower would have been justified, we may speculate, in expecting inflation between 2% and 3% over the life of the loan (even in this case, he would have been paying an expected real rate of 4-5%), as well as increases in nominal land prices approximating the safe rate of interest at the time, say 5% per year. Of course, as Tables 1 and 2 show, the borrower’s expectations would have been radically disappointed.

To take an admittedly extreme case, suppose that the borrower’s loan was still outstanding in 1999, and that at loan initiation he had expected a 2.5% annual rate of increase in the GDP deflator and a 5% annual rate of increase in land prices. Then by 1999 the real value of his principal obligation would be 22% higher, and the real value of his collateral some 42% lower, then he anticipated when he took out the loan. These adverse balance-sheet effects would certainly impede the borrower’s access to new credit and hence his ability to consume or make new investments. The lender, faced with a non-performing loan and the associated loss in financial capital, might also find her ability to make new loans to be adversely affected. [emphasis added]

To orthodox economics, the answer is obvious – the central bank must act to prevent further credit diminishment even to the point of unknown experimentation. Debt is and remains the nexus of all their economic paths. It never considers the more basic proposition; perhaps the borrower should be denied further credit because he doesn’t seem to be a very good at it. The same holds for the bank, failing in its mission of intermediation. Thus, the issue is not debt per se, but efficient and productive use of it – as if writing this sentence takes even the smallest amount of useful insight.

But the central bank further compounds this inequity by using money as the central axis to reinstitute credit and debt to the unworthy at any and all costs.

Money, unlike other forms of government debt, pays zero interest and has infinite maturity. The monetary authorities can issue as much money as they like. Hence, if the price level were truly independent of money issuance, then the monetary authorities could use the money they create to acquire indefinite quantities of goods and assets. This is manifestly impossible in equilibrium. Therefore money issuance must ultimately raise the price level, even if nominal interest rates are bounded at zero. This is an elementary argument, but, as we will see, it is quite corrosive of claims of monetary impotence.

Alas, this is only true if money is money as economists like Bernanke assume. What if it were not? Then we would be stuck forever trying to reward bad investors and bad banks with money that isn’t even functional. That about sums it up.

But that is not what passes for mainstream thought. Instead, the world is always short of further accommodation and “stimulus.” The latest is from economists at Morgan Stanley, published in Bloomberg, who tell us that the current economy is reminiscent of the 1930’s.

“In 1936-37, the premature and sharp pace of tightening of policies led to a double-dip in the U.S. economy, resulting in a relapse into recession and deflation in 1938,” the analysts wrote. “Similarly, in the current cycle, as growth recovered, policy-makers proceeded to tighten fiscal policy, which has contributed to a slowdown in growth in recent quarters.”

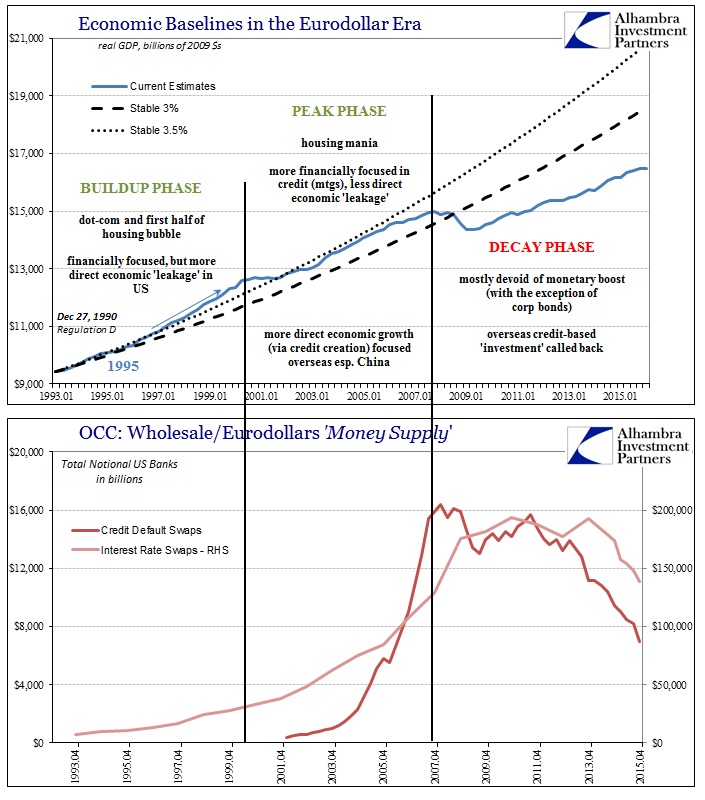

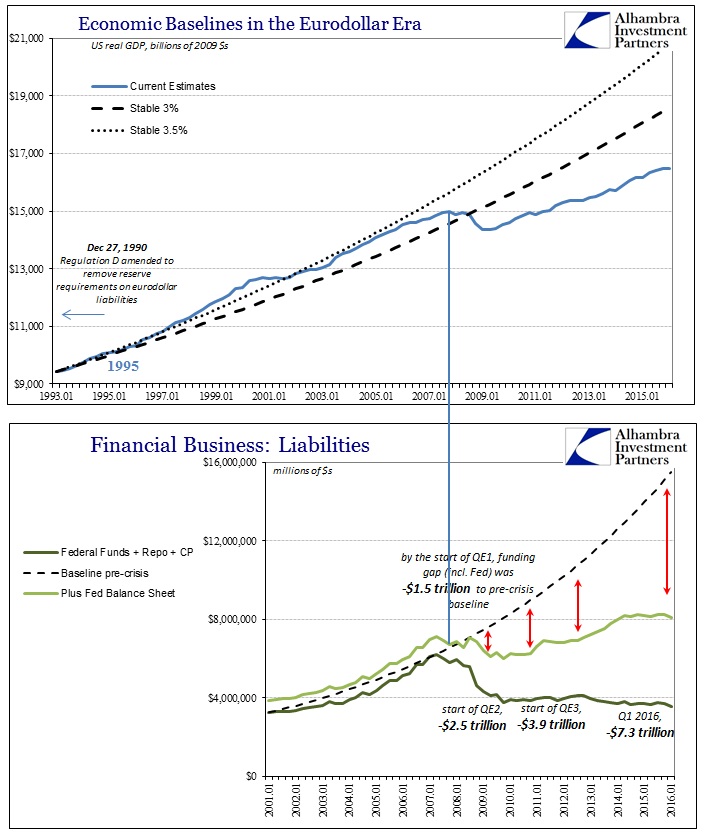

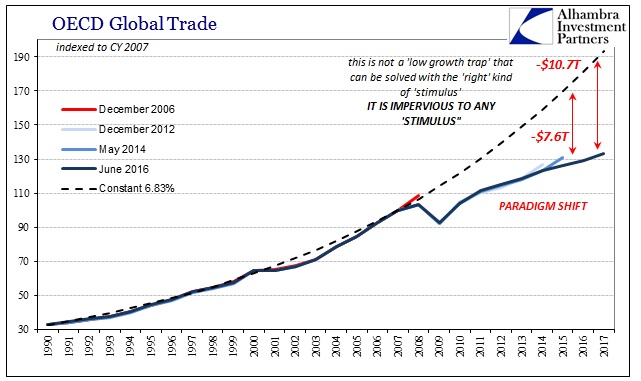

This is utter nonsense. The slowdown in growth in “recent quarters” occurred far before recent quarters. There is no ceteris paribus vacuum for such influence. When anyone without an economics degree views the charts below they do not see a lack of further government spending nor the need for even more negative rates whether real, nominal, or imaginary. What is absolutely plain is that the global economy was hit with a simultaneous blow in 2008 that it has not recovered from no matter what any central banker does anywhere.

That is not a rallying cry to do only more, it is a demand to go back and recalculate whether it was ever a good idea to keep pushing credit no matter what – to the point of monetary intransigence (pioneered in Japan) and revolution taking place outside the pitiful view of economists who obsess over the trivial and emphasize the meaningless. They have made a “science” of everything that doesn’t matter, all with the attempt to get an economy to move forward by taking it backward – as the Morgan Stanley economists write:

Activating fiscal policy, particularly at a time when the monetary policy stance is still accommodative, could lead to a virtuous cycle where the corporate sector takes up private investment, and sustains job creation and income growth.

That’s not how any of this works, those are just buzzwords; as if we needed any more proof.